The Trulia Price Monitor and the Trulia Rent Monitor are the earliest leading indicators of how asking prices and rents are trending nationally and locally. They adjust for the changing mix of listed homes and therefore show what’s really happening to asking prices and rents. Because asking prices lead sales prices by approximately two or more months, the Monitors reveal trends before other price indexes do. With that, here’s the scoop on where prices and rents are headed.

First Signs of Slowdown: Prices Down 0.3% Month-over-Month

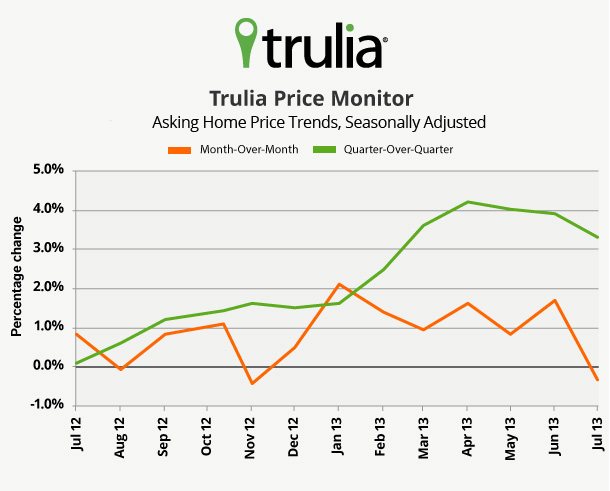

Asking home prices decreased 0.3% in July – the first month-over-month decline since November 2012. (See note at end of post.) Although monthly changes can be volatile, quarter-over-quarter changes – which are less jumpy – confirm the price slowdown: asking prices were up 3.3% quarter-over-quarter in July, down from a peak of 4.2% in April.

What’s driving this slowdown? As we’ve said, rising mortgage rates, more inventory, and declining investor demand all play a role in dampening price gains, but it’s hard to tease out which factor matters most. Inventory has increased 6% since January (even after adjusting for seasonality), and mortgage rates started their sharp rise in early May.

Prices are up 11.0% year-over-year – a new record since the recession – but the year-over-year change is an average over the past 12 months. That’s why the price turndown affects the month-over-month and quarter-over-quarter numbers first, even though the year-over-year change is increasing – for now.

|

July 2013 Trulia Price Monitor Summary |

|||

|

% change in asking prices |

# of 100 largest metros with asking-price increases |

% change in asking prices, excluding foreclosures |

|

| Month-over-month,

seasonally adjusted |

-0.3%* |

Not reported |

0.6%* |

| Quarter-over-quarter,

seasonally adjusted |

3.3% |

97 |

3.9% |

| Year-over-year |

11.0% |

98 |

11.5% |

| * Month-over-month change is July versus June. Quarter-over-quarter and year-over-year changes are three-month averages.

|

|||

Prices Cooling in the Hottest Markets

Although prices are up quarter-over-quarter in July in 97 of the 100 largest metros (see table above), price gains are decelerating. In 64 out of 100 metros, this quarterly price gain in July was lower than the quarterly gain three months earlier in April. Prices, therefore, continue to rise almost everywhere – but the slowdown is widespread, too.

The three markets with year-over-year price increases of more than 30% – Sacramento, Las Vegas, and Oakland – all saw price gains slow down in the most recent quarter, compared with the previous quarter (ending April) where those metros all had double-digit quarterly gains. To be sure, Las Vegas’s 7.5% quarterly price gain in July is still blazingly and unsustainably fast, but it’s a slowdown compared with its quarterly gain of 12.7% in April. Other California metros, including San Jose, Fresno, Ventura County, and San Francisco, saw quarter-over-quarter gains drop by at least two percentage points between April and July, as did Grand Rapids, MI, and Portland, OR. On the flip side, price gains accelerated in Detroit and Atlanta, which had quarter-over-quarter gains rise by more than three percentage points between April and July. Overall, the West Coast – where prices have rebounded strongly already – is seeing a price slowdown, while many metros in the South and Midwest are seeing price gains accelerate.

