The Trulia Price Monitor and the Trulia Rent Monitor are the earliest leading indicators of how asking prices and rents are trending nationally and locally. They adjust for the changing mix of listed homes and therefore show what’s really happening to asking prices and rents. Because asking prices lead sales prices by approximately two or more months, the Monitors reveal trends before other price indexes do. With that, here’s the scoop on where prices and rents are headed.

National Home Prices Up 2.3% Year over Year, and Rising in 68 of 100 Largest Metros

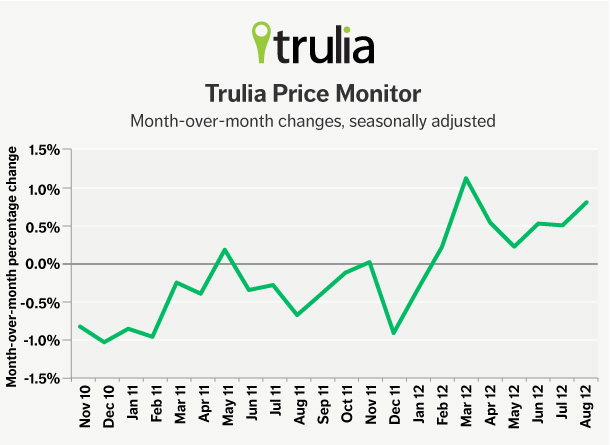

In August, asking prices rose 2.3% year over year, the largest annual jump reported yet by the Trulia Price Monitor and the largest year-over-year increases since before the recession. Excluding foreclosures, asking prices rose nationally 3.8% year over year. The month-over-month increase of 0.8% was the seventh consecutive monthly increase. Two-thirds of large metros – 68 out of 100 – had year-over-year price increases, and even more – 87 out of 100 — had quarter-over-quarter increases.

|

August 2012 Trulia Price Monitor Summary |

|||

|

% change in asking prices |

# of 100 largest metros with asking-price increases |

% change in asking prices, excluding foreclosures |

|

| Month-over-month,

seasonally adjusted |

0.8% |

(not reported) |

0.7% |

| Quarter-over-quarter,

seasonally adjusted |

1.8% |

87 |

2.2% |

| Year-over-year |

2.3% |

68 |

3.8% |

Prices Gains Accelerating Most in Arizona and Nevada

Let’s look at the top 10 markets with the largest year-over-year price increases. Asking prices in Phoenix rose 24.2% year-over-year in August. Two other Southwest metros – Tucson and Las Vegas – are on the top-ten list, along with four Florida metros (Cape Coral – Fort Myers, West Palm Beach, Miami and Orlando), Warren–Troy–Farmington Hills MI, Denver and San Jose. The Southwest metros of Tucson and Las Vegas have seen the biggest turnaround: three months ago, in May 2012, prices were falling year over year in those markets. In contrast, Miami’s year-over-year price increase slowed, from 14.5% in May to 9.6% in August. Miami prices rose only 1.1% quarter-over-quarter – which is below the national quarter over quarter increase of 1.8%! – so Miami’s gains aren’t so hot anymore.

|

Metros with Largest Year-over-year Asking Price Increases |

|||

| # | U.S. Metro |

Y-o-Y % change in asking prices, Aug 2012 |

Y-o-Y % change in asking prices, May 2012 |

| 1 | Phoenix, AZ |

24.2% |

17.6% |

| 2 | Cape Coral – Fort Myers, FL |

16.5% |

11.1% |

| 3 | Warren–Troy–Farmington Hills MI |

10.4% |

6.4% |

| 4 | West Palm Beach, FL |

10.4% |

6.6% |

| 5 | Tucson, AZ |

9.9% |

-4.4% |

| 6 | Miami, FL |

9.6% |

14.5% |

| 7 | Denver, CO |

8.9% |

5.3% |

| 8 | San Jose, CA |

8.6% |

4.0% |

| 9 | Orlando, FL |

8.6% |

5.3% |

| 10 | Las Vegas, NV |

6.9% |

-1.3% |

Among the 100 largest metro areas.

Rent Increases Slow Down to 4.7% Year Over Year, Thanks To New Construction

In August, rents rose nationally 4.7% year over year. That’s the smallest year-over-year increase since March. Three months ago, in May, rents were up 5.8% year over year. What’s slowing down those rent increases? One big factor is new construction: according to the Census, there was a big jump in the number of newly completed buildings with five or more units – which means more rental units are on the market to meet demand. Completed new units in multifamily buildings in July – the latest data available – were 47% higher than a year earlier.

Among the largest 25 rental markets, rents rose the most in Houston and Seattle, where they climbed more than 10% year over year in August. But renters are getting a touch of relief in Denver, San Francisco, Miami, Oakland and Boston, where rents are no longer rising quite as fast as they were three months ago. That may not be much comfort, though, since these hot rental markets are still seeing annual rent increases of 8% or more.

|

Metros with Largest Year-over-year Asking Rent Increases |

|||

| # | U.S. Metro |

% change in rents, Y-o-Y , Aug 2012 |

% change in rents, Y-o-Y, May 2012 |

| 1 | Houston, TX |

11.2% |

9.1% |

| 2 | Seattle, WA |

10.4% |

9.5% |

| 3 | Denver, CO |

9.9% |

10.2% |

| 4 | San Francisco, CA |

9.7% |

13.7% |

| 5 | Miami, FL |

9.7% |

10.7% |

| 6 | Oakland, CA |

9.7% |

11.0% |

| 7 | Boston, MA |

8.7% |

9.2% |

| 8 | Philadelphia, PA |

8.6% |

4.0% |

| 9 | Portland, OR-WA |

7.5% |

6.8% |

| 10 | New York, NY-NJ |

6.6% |

5.6% |

Among the 25 largest rental markets.

Bringing It All Together: Prices, Rents and Wages

With price increases accelerating and rent increases decelerating, the national year-over-year price increase, excluding foreclosures, of 3.8% is gaining ground on the national year-over-year rent increase of 4.7%. If prices start rising faster than rents, then buying a home won’t be getting any cheaper relative to renting.

And there’s another milestone: with prices excluding foreclosures up 3.8% year over year, prices are also rising faster than wages, which rose 2.6% year over year in 2011 according to the Bureau of Labor Statistics. When price increases outpace wage increases, affordability starts to decline. (Check out our post comparing affordability across metros, showing how long it takes to save for a downpayment.)

In short: price increases are important for the housing recovery and are great news for homeowners, particularly those who are underwater. They’re good news for the economy, too, since price increases encourage builders to start new construction, which in turn creates jobs. But this is a bit of a catch-22. Rising prices will also make housing less affordable for those who don’t own, especially if prices start rising faster than wages.

Will these trends continue? Look for the next Trulia Price Monitor and Trulia Rent Monitor on Thursday, October 4, 2012 at 10AM ET.

How did we put this report together? To recap the methodology, the Trulia Price Monitor and the Trulia Rent Monitor track asking home prices and rents on a monthly basis, adjusting for the changing composition of listed homes, including foreclosures provided by RealtyTrac. The Trulia Price Monitor also accounts for the regular seasonal fluctuations in asking prices in order to reveal the underlying trend in prices. The Monitors can detect price movements at least three months before the major sales-price indexes do. Our FAQs provide all the technical details.