The Trulia Price Monitor and the Trulia Rent Monitor are the earliest leading indicators of how asking prices and rents are trending nationally and locally. They adjust for the changing mix of listed homes and therefore show what’s really happening to asking prices and rents. Because asking prices lead sales prices by approximately two or more months, the Monitors reveal trends before other price indexes do. With that, here’s the scoop on where prices and rents are headed.

Prices Rose 1.0% Month-over-Month in August

Nationally, the month-over-month increase in asking home prices rose to 1.0% in August, up a bit from 0.7% in July. Asking prices rose 7.8% year-over-year, slower than one year ago, in August 2013, when asking prices were up 9.9% year-over-year. At the local level, asking prices rose year-over-year in 96 of the 100 largest U.S. metros.

| August 2014 Trulia Price Monitor Summary | |||

| % change in asking prices | # of 100 largest metros with asking-price increases | % change in asking prices, excluding foreclosures | |

| Month-over-month,

seasonally adjusted |

1.0% | N/A | 1.1% |

| Quarter-over-quarter,

seasonally adjusted |

2.8% | 92 | 3.1% |

| Year-over-year | 7.8% | 96 | 7.3% |

| *Data from previous months are revised each month, so data being reported now for previous months might differ from previously reported data. | |||

The South Now Leads the Home-Price Recovery

Seven of the 10 U.S. metros with the largest year-over-year price increases are in the South, including the top four: Miami, Birmingham, Lakeland-Winter Haven, and West Palm Beach. These 10 metros include markets where prices are now rising much faster than one year ago and markets where prices are slowing down. In the accelerating markets of Birmingham, West Palm Beach, and Palm Bay-Melbourne-Titusville, the year-over-year price gain in August 2013 was less than 5% and is now more than 13%. But in Riverside-San Bernardino, Atlanta, and Oakland, price gains have slowed significantly from more than 20% year-over-year in August 2013 to less than 14% now.

| Where Asking Prices Rose Most Year-over-Year, August 2014 | ||||

| # | U.S. Metro | Y-o-Y % asking price change, Aug 2014 | Y-o-Y % asking price change, Aug 2013 | Difference in price change, Aug 2014 vs Aug 2013 |

| 1 | Miami, FL | 15.6% | 10.3% | 5.3% |

| 2 | Birmingham, AL | 15.6% | -0.9% | 16.5% |

| 3 | Lakeland–Winter Haven, FL | 14.8% | 10.7% | 4.1% |

| 4 | West Palm Beach, FL | 14.5% | 4.8% | 9.7% |

| 5 | Riverside–San Bernardino, CA | 13.8% | 26.0% | -12.1% |

| 6 | Palm Bay–Melbourne–Titusville, FL | 13.6% | 4.9% | 8.7% |

| 7 | Atlanta, GA | 13.3% | 21.2% | -7.9% |

| 8 | Cape Coral–Fort Myers, FL | 12.7% | 11.5% | 1.2% |

| 9 | Chicago, IL | 12.5% | 8.5% | 4.1% |

| 10 | Oakland, CA | 12.4% | 30.9% | -18.6% |

| Note: among 100 largest U.S. metros. To download the list of asking home price changes for the largest metros: Excel or PDF. | ||||

The housing markets with the slowest price increases (and, in four metros, decreases) are clustered in the Northeast, such as in upstate New York. Why is that? These markets had a mild housing bubble and bust last decade and therefore are now having only a slight price recovery; they’ve also had relatively weak job growth recently.

Among Harder-Hit Markets, Prices Rising Faster in Judicial States

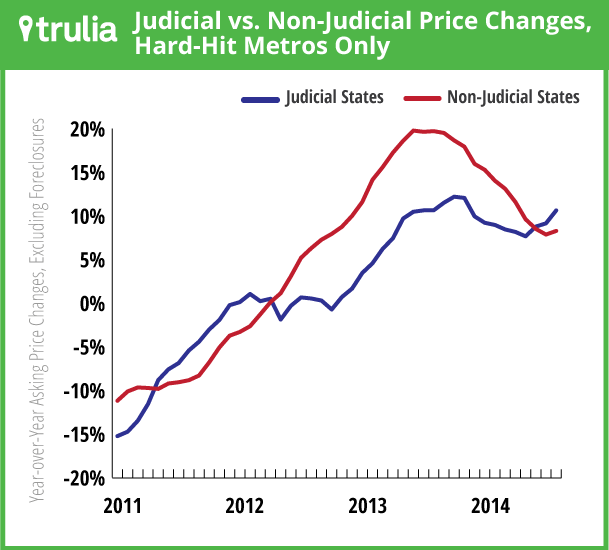

Foreclosures have shaped where and when home prices have recovered. Foreclosed homes tend to depress neighboring home values and sell at a discount. But once most of the foreclosures in a market are sold, then overall inventory tightens – especially at the low end – giving home prices a boost. In states with a “non-judicial” foreclosure process (such as California, Michigan, and Texas), foreclosures don’t have to go through the courts. That means homes in non-judicial states are foreclosed and sold more quickly than in states with a “judicial” process (such as Florida, Illinois, and New York). As a result, the foreclosure wave cleared sooner and faster in non-judicial states, and housing markets in those states got an earlier and sharper price boost.

