The Federal Reserve Board is on track to raise interest rates as soon as today. It’s a move that will mean higher mortgage rates, higher monthly payments, and reduced purchasing power for new borrowers. Homebuyers, who haven’t seen an interest rate increase in nearly 10 years, may be tempted by lower-rate 15-year mortgages. But do the advantages of a 15-year mortgage outweigh the costs? The answer depends partly on where you live.

We’ve crunched the numbers for the largest U.S. metros, and found that:

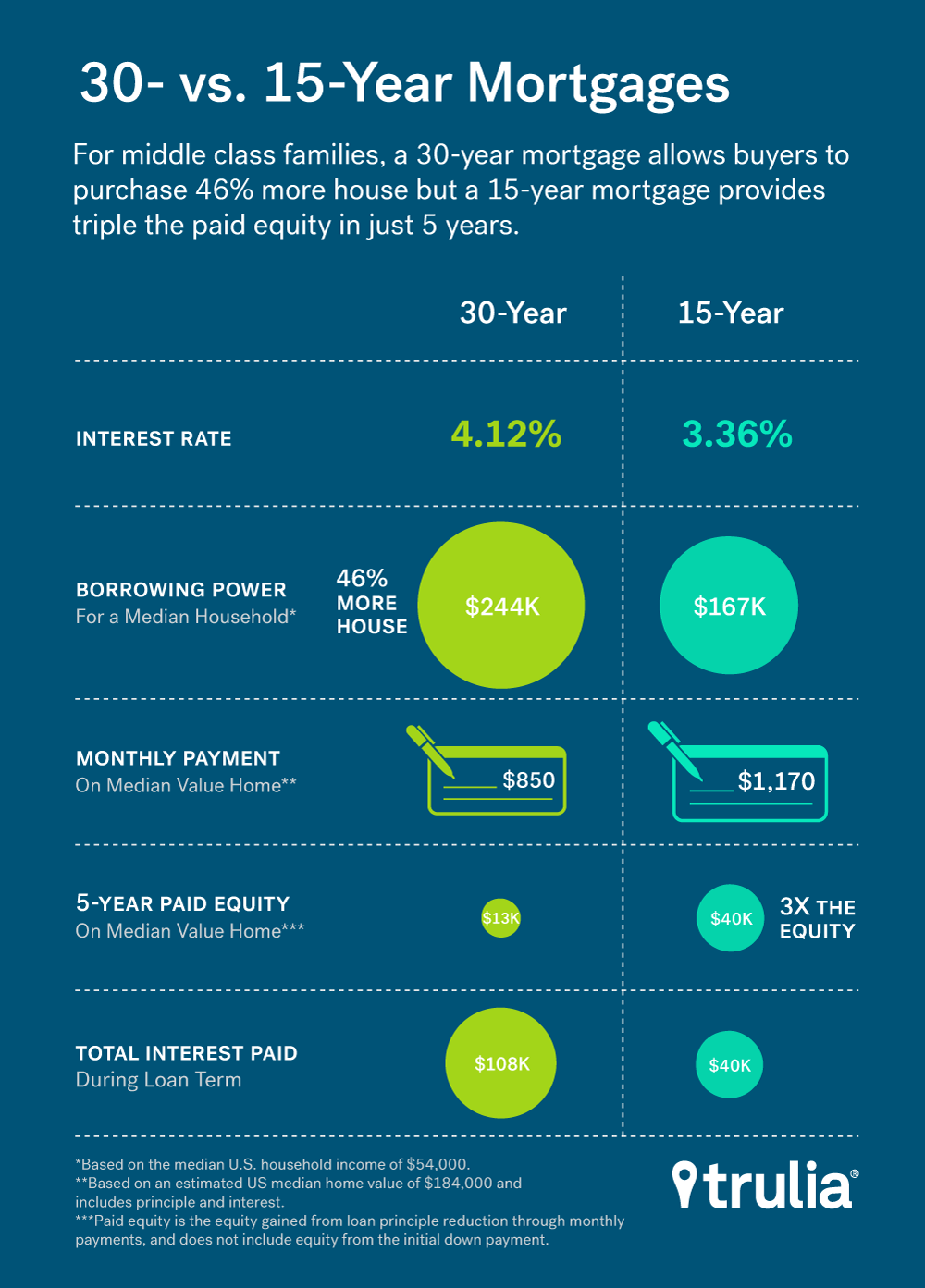

- With the median US household income, a 30-year mortgage allows homebuyers to purchase 46% more house, but a 15-year mortgage provides triple the paid equity in just 5 years.

