The Trulia Price Monitor and the Trulia Rent Monitor are the earliest leading indicators of how asking prices and rents are trending nationally and locally. They adjust for the changing mix of listed homes and therefore show what’s really happening to asking prices and rents. Because asking prices lead sales prices by approximately two or more months, the Monitors reveal trends before other price indexes do. With that, here’s the scoop on where prices and rents are headed.

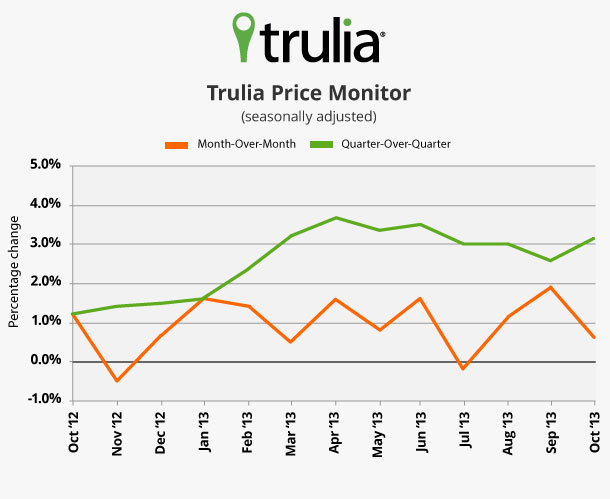

Asking Prices Rise 0.6% in October, Slowing but Still Big Gains

Asking home prices increased 0.6% month-over-month in October. That’s the second-slowest monthly gain in seven months. However, even though prices are slowing down compared to earlier this year, the monthly, quarterly, and yearly gains are all high compared with historical norms. In fact, the 11.7% year-over-year increase is the highest since the housing bubble burst. Why this big increase? Asking prices are rising quickly because buying still looks cheap relative to renting – and also because inventory remains tight, even though it has increased since January.

As we reported mid-month, the government shutdown does not appear to have hurt asking prices. There was no difference in the October month-over-month asking-price change between metros more directly affected by the shutdown (i.e. those which are more dependent on federal wages like Washington, D.C.) and other metros. The price slowdown in recent months is primarily because of expanding inventory, rising mortgage rates, and declining investor activity. In coming months, we could see prices slow further if consumer confidence suffers from the ongoing budget uncertainty and future shutdown and debt-default worries.

|

October 2013 Trulia Price Monitor Summary |

|||

|

% change in asking prices |

# of 100 largest metros with asking-price increases |

% change in asking prices, excluding foreclosures |

|

| Month-over-month,

seasonally adjusted |

0.6% |

Not reported |

0.1% |

| Quarter-over-quarter,

seasonally adjusted |

3.1% |

91 |

2.6% |

| Year-over-year |

11.7% |

99 |

11.8% |

| *Month-over-month change is October versus September. Quarter-over-quarter and year-over-year changes are three-month averages. Data from previous months are revised each month, so data being reported now for previous months might differ from previously reported data. | |||

Home Prices in Red America vs. Blue America

American politics are heating up – not only because today is Election Day, but also because the shutdown, the debt ceiling, and the budget negotiations are raising the stakes in Washington. In the housing and economic recovery, Red and Blue America really are different – and that helps fuel political partisanship. For this month’s Price Monitor, we identified the reddest and bluest metro areas in the US based on the 2012 Presidential election: the reddest are those where Governor Mitt Romney, the Republican presidential candidate, had the largest margin over President Barack Obama, and the bluest metros are those where Obama had the largest margin over Romney, according to county-level data from Election Atlas. Among the 100 largest metros, 68 are blue and 32 are red.

America’s reddest metros are Knoxville, TN, Tulsa, OK, and Greenville, SC: their housing markets have seen modest price increases year-over-year, below the national average of 11.7%. Among the reddest metros, only Bakersfield, CA, has seen prices rise more than 15% year-over-year.

|

Price Changes in the Reddest Metros |

|||

| # | Metro |

President Obama’s margin in 2012 election |

Y-o-Y % change in asking prices, October 2013 |

| 1 | Knoxville, TN |

-34% |

2.2% |

| 2 | Tulsa, OK |

-32% |

4.3% |

| 3 | Greenville, SC |

-30% |

9.5% |

| 4 | Oklahoma City, OK |

-27% |

4.1% |

| 5 | Fort Worth, TX |

-23% |

12.0% |

| 6 | Salt Lake City, UT |

-21% |

10.4% |

| 7 | Colorado Springs, CO |

-21% |

4.6% |

| 8 | Birmingham, AL |

-20% |

12.9% |

| 9 | Jacksonville, FL |

-19% |

9.3% |

| 10 | Bakersfield, CA |

-17% |

24.3% |

| Note: a negative margin for Obama means Romney got more votes than Obama. Among 100 largest metros. | |||

In contrast, home prices in seven of the 10 bluest metros rose more than 15% year-over-year, with three of the bluest metros – Oakland, Detroit, and Los Angeles – clocking gains over 20%. Four of the six bluest metros in American are in California (San Francisco, Oakland, San Jose, and Los Angeles) – the state, along with other western states, which has led the home price recovery.

