Home prices today are rising nearly as fast as they did during the peak bubble years of 2005-2006. Since that bubble helped push us into the Great Recession, we should all be on high alert for the next housing bubble. To track whether home prices are in or nearing bubble territory, today we introduce Trulia’s Bubble Watch, which is based on the most recent price data from the Trulia Price Monitor and other data sources.

So are we in bubble territory? No. Bubble-phobes can rest easy. Even with recent sharp home price increases, prices are still low relative to fundamentals and are far below bubble levels.

Back to Basics: How to Spot a Bubble

To see a bubble, you first need to know what you’re looking for. A bubble in home prices (or in the price of any asset – like stocks or even tulips) is when prices soar above their fundamental value. Fundamental value is based on supply, demand, and realistic expectations about the future. We all learned in Economics 101 that prices move back toward an equilibrium determined by fundamentals of supply and demand. In a bubble, however, rising prices encourage speculation and fuel further demand – up until when the bubble suddenly bursts and people rush to sell, which causes prices to accelerate downward, sometimes well below their fundamental value. Bubbles are notoriously difficult to predict and hard to confirm until after they’ve burst: it’s impossible to be sure whether price gains are justified by fundamentals until, if and when, a bubble bursts. San Francisco home prices, for instance, are the highest in the country; is that “irrational exuberance” by speculative homebuyers, or are those prices justified by strong job growth, high incomes, great weather, and constraints on the local housing supply?

To answer that question, we assess whether home prices are overvalued or undervalued relative to their fundamental value by comparing prices today with historical prices, incomes, and rents. Incomes determine how much people can pay for housing, and price increases aren’t sustainable if they push prices too high relative to incomes. Rents reflect how much people value housing even if they won’t benefit from price appreciation (as renters don’t, but owners do); the price-to-rent ratio is like the price-earnings (P/E) ratio for stocks. Using data from multiple sources (see footnote), we create several measures of fundamental value and combine them in order to calculate how overvalued or undervalued home prices are relative to fundamentals.

Home Prices are Undervalued 7% Nationally and Regionally in 91 of the 100 Largest Metros

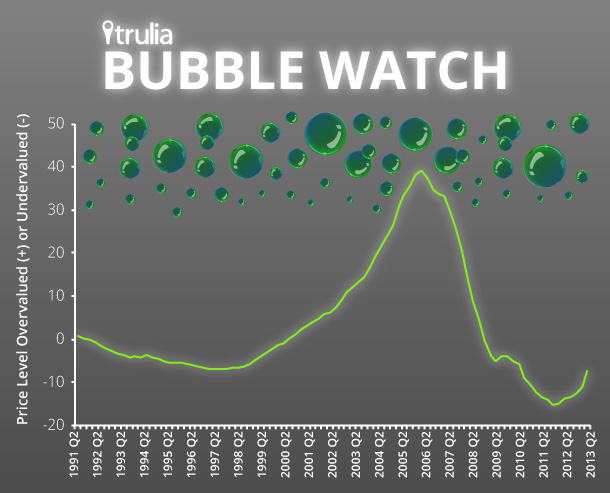

We estimate that national home prices are 7% undervalued in the second quarter of 2013 (2013 Q2). During last decade’s bubble, prices were as high as 39% overvalued in 2006 Q1, then during the bust, fell to 15% undervalued in 2011 Q4. Therefore, even with the recent price increases, home prices nationally remain undervalued relative to fundamentals and much lower than in the last bubble. That’s why today’s price gains are actually still a rebound, not a bubble. This chart shows how far prices are from bubble territory:

At the metro level, prices are below their fundamental value in 91 of the 100 largest metros. Prices are overvalued in the California metros of Orange County (+9%), Los Angeles (+5%), San Jose (+3%), and San Francisco (+2%), and the Texas metros of Austin (7%), San Antonio (5%), and Houston (2%), as well as in Portland (plus Honolulu, which at 0.01% is ever so slightly overvalued). The California metros are far less overvalued than at the height of the bubble – Orange County prices were 71% overvalued in 2006 Q1! Even the Texas metros, which largely avoided last decade’s housing bubble, are less overvalued today than at their peaks during the last bubble.