- Homebuyers in areas where prices have a history of rising will benefit greatly from faster equity-building with a 15-year mortgage.

- Buyers in areas with historically slow growing to flat housing prices will benefit less from shorter-term mortgages and potentially more from the borrowing power of a 30-year loan.

The Tradeoffs Between 30- and 15-year Mortgages

In general, 30-year mortgages have three advantages:

- Monthly payments are lower

- Borrowing power is higher

- Tax benefits are greater

The primary advantage of a 30-year mortgage is lower monthly payments. On the median valued U.S. home, a 30-year mortgage comes with a payment that is $320, or 27%, lower than a 15-year mortgage. Lower payments also mean that a borrower’s debt-to-income (DTI) ratio is lower than a 15–year loan. This allows middle class buyers (a household earning the U.S. median income) to borrow $77,000, or 46%, more with a 30-year mortgage than a 15-year. Last, borrowers with a 30-year mortgage can write off nearly $68,000 more than a 15-year mortgage via the mortgage-interest deduction on their federal income taxes.

A 15-year mortgage has three advantages over a 30-year mortgage:

- Equity builds faster

- Interest rates are lower

- Loan term is shorter

The primary advantage of a 15-year mortgage is that a larger share of each monthly payment goes towards paying off the loan principal. After five years (the number of years the average young household moves), equity gained from paying off the loan balance is more than $39,000, or three-times greater with a 15-year mortgage on the median value home. In addition, the 15-year rate is 3.36%, compared with 4.12% for a 30-year note. And over the loan term, borrowers with 15-year mortgages pay just under $40,000 in interest with a 15-year compared to over $107,000 with a 30-year on the median value home.

