The Trulia Price Monitor and the Trulia Rent Monitor are the earliest leading indicators of how asking prices and rents are trending nationally and locally. They adjust for the changing mix of listed homes and therefore show what’s really happening to asking prices and rents. Because asking prices lead sales prices by approximately two or more months, the Monitors reveal trends before other price indexes do. With that, here’s the scoop on where prices and rents are headed.

Prices Rise 8.1% Year-over-Year in June

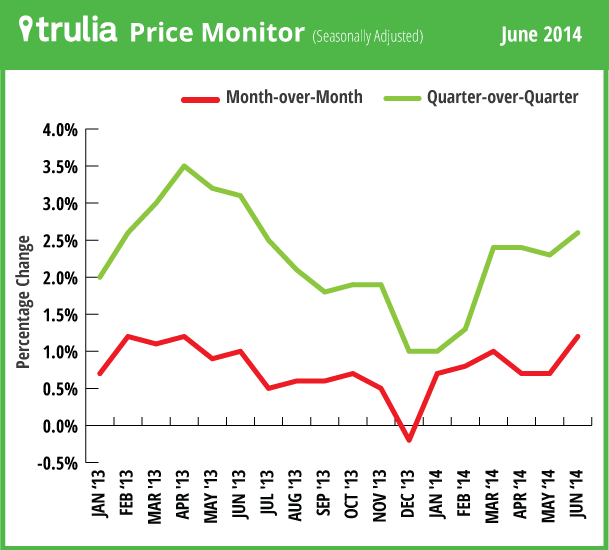

Both the quarter-over-quarter and year-over-year increases are lower than they were twelve months ago. In June 2014, prices were up 8.1% year-over-year and 2.6% quarter-over-quarter, compared with 9.5% and 3.1%, respectively, in June 2013.

But despite this national slowdown in price gains, price increases continue to be widespread, with 97 of 100 metros posting year-over-year price gains – the most since the recovery began. Furthermore, asking prices in June rose at their highest month-over-month rate (1.2%) in sixteen months.

| June 2014 Trulia Price Monitor Summary | |||

| % change in asking prices | # of 100 largest metros with asking-price increases | % change in asking prices, excluding foreclosures | |

| Month-over-month,

seasonally adjusted |

1.2% | N/A | 1.2% |

| Quarter-over-quarter,

seasonally adjusted |

2.6% | 94 | 2.5% |

| Year-over-year | 8.1% | 97 | 7.4% |

| *Data from previous months are revised each month, so data being reported now for previous months might differ from previously reported data. | |||

West No Longer Leading Price Recovery

Aside from two inland California housing markets, Riverside-San Bernardino and Bakersfield, the top 10 metros with the biggest year-over-year price gains are in the South and Midwest. These markets with the largest year-over-year price gains are generally more affordable, but prices in these markets are rising much faster than wages, according to recently released full-year 2013 wage data from the Bureau of Labor Statistics’ Quarterly Census of Employment and Wages (QCEW). In fact, average wages per worker rose less than 1% in 2013 in all but one of the 10 metros with the largest price increases. Nationally, asking prices (year-over-year in June 2014) rose faster than wages per worker (year-over-year in 2013) in 95 of the 100 largest metros.

| Where Asking Prices Rose Most Year-over-Year, June 2014 | |||

| # | U.S. Metro | Y-o-Y % asking price change, June 2014 | Y-o-Y % change in wages per worker, 2013 vs. 2012 |

| 1 | Riverside–San Bernardino, CA | 16.9% | 0.6% |

| 2 | Atlanta, GA | 15.7% | 0.8% |

| 3 | Grand Rapids, MI | 15.3% | 0.4% |

| 4 | Miami, FL | 14.6% | 0.9% |

| 5 | Detroit, MI | 14.5% | 0.6% |

| 6 | Bakersfield, CA | 13.9% | -0.3% |

| 7 | Chicago, IL | 13.8% | 0.3% |

| 8 | Lake County-Kenosha County, IL-WI | 13.6% | 2.0% |

| 9 | Birmingham, AL | 13.6% | 0.4% |

| 10 | Cape Coral–Fort Myers, FL | 13.4% | 0.7% |

| Note: among 100 largest metros. To download the list of asking home price changes for the largest U.S. metros: Excel or PDF. | |||