|

Price Changes in the Bluest Metros |

|||

| # | Metro |

President Obama’s margin in 2012 election |

Y-o-Y % change in asking prices, October 2013 |

| 1 | San Francisco, CA |

58% |

15.6% |

| 2 | Oakland, CA |

50% |

29.6% |

| 3 | New York, NY-NJ |

49% |

7.3% |

| 4 | Detroit, MI |

47% |

24.5% |

| 5 | San Jose, CA |

42% |

19.1% |

| 6 | Los Angeles, CA |

42% |

22.5% |

| 7 | Honolulu, HI |

39% |

2.9% |

| 8 | Washington, DC-VA-MD-WV |

37% |

7.6% |

| 9 | Fort Lauderdale, FL |

35% |

17.8% |

| 10 | Seattle, WA |

35% |

13.5% |

| Note: a positive margin for Obama means Obama got more votes than Romney. Among 100 largest metros. | |||

Does this mean that housing markets in Blue America are on more solid ground? Not really. While asking prices did rise faster year-over-year in blue metros (12.5%) than in red metros (11.1%), the blue metros actually suffered more in the housing crash. The peak-to-trough price decline, based on FHFA data, was 25% in the blue metros and just 16% in red metros. That means the stronger price recovery year-over-year in the blue metros is a rebound after a bigger decline. Furthermore, blue metros face some bigger housing and economic challenges today than red metros. For instance, housing affordability is worse in Blue America: median price per square foot is 61% higher in blue metros ($169) than in red metros ($105). Although incomes in blue metros are higher, too, they’re not high enough to compensate for higher home prices: as a result, just 57% of for-sale homes are affordable to the middle class in blue metros, versus 67% in red metros. Finally, the unemployment rate is higher in blue metros (7.7%) versus red metros (6.6%).

|

Housing and Economic Scorecard: Red vs. Blue Metros |

||

|

Red Metros |

Blue Metros |

|

| Y-o-Y % change in asking prices, October 2013 (Trulia) |

11.1% |

12.5% |

| % change in home prices during crash, peak to trough (FHFA) |

-16% |

-25% |

| Median asking price per square foot (Trulia) |

$105 |

$169 |

| % of for-sale homes affordable to middle class (Trulia) |

67% |

57% |

| Unemployment rate, August 2013 (BLS) |

6.6% |

7.7% |

| Note: red metros are those where Romney defeated Obama, and blue metros are those where Obama defeated Romney. Among the 100 largest metros, 68 are blue and 32 are red. | ||

Therefore, even though Blue America, led by California, has had a stronger home-price recovery, Red America suffered less in the housing crash and today enjoys greater housing affordability and lower unemployment. That means that as the budget battles in Washington continue, the politicians representing Blue America will be under more pressure from their voters to fight for policies that could reduce unemployment and make homeownership more within reach of the middle class. These red-blue gaps in housing affordability and unemployment add to the long list of reasons why Democratic and Republican politicians see the world differently.

Rents Up 2.7% Nationally, But Soaring By 10.1% in Pricey San Francisco

Among the 25 largest rental markets, rents are rising fastest in San Francisco, Portland, and Seattle, while they’re falling slightly in Washington, D.C., and Philadelphia. San Francisco has not only the steepest year-over-year rent increase, but also has the highest median rent ($3250/month) for 2-bedroom units in the country, edging out the New York metro ($3150). No other market comes close to San Francisco and New York: Boston, the third-most expensive, comes in at $2300. At the other extreme, median rent for a 2-bedroom unit is less than $1000 in Phoenix, St. Louis, and Las Vegas.

|

Rent Trends in the 25 Largest Rental Markets |

|||

| # | U.S. Metro |

Y-o-Y % change, October 2013 |

Median rent on 2-bedroom units |

| 1 | San Francisco, CA |

10.1% |

$3,250 |

| 2 | New York, NY-NJ |

2.8% |

$3,150 |

| 3 | Boston, MA |

2.2% |

$2,300 |

| 4 | Los Angeles, CA |

2.7% |

$2,250 |

| 5 | Oakland, CA |

2.0% |

$2,250 |

| 6 | Miami, FL |

7.6% |

$2,200 |

| 7 | Washington, DC-VA-MD-WV |

-1.4% |

$2,100 |

| 8 | Orange County, CA |

4.4% |

$2,000 |

| 9 | San Diego, CA |

8.3% |

$1,850 |

| 10 | Seattle, WA |

9.2% |

$1,600 |

| 11 | Chicago, IL |

2.8% |

$1,600 |

| 12 | Philadelphia, PA |

-1.6% |

$1,500 |

| 13 | Riverside–San Bernardino, CA |

3.3% |

$1,450 |

| 14 | Baltimore, MD |

1.6% |

$1,450 |

| 15 | Houston, TX |

3.8% |

$1,400 |

| 16 | Denver, CO |

4.7% |

$1,350 |

| 17 | Dallas, TX |

3.9% |

$1,300 |

| 18 | Minneapolis–St. Paul, MN-WI |

1.8% |

$ 1,250 |

| 19 | Portland, OR-WA |

9.8% |

$1,200 |

| 20 | Atlanta, GA |

2.7% |

$1,100 |

| 21 | Tampa–St. Petersburg, FL |

1.7% |

$1,050 |

| 22 | Sacramento, CA |

0.9% |

$1,050 |

| 23 | Phoenix, AZ |

4.3% |

$950 |

| 24 | St. Louis, MO-IL |

2.9% |

$900 |

| 25 | Las Vegas, NV |

2.1% |

$900 |

|

To download the list of rent changes for the largest metros: Excel or PDF. |

|||