Housing data from the 2010 Census came out this week: yesterday’s blog post on where vacancies are high showed which markets are tightening and which are still weighed down by lots of vacant homes. Today, some mixed news on construction trends, good news on the number of home loan delinquencies and news you can use when you price your home to sell.

Construction Spending Favors Renters

What happens to the construction industry matters for builders and construction workers – especially with the unemployment rate for construction workers at 13.3% (which is several points higher than the overall unemployment rate). But construction trends also matter for all of us. Although construction employment and investment are up only minimally in the past year, new Census construction spending data show two key trends. First, construction spending on new multi-family homes – that’s apartments, condos, and so on – is 13% higher than a year ago. This is a reaction to rising rents and falling homeownership rates, and when this new construction becomes available, it will lower the cost of renting versus buying. But the second trend is the decline in government construction projects – especially roads and schools. Unlike the worst years of the housing crash, when the federal stimulus kept public construction projects going, state and local budget cuts are taking their toll. In the last year, public spending on roads is down 4.0% and on school construction is down 4.5%. Until this turns around, the infrastructure we rely on will suffer.

Links

—Bureau of Labor Statistics national employment and unemployment for September

—Census construction spending report for August

You Can’t Pay Your Mortgage If You Don’t Have a Job

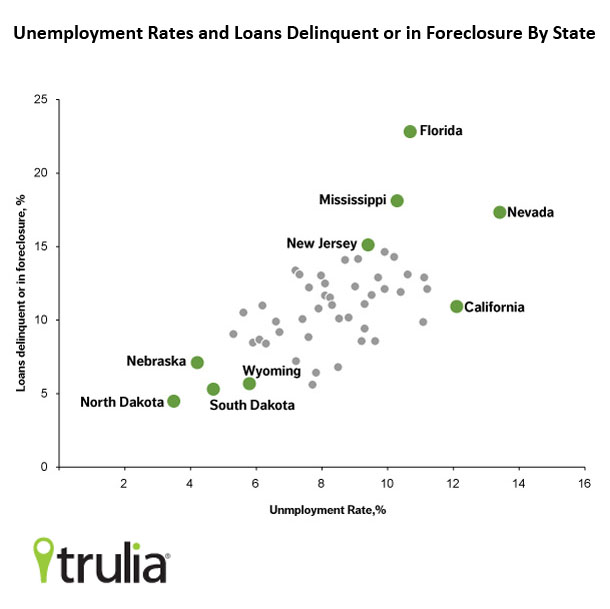

A positive sign from this week is that delinquencies – homes with mortgages that are at least 30 days behind on their payments – are down almost 12% in August versus a year earlier, according to the LPS Mortgage Monitor. Meanwhile, foreclosures rose over the same period by 8%. What gives? Delinquencies and foreclosures are part of the same overall process. Some of those homes with late mortgage payments moved into the foreclosure stage, lowering the number of delinquencies and raising the number in foreclosure at the same time. Nationally, 12.2% of all loans – that’s one-eighth — are delinquent or in foreclosure. But this can be as high as 22.8% in Florida to just 4.5% in North Dakota. One reason for this discrepancy is that the relationship between the job market and the housing market is very strong. It’s a lot easier to pay your mortgage if you’ve got a job, and because a struggling housing market kills construction jobs. As you can see from the chart that we made below, all of the states where unemployment is low have below-average delinquencies and foreclosures. Meanwhile the states where homeowners struggle most to make their payments and keep their homes all have high or very high unemployment. The bottom line: the housing market won’t recover without a healthy job market.

Links

—LPS Mortgage Monitor September report

—Bureau of Labor Statistics, state unemployment rates for August

How to Price Your Home to Sell

Time for some news you can really use. The burning question on the minds of home sellers everywhere is price – how much should sell your home for? Should you set a high listing price to give yourself a better starting point for negotiations, or should you set a low listing price to draw in lots of prospective buyers and generate a ton of competing bids to push up the final offer? According to new unpublished academic research, you should price your home high, even though many real estate pros often recommend that you list low. This is because high list prices tend to lead to higher sales prices, even after taking into account details about the house, the neighborhood and time on the market. In fact, listing high is the right strategy – even in markets with lots of sales where you’d think listing low is the right call because it will spark a bidding war – because the high listing price will boosts the final sales price. This is even true in local markets with lots of foreclosures. Of course, if you need to sell quickly, a low listing price should get you out faster than a high listing price, but if you want the best price, even in today’s market, list high.

Links

—“Listing Behaviors and Housing Market Outcomes,” Grace Wong Bucchianeri and Julia Minson