The price slowdown has been particularly sharp in the boom-and-bust markets of California and the Southwest, where the recession was severe, the recovery was dramatic, and the slowdown is now most pronounced. In Phoenix, Las Vegas, Sacramento, and Orange County, price gains have skidded to a stop or gone into reverse in the past quarter after posting gains of more than 20% year-over-year in June 2013. Although these four housing markets all still have average or above-average year-over-year price increases in June 2014, their slowdowns or reversals in the most recent quarter foreshadow a continued deceleration in year-over-year gains:

| The Four Metros Where Asking Prices Have Hit the Skids | |||||

| # | U.S. Metro | Q-o-Q % asking price change, June 2014 | Q-o-Q % asking price change, March 2014 | Y-o-Y % asking price change, June 2014 | Y-o-Y % asking price change, June 2013 |

| 1 | Phoenix, AZ | -0.3% | 3.3% | 7.0% | 26.0% |

| 2 | Las Vegas, NV | 0.0% | 4.8% | 12.6% | 33.4% |

| 3 | Sacramento, CA | 0.3% | 5.6% | 12.2% | 32.5% |

| 4 | Orange County, CA | 0.4% | 1.8% | 7.6% | 23.1% |

| Note: the national quarter-over-quarter asking-price change was 2.6% in June 2014 and 2.4% in March 2014. | |||||

Rental Affordability Worsens as Rents Rise 5.5% Year-over-Year

Rent increases outpaced wage increases in all of the 25 largest Rents rose more than 10% year-over-year in Miami, Oakland, San Francisco, San Diego, and Denver. Among these five markets with the largest rent increases, all but Denver are among the nation’s least affordable rental markets. The median rent for a 2-bedroom unit costs more than 40% of the average local wage in these markets. The least affordable rental market is Miami, where a 2-bedroom typically rents for 62% of the average local wage. At the other extreme, a 2-bedroom rental costs just 24% of the average local wage in St. Louis.

| Rent Trends in the 25 Largest Rental Markets | ||||

| # | U.S. Metro | Y-o-Y % change in rents, June 2014 | Median rent for 2-bedroom, June 2014 | Median rent for 2-bedroom, as share of average local wage |

| 1 | Miami, FL | 10.1% | $2,450 | 62% |

| 2 | New York, NY-NJ | 4.5% | $3,500 | 56% |

| 3 | Los Angeles, CA | 6.1% | $2,350 | 51% |

| 4 | Oakland, CA | 12.6% | $2,550 | 49% |

| 5 | San Francisco, CA | 13.8% | $3,550 | 48% |

| 6 | Riverside–San Bernardino, CA | 5.9% | $1,550 | 46% |

| 7 | San Diego, CA | 10.5% | $2,000 | 44% |

| 8 | Orange County, CA | 3.4% | $2,000 | 44% |

| 9 | Boston, MA | 4.7% | $2,400 | 42% |

| 10 | Washington, DC-VA-MD-WV | 2.6% | $2,200 | 38% |

| 11 | Baltimore, MD | 7.8% | $1,600 | 36% |

| 12 | Chicago, IL | 7.3% | $1,650 | 36% |

| 13 | Seattle, WA | 8.4% | $1,850 | 34% |

| 14 | Philadelphia, PA | 7.2% | $1,600 | 33% |

| 15 | Denver, CO | 10.8% | $1,500 | 32% |

| 16 | Tampa–St. Petersburg, FL | 4.6% | $1,100 | 30% |

| 17 | Portland, OR-WA | 3.5% | $1,250 | 30% |

| 18 | Dallas, TX | 4.4% | $1,400 | 29% |

| 19 | Minneapolis–St. Paul, MN-WI | 3.5% | $1,300 | 28% |

| 20 | Houston, TX | 3.9% | $1,450 | 28% |

| 21 | Sacramento, CA | 9.8% | $1,200 | 28% |

| 22 | Atlanta, GA | 8.6% | $1,200 | 27% |

| 23 | Phoenix, AZ | 7.0% | $1,050 | 26% |

| 24 | Las Vegas, NV | 4.4% | $950 | 26% |

| 25 | St. Louis, MO-IL | 5.1% | $950 | 24% |

| To download the list of rent changes for the largest U.S. metros: Excel or PDF. Wage data are from the Bureau of Labor Statistics for full-year 2013, which only reports average wages, not medians. | ||||

The next Trulia Price Monitor and Trulia Rent Monitor will be released on Thursday, August 7.

How did we put this report together? To recap the methodology, the Trulia Price Monitor and the Trulia Rent Monitor track asking home prices and rents on a monthly basis, adjusting for the changing composition of listed homes, including foreclosures provided by RealtyTrac. The Trulia Price Monitor also accounts for the regular seasonal fluctuations in asking prices in order to reveal the underlying trend in prices. The Monitors can detect price movements at least three months before the major sales-price indexes do. Historical data are sometimes revised each month, and historical data in the current release are the best comparison with current data. Our FAQs provide all the technical details.