But now, even judicial states are seeing the light at the end of the foreclosure tunnel and are getting their own price boost. In August 2014, asking prices on for-sale homes excluding foreclosures were up 6.9% year-over-year in metros in judicial states, only slightly behind the 7.8% increase in metros in non-judicial states. In contrast, in August 2013, the year-over-year price gain was 14.1% in non-judicial states and just 5.1% in judicial states.

The above comparison between judicial and non-judicial states includes all 100 large metros. But in markets that had a mild housing bust, there were fewer foreclosures; in those markets we wouldn’t expect the home-price recovery to have been as affected by the foreclosure process as in harder-hit markets. Looking instead only at markets where prices dropped more than 25% during the bust, asking prices actually rose faster year-over-year in judicial states (10.6%) than in non-judicial states (8.3%).

Furthermore, the above charts show that the price recovery in judicial states has been steadier than in non-judicial states. The most extreme price slowdowns today are concentrated in non-judicial states, particularly in California and the Southwest but also Georgia and Michigan. Despite the pain that a longer foreclosure process can cause, markets in judicial states have had a more sober and sustainable price recovery.

Rents Accelerate, Rising 6.3% Year-over-Year

In five of the 25 largest rental markets, rents rose more than 10% year-over-year. Three of these five are in northern California: Sacramento, San Francisco, and Oakland have the highest rent increases in the country, followed by Denver and Miami. Rents rose faster year-over-year in August than three months ago, in May, in 20 of the 25 largest rental markets. In August compared to May, rents accelerated most in Sacramento while cooling in San Diego.

| Rent Trends in the 25 Largest Rental Markets | ||||

| # | U.S. Metro | Y-o-Y % change in rents, Aug 2014 | Y-o-Y % change in rents, May 2014 | Median rent for 2-bedroom, Aug 2014 |

| 1 | Sacramento, CA | 14.9% | 8.0% | $1,250 |

| 2 | San Francisco, CA | 14.5% | 15.1% | $3,500 |

| 3 | Oakland, CA | 14.4% | 10.7% | $2,600 |

| 4 | Denver, CO | 13.1% | 10.4% | $1,550 |

| 5 | Miami, FL | 11.3% | 8.5% | $2,450 |

| 6 | Philadelphia, PA | 9.2% | 5.0% | $1,600 |

| 7 | Los Angeles, CA | 8.8% | 5.4% | $2,450 |

| 8 | Seattle, WA | 8.7% | 8.4% | $1,850 |

| 9 | Baltimore, MD | 8.3% | 7.4% | $1,600 |

| 10 | Phoenix, AZ | 8.3% | 6.7% | $1,050 |

| 11 | Chicago, IL | 7.7% | 5.9% | $1,650 |

| 12 | Atlanta, GA | 7.7% | 8.7% | $1,250 |

| 13 | New York, NY-NJ | 7.0% | 5.3% | $3,500 |

| 14 | San Diego, CA | 6.6% | 11.0% | $2,000 |

| 15 | St. Louis, MO-IL | 6.4% | 5.9% | $950 |

| 16 | Riverside–San Bernardino, CA | 6.3% | 4.9% | $1,550 |

| 17 | Las Vegas, NV | 6.0% | 3.0% | $1,000 |

| 18 | Tampa–St. Petersburg, FL | 5.7% | 4.1% | $1,150 |

| 19 | Orange County, CA | 5.1% | 2.8% | $2,100 |

| 20 | Boston, MA | 4.9% | 3.3% | $2,350 |

| 21 | Dallas, TX | 4.6% | 4.2% | $1,400 |

| 22 | Houston, TX | 4.5% | 3.3% | $1,500 |

| 23 | Portland, OR-WA | 3.8% | 4.5% | $1,300 |

| 24 | Washington, DC-VA-MD-WV | 3.7% | 1.4% | $2,200 |

| 25 | Minneapolis–St. Paul, MN-WI | 2.2% | 3.5% | $1,300 |

| To download the list of rent changes for the largest metros: Excel or PDF. | ||||

The next Trulia Price Monitor and Trulia Rent Monitor will be released on Thursday, October 9.

How did we put this report together? To recap the methodology, the Trulia Price Monitor and the Trulia Rent Monitor track asking home prices and rents on a monthly basis, adjusting for the changing composition of listed homes, including foreclosures provided by RealtyTrac. The Trulia Price Monitor also accounts for the regular seasonal fluctuations in asking prices in order to reveal the underlying trend in prices. The Monitors can detect price movements at least three months before the major sales-price indexes do. Historical data are sometimes revised each month, and historical data in the current release are the best comparison with current data. Our FAQs provide all the technical details.