In Bargain Markets, 15-year Mortgages Are A Homebuyer’s Best Bet For Equity

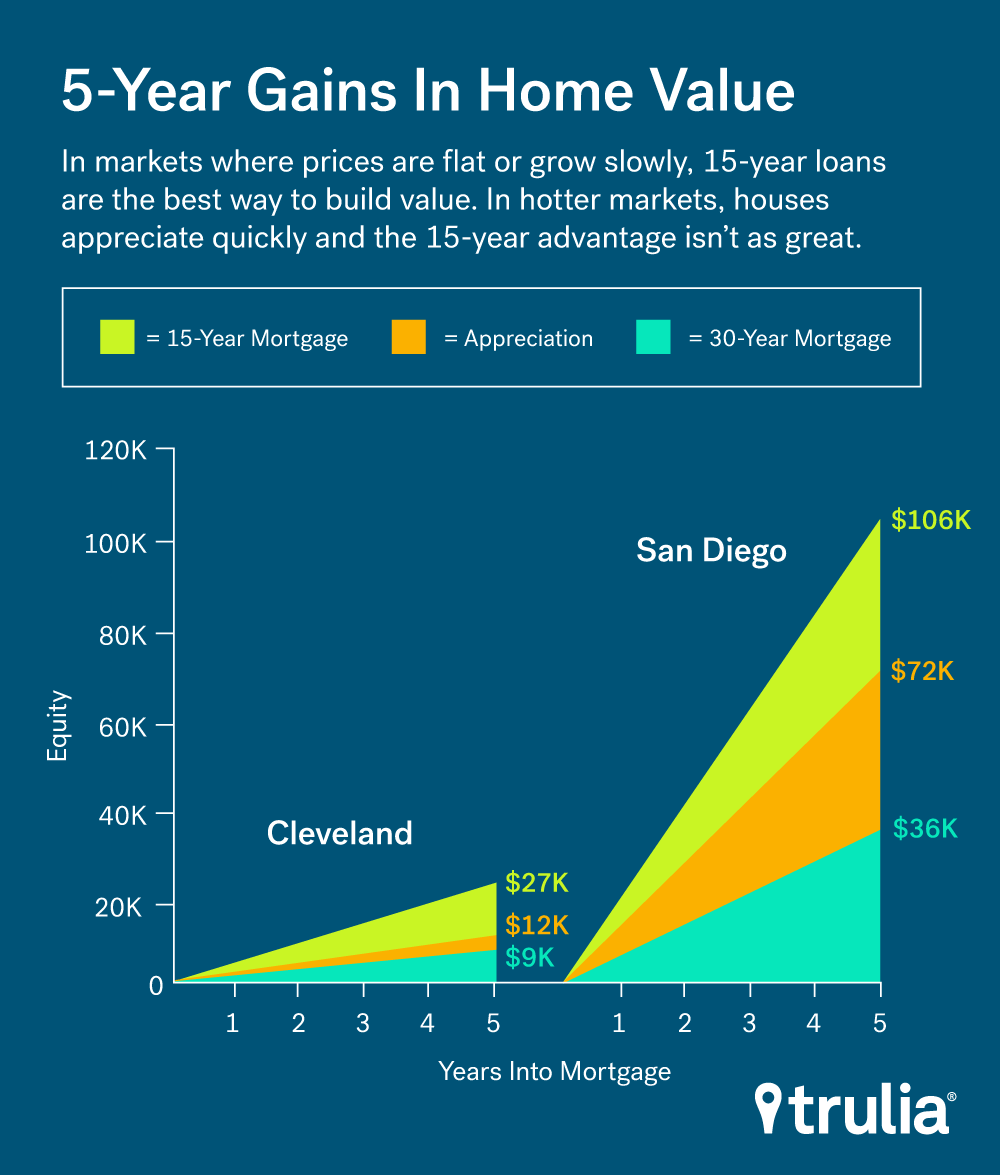

Home equity can come from three sources: down payment, principal reduction, and home value appreciation. This means that in markets with slow appreciation, a larger share of equity will come from homeowners paying down the loan balance when compared to home value appreciation. In such markets, 15-year loans offer a relatively faster route to building equity.

We’ve identified the 10 markets in the country where, after five years of ownership, homeowners will have the most equity from principal reduction relative to home price appreciation. At the top of the list are markets exclusively in the Bargain Belt (Midwest and Southeast). In each of these markets, 15-year mortgages can provide over twice the equity relative to home price appreciation. For example, homeowners in Dayton, Ohio, can earn $22,018 in equity from mortgage payments with a 15-year mortgage, which is 2.37-times greater than the $9,295 gained from price appreciation. With a 30-year mortgage, payments would net households just $7,393. Clearly, household in these markets would gain much more equity by paying down their mortgage principle with a 15-year loan than from home value appreciation.

| Markets where Principal Repayment is Key to Equity Growth | ||||||

| # | U.S. Metro | 5-year Equity from Principal Repayment, 15-year | 5-year Equity from Principal Repayment, 30-Year | 5-year Equity from Home Value Appreciation | 5-year Principal Repayment Relative to Appreciation, 15-year* | 5-year Principal Repayment Relative to Appreciation, 30-year |

| 1 | Dayton, OH | $22,018 | $7,393 | $9,295 | 2.37 | 0.80 |

| 2 | Cleveland, OH | $26,906 | $9,034 | $11,960 | 2.25 | 0.76 |

| 3 | Toledo, OH | $21,193 | $7,116 | $9,667 | 2.19 | 0.74 |

| 4 | Akron, OH | $26,993 | $9,063 | $12,420 | 2.17 | 0.73 |

| 5 | Rochester, NY | $27,704 | $9,302 | $12,862 | 2.15 | 0.72 |

| 6 | Detroit, MI | $13,171 | $4,422 | $6,180 | 2.13 | 0.72 |

| 7 | Greensboro-High Point, NC | $24,924 | $8,369 | $11,778 | 2.12 | 0.71 |

| 8 | Lake County-Kenosha County, IL-WI | $43,508 | $14,608 | $20,620 | 2.11 | 0.71 |

