The Trulia Price Monitor and the Trulia Rent Monitor are the earliest leading indicators of how asking prices and rents are trending nationally and locally. They adjust for the changing mix of listed homes and therefore show what’s really happening to asking prices and rents. Because asking prices lead sales prices by approximately two or more months, the Monitors reveal trends before other price indexes do. With that, here’s the scoop on where prices and rents are headed.

Prices Up 10.7% Y-o-Y and Rising in 99 of 100 Largest Metros

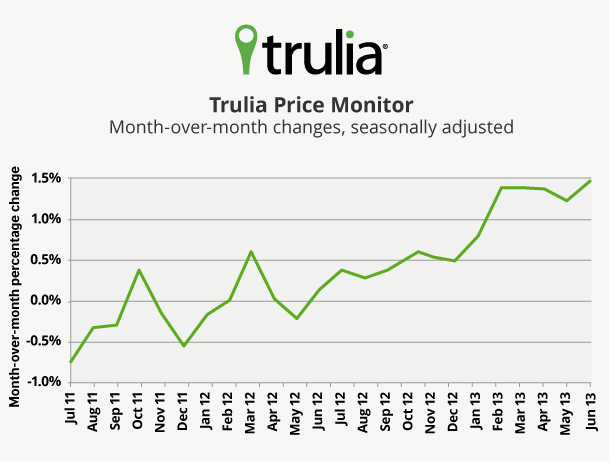

Despite rising mortgage rates – which make housing less affordable and should help slow down price gains eventually – prices show no sign of cooling off. In June, asking home prices rose 1.5% month-over-month, seasonally adjusted. Prices have risen between 1.2% and 1.5% per month for the past five months, and nationally, prices rose 10.7% year-over-year. Even excluding foreclosures, prices are up 11.4% year-over-year, which means the national price increases aren’t primarily driven by the shift away from foreclosure to non-distressed homes for sale. Prices won’t keep rising this fast: rising mortgage rates, more inventory, and declining investor demand should all tap the brakes on price gains – though just not yet.

|

June 2013 Trulia Price Monitor Summary |

|||

|

% change in asking prices |

# of 100 largest metros with asking-price increases |

% change in asking prices, excluding foreclosures |

|

| Month-over-month,

seasonally adjusted |

1.5% |

Not reported |

1.5% |

| Quarter-over-quarter,

seasonally adjusted |

4.1% |

98 |

4.5% |

| Year-over-year |

10.7% |

99* |

11.4% |

| * Only Philadelphia saw a year-over-year decline, and only slightly, at -0.01%. | |||

“Last-to-the-Party” Housing Markets See Big Price Gains

Home prices have been climbing for more than a year in most of the country and for more than two years in San Jose, Phoenix, Denver, Miami, and other markets where job growth or bargain buying started boosting prices earlier. But in a few markets, particularly on the East Coast and in the Midwest, prices were falling until recently. In 17 of the 100 largest metros, prices bottomed in just the past six months. Even in these “last-to-the-party” markets, all except Philadelphia have seen prices rise enough that they’re higher than they were a year ago. Among these recently bottoming markets, prices are up more than 7% in Edison–New Brunswick, NJ, Chicago, Lake County-Kenosha County, IL-WI, and Baltimore.

|

Price Changes Where Prices Bottomed Most Recently |

|||

| # | U.S. Metro |

Y-o-Y% change in asking prices |

Months since prices bottomed |

| 1 | Edison–New Brunswick, NJ |

8.6% |

5 |

| 2 | Chicago, IL |

8.4% |

6 |

| 3 | Lake County-

Kenosha County, IL-WI |

7.9% |

6 |

| 4 | Baltimore, MD |

7.1% |

6 |

| 5 | St. Louis, MO-IL |

6.4% |

6 |

| 6 | Fairfield County, CT |

6.4% |

6 |

| 7 | Virginia Beach–

Norfolk, VA-NC |

5.3% |

6 |

| 8 | Gary, IN |

5.3% |

4 |

| 9 | New Orleans, LA |

4.6% |

6 |

| 10 | Newark, NJ-PA |

3.1% |

5 |

| 11 | Camden, NJ |

3.0% |

5 |

| 12 | Greensboro, NC |

2.4% |

3 |

| 13 | Albuquerque, NM |

2.3% |

5 |

| 14 | Allentown, PA-NJ |

2.1% |

5 |

| 15 | New Haven, CT |

2.1% |

6 |

| 16 | Long Island, NY |

1.3% |

4 |

| 17 | Philadelphia, PA |

0.0% |

5 |

| Note: Includes all markets where prices bottomed in the last 6 months. The Philadelphia Y-o-Y price change is ever so slightly negative: -0.01%. | |||

Rents Pick Up Steam, Though Prices Still Rising Faster in Nearly All Large Markets

Rents are up 2.8% year-over-year nationally – the biggest year-over-year increase since January. Still, rents are rising faster than home prices in just three of the 25 largest rental markets: Houston, New York, and Philadelphia. Rents are rising most in Houston, Miami, and Tampa–St. Petersburg, but falling in the three big rental markets with home price gains of more than 30%: Sacramento, Oakland, and Las Vegas.

|

Rent and Price Changes in 25 Largest Rental Markets |

|||

| # | U.S. Metro |

Y-o-Y % change in rents |

Y-o-Y % change in asking prices |

| 1 | Houston, TX |

11.1% |

9.4% |

| 2 | Miami, FL |

6.7% |

15.6% |

| 3 | Tampa– |

5.2% |

11.4% |

| 4 | Chicago, IL |

4.9% |

8.4% |

| 5 | New York, NY-NJ |

4.8% |

4.7% |

| 6 | San Diego, CA |

4.3% |

19.0% |

| 7 | Boston, MA |

4.1% |

7.6% |

| 8 | Los Angeles, CA |

3.8% |

19.2% |

| 9 | San Francisco, CA |

3.7% |

18.6% |

| 10 | Denver, CO |

3.7% |

12.0% |

| 11 | Orange County, CA |

3.4% |

23.1% |

| 12 | Portland, OR-WA |

2.8% |

16.5% |

| 13 | Washington, DC-VA-MD-WV |

2.5% |

9.6% |

| 14 | Dallas, TX |

2.4% |

12.6% |

| 15 | Philadelphia, PA |

2.4% |

0.0% |

| 16 | Riverside– |

2.0% |

22.5% |

| 17 | St. Louis, MO-IL |

1.6% |

6.4% |

| 18 | Phoenix, AZ |

1.4% |

23.8% |

| 19 | Atlanta, GA |

1.3% |

15.2% |

| 20 | Seattle, WA |

1.2% |

15.7% |

| 21 | Minneapolis–St. Paul, MN-WI |

1.0% |

12.6% |

| 22 | Baltimore, MD |

0.3% |

7.1% |

| 23 | Sacramento, CA |

-0.4% |

32.6% |

| 24 | Oakland, CA |

-0.5% |

34.2% |

| 25 | Las Vegas, NV |

-0.8% |

30.8% |

| Among 25 largest rental markets. | |||

The next Trulia Price Monitor and Trulia Rent Monitor will be released on Tuesday, August 6, at 10 AM ET.

How did we put this report together? To recap the methodology, the Trulia Price Monitor and the Trulia Rent Monitor track asking home prices and rents on a monthly basis, adjusting for the changing composition of listed homes, including foreclosures provided by RealtyTrac. The Trulia Price Monitor also accounts for the regular seasonal fluctuations in asking prices in order to reveal the underlying trend in prices. The Monitors can detect price movements at least three months before the major sales-price indexes do. Our FAQs provide all the technical details.