The Trulia Price Monitor and the Trulia Rent Monitor are the earliest leading indicators of how asking prices and rents are trending nationally and locally. They adjust for the changing mix of listed homes and therefore show what’s really happening to asking prices and rents. Because asking prices lead sales prices by approximately two or more months, the Monitors reveal trends before other price indexes do. With that, here’s the scoop on where prices and rents are headed.

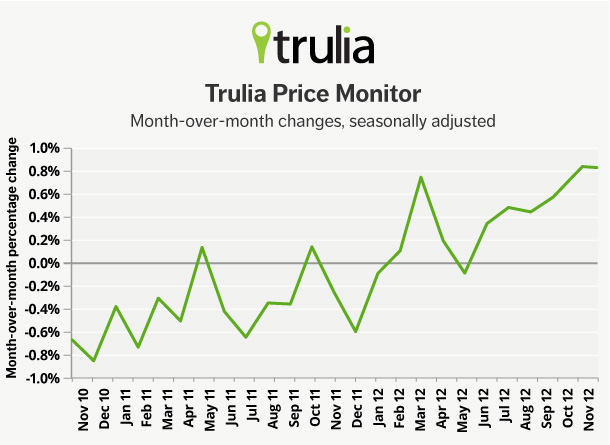

Asking Prices Post Second-Biggest Monthly Gain in Years

In November, asking prices on for-sale homes rose 0.8% month-over-month, for a 3.8% year-over-year increase–the second-largest post-crisis monthly gain (just slightly behind October 2012) and the largest yearly gain to date. More than three quarters of large metros (76 out of 100) had year-over-year price increases. Quarter-over-quarter prices rose 2.2 percent, seasonally adjusted, another post-crisis high; in fact, prices rose 0.8 percent quarter-over-quarter without adjusting for seasonality (not shown in table), even though prices typically decline after the summer.

|

November 2012 Trulia Price Monitor Summary |

|||

|

% change in asking prices |

# of 100 largest metros with asking-price increases |

% change in asking prices, excluding foreclosures |

|

| Month-over-month,

seasonally adjusted |

0.8% |

Not reported |

0.8% |

| Quarter-over-quarter,

seasonally adjusted |

2.2% |

70 |

1.6% |

| Year-over-year |

3.8% |

76 |

4.3% |

Prices Rebounding in Atlanta, Sacramento, and the Inland Empire

This month, we focus on quarter-over-quarter price changes for the last four quarters. Salt Lake City and Wilmington, DE, had the largest increases in November, surpassing 7%. Meanwhile, Phoenix and San Jose had strong quarterly gains both in November and three months earlier, in August.

But several other top gainers are new to the party. Atlanta and two inland California metros – Riverside–San Bernardino (known as the “Inland Empire”) and Sacramento – all saw large quarter-over-quarter gains in November after smaller gains or declines in previous quarters. Two other inland California metros–Fresno and Bakersfield–had the 11th and 12th largest quarter-over-quarter asking-price increases. These metros, all hard-hit during the housing crisis, were slower than other hard-hit metros like Phoenix, Las Vegas, and Miami to benefit from a price rebound. But now, with the price gains in Atlanta and inland California, all of the hardest-hit metros during the housing bust have started to bounce back.

|

Metros with the Largest Quarterly Asking Price Increases |

|||||

|

# |

U.S. Metro |

Q-o-Q % change in asking price |

|||

|

Nov 2012 |

Aug 2012 |

May 2012 |

Feb 2012 |

||

|

1 |

Salt Lake City, UT |

7.8% |

2.2% |

4.2% |

-4.1% |

|

2 |

Wilmington, DE-MD-NJ |

7.4% |

-1.9% |

-0.5% |

-1.3% |

|

3 |

Phoenix, AZ |

6.8% |

5.2% |

6.5% |

6.0% |

|

4 |

Atlanta, GA |

6.2% |

0.0% |

1.7% |

-2.1% |

|

5 |

Cape Coral– |

6.1% |

2.4% |

0.7% |

4.5% |

|

6 |

Riverside– |

5.5% |

3.5% |

0.9% |

-1.3% |

|

7 |

Sacramento, CA |

5.3% |

2.1% |

1.3% |

-4.3% |

|

8 |

San Jose, CA |

5.0% |

5.9% |

2.2% |

0.9% |

|

9 |

Portland, OR-WA |

4.8% |

0.3% |

2.1% |

-0.6% |

|

10 |

Denver, CO |

4.7% |

2.9% |

1.9% |

2.2% |

| Among the 100 largest metro areas. | |||||

Home-Price Recovery Strengthens, But Unevenly

Nationally, price gains are accelerating. The quarter-over-quarter change in asking prices has increased steadily over the past six months, from 0.8% in May to 1.3% in August to 2.2% in November. However, the number of metros (out of the 100 largest metros) with quarter-over-quarter price gains was 73 in May, 79 in August, and just 70 in November.