| 9 | Memphis, TN | $23,289 | $7,819 | $11,093 | 2.10 | 0.70 |

| 10 | Winston-Salem, NC | $26,544 | $8,912 | $12,668 | 2.10 | 0.70 |

In Pricey Markets, 15-year Mortgages Are A Tougher Call

In markets with strong home price appreciation, deciding between a 15-year and 30-year mortgage is a tougher call. Like bargain markets, 15-year loans provide more equity from principal repayment than from appreciation. The difference, however, is much smaller. In pricey San Francisco and San Jose, Calif., 15-year mortgages provide just 1.35 times more equity from principal payoff than appreciation. Still, the difference in equity from principal repayment is great between a 30-year and a 15-year mortgage. For example, households in Orange County would stand to gain nearly $100,000 more in equity after 5 years by choosing a 15-year mortgage.

| Markets where Appreciation Drives Equity Growth | ||||||

| # | U.S. Metro | 5-year Equity from Principal Repayment, 15-year | 5-year Equity from Principal Repayment, 30-Year | 5-year Equity from Home Value Appreciation | 5-year Principal Repayment Relative to Appreciation, 15-year | 5-year Principal Repayment Relative to Appreciation, 30-year |

| 1 | San Francisco, CA | $247,382 | $83,061 | $184,397 | 1.34 | 0.45 |

| 2 | San Jose, CA | $203,060 | $68,179 | $150,088 | 1.35 | 0.45 |

| 3 | Orange County, CA | $139,362 | $46,792 | $96,300 | 1.45 | 0.49 |

| 4 | Los Angeles, CA | $112,946 | $37,922 | $76,446 | 1.48 | 0.50 |

| 5 | Oakland, CA | $136,768 | $45,921 | $92,323 | 1.48 | 0.50 |

| 6 | San Diego, CA | $106,895 | $35,891 | $72,083 | 1.48 | 0.50 |

| 7 | Ventura County, CA | $111,904 | $37,573 | $73,109 | 1.53 | 0.51 |

| 8 | Boston, MA | $90,176 | $30,277 | $58,567 | 1.54 | 0.52 |

| 9 | Austin, TX | $50,860 | $17,077 | $32,778 | 1.55 | 0.52 |

| 10 | Charleston, SC | $44,599 | $14,975 | $28,684 | 1.55 | 0.52 |

Even though 15-year mortgages provide more equity through loan repayment than appreciation, they also come at the expense of borrowing power. In high-priced markets, the difference in nominal terms can be substantial. For example, middle class families in San Francisco (households making the median income of $104,000 per year) could purchase a $628,000 home with a 30-year mortgage but only a $430,000 home with a 15-year. This makes house hunting hard when the median priced home costs more than $1 million. As a results, this could be the difference between buying their dream-home or a starter for some households.