|

Recent Price Changes in the 20 Hottest Markets |

|||||

| # | U.S. Metro |

Y-o-Y % change, July 2013 |

Q-o-Q % change, July 2013 |

Q-o-Q % change, April 2013 |

Price slowdown = Difference in Q-o-Q % change, July minus April |

| 1 | Sacramento, CA |

33.7% |

6.8% |

10.2% |

-3.3% |

| 2 | Las Vegas, NV |

32.9% |

7.5% |

12.7% |

-5.2% |

| 3 | Oakland, CA |

31.0% |

7.2% |

10.8% |

-3.6% |

| 4 | Riverside–San Bernardino, CA |

24.7% |

6.9% |

6.8% |

0.1% |

| 5 | Bakersfield, CA |

24.2% |

5.4% |

6.6% |

-1.2% |

| 6 | Phoenix, AZ |

24.2% |

5.9% |

5.3% |

0.5% |

| 7 | Orange County, CA |

23.3% |

5.9% |

7.0% |

-1.1% |

| 8 | Warren–Troy–Farmington Hills, MI |

22.6% |

7.1% |

6.6% |

0.5% |

| 9 | Detroit, MI |

21.8% |

8.3% |

4.7% |

3.7% |

| 10 | San Jose, CA |

20.9% |

4.5% |

6.9% |

-2.4% |

| 11 | Los Angeles, CA |

20.9% |

5.6% |

6.7% |

-1.1% |

| 12 | San Diego, CA |

20.3% |

6.1% |

5.7% |

0.4% |

| 13 | Fresno, CA |

19.9% |

5.2% |

7.4% |

-2.2% |

| 14 | Atlanta, GA |

19.0% |

5.4% |

2.2% |

3.2% |

| 15 | Ventura County, CA |

18.6% |

5.3% |

8.2% |

-2.9% |

| 16 | Fort Lauderdale, FL |

18.3% |

5.0% |

4.5% |

0.5% |

| 17 | Grand Rapids, MI |

18.2% |

5.1% |

7.6% |

-2.6% |

| 18 | Portland, OR-WA |

18.1% |

3.6% |

6.9% |

-3.3% |

| 19 | Salt Lake City, UT |

17.4% |

3.3% |

4.6% |

-1.3% |

| 20 | San Francisco, CA |

17.2% |

3.0% |

6.5% |

-3.5% |

| * The final column equals the difference between the third and second data columns, but the numbers might not appear to add up due to rounding. | |||||

Rents Up 3.9%, But Prices are Rising Faster Everywhere

Rents are up 3.9% year-over-year nationally. That’s a big increase compared with inflation or with income growth – but small compared with price gains. Even with the beginning of the price slowdown, prices outpaced rents in all 25 of the largest rental markets, making July the first time that rents aren’t rising faster than prices in any major market. Rents are rising fastest in the artisan coffee belt – Seattle, San Francisco, and Portland – along with Houston.

|

Rent and Price Changes in 25 Largest Rental Markets |

|||

| # | U.S. Metro |

Y-o-Y % change in rents |

Y-o-Y % change in asking prices |

| 1 | Seattle, WA |

11.1% |

16.0% |

| 2 | Houston, TX |

8.5% |

10.2% |

| 3 | San Francisco, CA |

8.1% |

17.2% |

| 4 | Portland, OR-WA |

7.7% |

18.1% |

| 5 | Denver, CO |

7.1% |

11.7% |

| 6 | Miami, FL |

5.8% |

12.2% |

| 7 | Oakland, CA |

5.6% |

31.0% |

| 8 | Tampa–St. Petersburg, FL |

5.0% |

11.9% |

| 9 | Dallas, TX |

4.9% |

12.6% |

| 10 | Riverside–San Bernardino, CA |

4.7% |

24.7% |

| 11 | Los Angeles, CA |

4.3% |

20.9% |

| 12 | Orange County, CA |

4.3% |

23.3% |

| 13 | Boston, MA |

4.1% |

7.9% |

| 14 | Baltimore, MD |

4.0% |

8.0% |

| 15 | San Diego, CA |

3.9% |

20.3% |

| 16 | New York, NY-NJ |

3.7% |

5.0% |

| 17 | Chicago, IL |

3.2% |

11.3% |

| 18 | Phoenix, AZ |

3.1% |

24.2% |

| 19 | St. Louis, MO-IL |

3.0% |

5.7% |

| 20 | Atlanta, GA |

2.0% |

19.0% |

| 21 | Las Vegas, NV |

1.7% |

32.9% |

| 22 | Minneapolis–St. Paul, MN-WI |

1.4% |

13.2% |

| 23 | Philadelphia, PA |

0.1% |

0.3% |

| 24 | Washington, DC-VA-MD-WV |

-0.1% |

9.5% |

| 25 | Sacramento, CA |

-2.3% |

33.7% |

| Among 25 largest rental markets. | |||

The next Trulia Price Monitor and Trulia Rent Monitor will be released on Thursday, September 5, at 10 AM ET.

How did we put this report together? To recap the methodology, the Trulia Price Monitor and the Trulia Rent Monitor track asking home prices and rents on a monthly basis, adjusting for the changing composition of listed homes, including foreclosures provided by RealtyTrac. The Trulia Price Monitor also accounts for the regular seasonal fluctuations in asking prices in order to reveal the underlying trend in prices. The Monitors can detect price movements at least three months before the major sales-price indexes do. Our FAQs provide all the technical details.

From now on, we are reporting month-over-month asking price changes as the current month relative to the previous month, rather than as three-month averages. This will increase volatility in the month-over-month figures but will show price changes more quickly. The quarter-over-quarter and year-over-year changes will continue to be three-month averages in order to have sufficient samples to report metro-level changes. Also, starting this month we added more housing units to the Rent Monitor, which caused a modest upward revision to previously published recent year-over-year rent changes, primarily on apartment units, but not single-family homes.