How can prices be rising nationally while the number of metros with price increases falls? It’s because the recovery in home prices is becoming more uneven across metros: the spread in price changes between metros with the biggest gains and metros with the biggest losses is widening. (More precisely, the standard deviation across metros in quarter-over-quarter price changes has been increasing.) Even though prices are rising nationally, more metros are seeing quarterly price declines. There’s a pattern to this uneven price recovery: as the table below shows, the largest metros (the top 25 of the 100 large metros that we track, such as Seattle and Miami) have had, on average, bigger yearly and quarterly price increases than other large metros, such as Worcester, MA, and Greenville, SC.

| Metro Size (rank 1 = largest) |

Y-o-Y % change in asking prices, Nov 2012 |

Q-o-Q % change in asking prices, Nov 2012 |

| Rank 1-25 |

5.4% |

2.4% |

| Rank 26-50

(e.g. Portland, OR, |

4.5% |

1.6% |

| Rank 51-75

(e.g. Richmond, VA, |

2.7% |

1.1% |

| Rank 76-100

(e.g. Worcester, MA, |

1.3% |

0.7% |

| Note: 100 largest metros grouped by size (# of households). | ||

Rents Up 5.6% Year-over-Year, But Prices Catching Up in Largest Markets

Nationally, rents rose 5.6% year-over-year, outpacing the national price gain of 3.8%. But, remember, price gains are now uneven, with prices in the biggest metros up 5.4% year-over-year. In fact, even in some markets with the biggest rent gains nationally, prices are zooming ahead of fast-rising rents–including Denver, Seattle, and San Francisco. Across the largest 25 rental markets, rents are rising faster than prices in only 11 markets, and prices are rising faster than rents in the other 14. That means in most of the largest rental markets, homeownership is getting less affordable relative to renting.

|

Y-o-Y Rent Increases vs. Y-o-Y Asking Price Gains |

|||

|

# |

U.S. Metro |

% change in rents, Y-o-Y, Nov 2012 |

% change in asking prices, Y-o-Y, Nov 2012 |

|

1 |

Houston, TX |

16.8% |

2.3% |

|

2 |

Oakland, CA |

11.6% |

10.5% |

|

3 |

Miami, FL |

10.8% |

7.6% |

|

4 |

Denver, CO |

9.0% |

12.4% |

|

5 |

Philadelphia, PA |

8.9% |

-0.8% |

|

6 |

Seattle, WA |

8.3% |

8.8% |

|

7 |

Minneapolis–St. Paul, MN-WI |

7.8% |

7.1% |

|

8 |

Chicago, IL |

6.9% |

-3.1% |

|

9 |

New York, NY-NJ |

6.6% |

0.3% |

|

10 |

San Francisco, CA |

5.8% |

9.5% |

|

11 |

Boston, MA |

5.7% |

3.2% |

|

12 |

Portland, OR-WA |

5.1% |

6.7% |

|

13 |

Los Angeles, CA |

5.1% |

2.8% |

|

14 |

Atlanta, GA |

5.0% |

6.0% |

|

15 |

Baltimore, MD |

4.7% |

1.2% |

|

16 |

Dallas, TX |

4.4% |

0.8% |

|

17 |

Riverside–San Bernardino, CA |

4.1% |

9.1% |

|

18 |

Tampa–St. Petersburg, FL |

3.4% |

7.4% |

|

19 |

Orange County, CA |

3.2% |

7.7% |

|

20 |

San Diego, CA |

2.8% |

5.4% |

|

21 |

Washington, DC-VA-MD-WV |

2.6% |

6.4% |

|

22 |

Phoenix, AZ |

2.3% |

26.9% |

|

23 |

St. Louis, MO-IL |

1.2% |

1.7% |

|

24 |

Sacramento, CA |

1.2% |

5.0% |

|

25 |

Las Vegas, NV |

-0.7% |

13.7% |

| NOTE: Largest 25 rental markets | |||

The next Trulia Price Monitor and Trulia Rent Monitor will be released on Thursday, January 3, at 10 AM ET.

How did we put this report together? To recap the methodology, the Trulia Price Monitor and the Trulia Rent Monitor track asking home prices and rents on a monthly basis, adjusting for the changing composition of listed homes, including foreclosures provided by RealtyTrac. The Trulia Price Monitor also accounts for the regular seasonal fluctuations in asking prices in order to reveal the underlying trend in prices. The Monitors can detect price movements at least three months before the major sales-price indexes do. Our FAQs provide all the technical details.