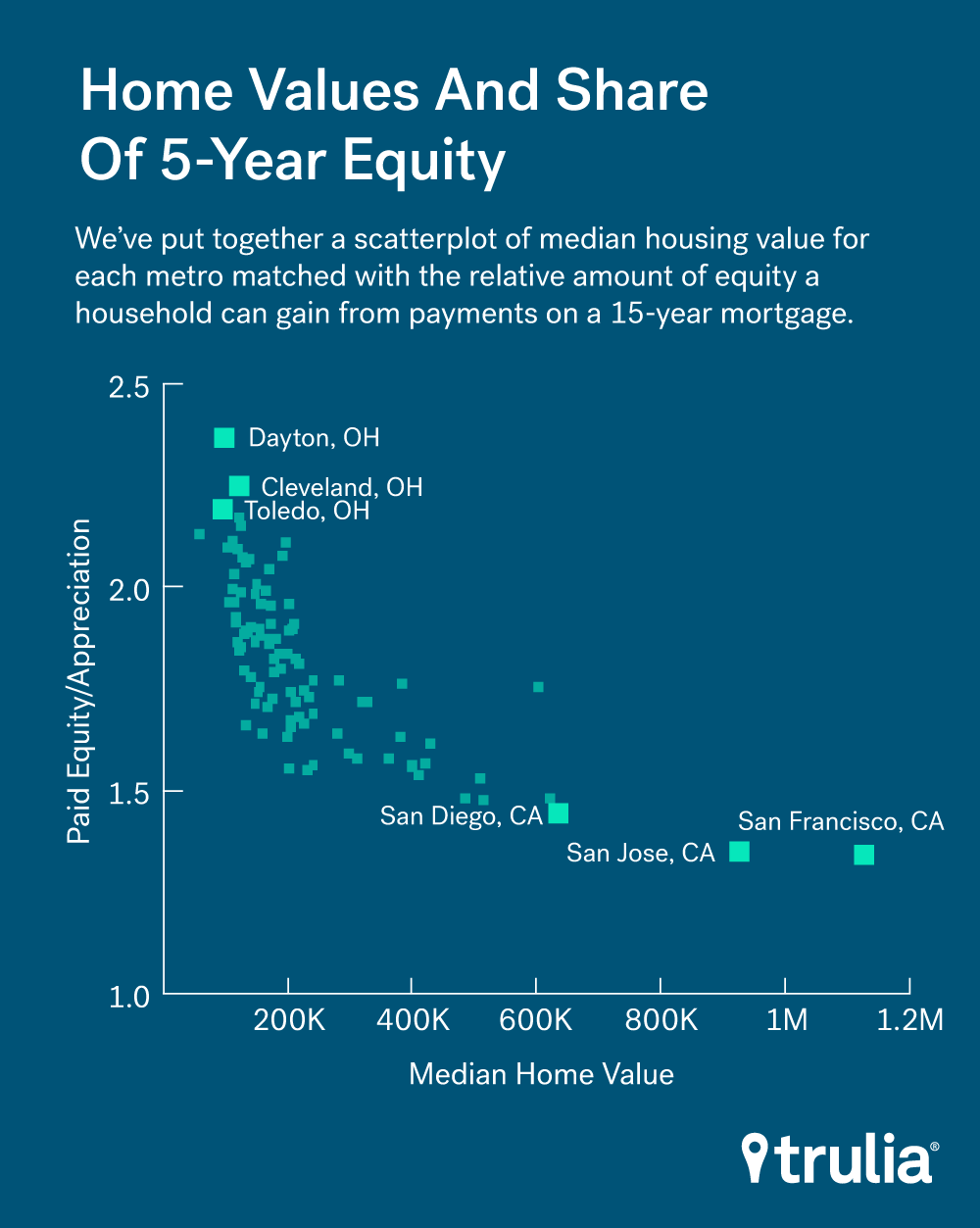

To show why households in expensive housing markets have a much tougher decision, we’ve put together a scatterplot of median home values for each of the 100 largest U.S. metros and matched it with the relative amount of equity a household can gain from payments on a 15-year mortgage. As you can see, households in cheaper markets (bottom axis) stand to gain relatively more equity (left axis) from paying down their mortgage with a 15-year note than through home value appreciation when compared to pricier markets. For example, households in affordable Cleveland, which has a median home value of $123,000, can reap 2.25 times the equity from loan repayment than appreciation. In San Francisco, the land of million dollar homes, the added value is only 1.34 times the equity.

The takeaway: 15-year mortgages are a great option for those wanting to build equity, regardless of how expensive or how fast growing a market is. However, in places with historically low appreciation, 15-year mortgages are a much better deal for building equity because it’s about the only way to do so though paying of the loan balance. On the other hand, in areas with historically high price appreciation that also happen to be expensive, households need to consider the tradeoffs between the borrowing power of 30-year mortgages, expected equity from home price appreciation, and whether or not they will use equity from their existing home as a down payment on their next one.

Methodology

To compare 30- and 15-year mortgages, we estimate the amount of equity a household would gain from both appreciation and from paying off the principal after 5-years of homeownership of the median valued home. We estimate this separately for each of the 100 largest U.S. metros, and use an annualized 20-year Federal Housing Finance Administration (FHFA) house price growth rate to project home values 5 years into the future. Last, we compare the nominal and relative amount of equity a household would gain by choosing either a 30- or 15-year mortgage and comparing that to the expected gain in equity from home value appreciation.