|

Market Where Home Prices are Overvalued |

||||

| # | U.S. Metro |

Home prices relative to fundamentals, 2013 Q2 |

Home prices relative to fundamentals at local peak |

When home prices peaked locally |

| 1 | Orange County, CA |

+9% |

+71% |

2006 Q1 |

| 2 | Austin, TX |

+7% |

+12% |

2007 Q2 |

| 3 | San Antonio, TX |

+5% |

+12% |

2007 Q1 |

| 4 | Los Angeles, CA |

+5% |

+78% |

2006 Q1 |

| 5 | San Jose, CA |

+3% |

+59% |

2005 Q4 |

| 6 | San Francisco, CA |

+2% |

+52% |

2005 Q4 |

| 7 | Houston, TX |

+2% |

+8% |

2005 Q1 |

| 8 | Portland, OR-WA |

+1% |

+44% |

2007 Q1 |

| Note: positive numbers indicate overvalued prices; negative numbers indicate undervalued. Among the 100 largest metros. To see if prices are over or under valued in the 100 largest metros, see here. | ||||

Prices are most undervalued today in Las Vegas and Detroit, even after their price gains in the past year. Several Florida and Ohio metros are also among the most undervalued. All of these metros were overvalued at the height of the bubble, some less so (Dayton, Akron) than others (Las Vegas, Palm Bay–Melbourne–Titusville).

|

Markets Where Home Prices Most Undervalued |

||||

| # | U.S. Metro |

Home prices relative to fundamentals, 2013 Q2 |

Home prices relative to fundamentals at local peak |

When home prices peaked locally |

| 1 | Las Vegas, NV |

-24% |

+70% |

2006 Q1 |

| 2 | Detroit, MI |

-23% |

+42% |

2005 Q1 |

| 3 | Palm Bay |

-22% |

+75% |

2006 Q1 |

| 4 | Akron, OH |

-21% |

+19% |

2005 Q1 |

| 5 | Cleveland, OH |

-21% |

+21% |

2005 Q1 |

| 6 | Warren–Troy– |

-20% |

+34% |

2005 Q1 |

| 7 | Jacksonville, FL |

-18% |

+45% |

2006 Q4 |

| 8 | Toledo, OH |

-18% |

+25% |

2005 Q2 |

| 9 | Dayton, OH |

-17% |

+16% |

2005 Q1 |

| 10 | Lake County–

Kenosha County, IL-WI |

-17% |

+29% |

2006 Q1 |

| Note: positive numbers indicate overvalued prices; negative numbers indicate undervalued. Among the 100 largest metros. To see if prices are over or under valued in the 100 largest metros, see here. | ||||

Other indicators aside from home prices, like mortgage lending and construction activity, confirm that the housing market isn’t forming a new bubble. Mortgage credit remains very tight, especially for people with lower credit scores, and the new “qualified mortgage” rules under Dodd-Frank intend to prevent the recurrence of toxic mortgages that artificially inflated housing demand in the last bubble. Also, construction activity, though rebounding, is still well below normal levels, and the vacancy rate is falling, so there’s no evidence of overbuilding today like we had during the last decade.

Is the Next Bubble Coming Soon?

If prices keep rising as fast as they are today, we’d be back in bubble territory in several years. However, prices are unlikely to keep rising as fast as they are today, for three reasons:

- Inventory should expand. Tight inventory is boosting prices today as buyers bid up prices on scarce homes; however, as prices continue to rise, more people will sell as they get back above water or decide to cash out, and more new construction will add to inventory.

- Mortgage rates should rise. Low mortgage rates today increase buying power because borrowers can afford a more expensive house for the same monthly payment. Rates are likely to rise as a result of the strengthening economy, either through market forces or Fed actions, which – along with more inventory – should slow down price gains.

- Investor interest should fade. Undervalued prices have attracted investors, who have helped push up home prices as they have bought and rented out homes. But as prices rise, investor interest will fade.

Will expanding inventory, rising mortgage rates, and declining investor activity cause home prices to plunge? Slow down, yes, but probably not plunge. Just as these factors should cause home prices to slow down, job growth and increased household formation should support a continued recovery in housing demand.

Is Another Bubble Coming Ever?

Even though we’re not in bubble territory today, another one is coming – someday. The history of American real estate is full of speculation, bubbles, and busts. Trulia’s own survey of consumers shows that most people expect prices to get back to the peak of the previous bubble again in the next 10 years – including people in housing markets where prices had been overvalued most. Furthermore, our rent-versus-buy analysis, which indirectly reveals where people expect prices to rise the most long-term, shows that people expect future prices to rise more if they live in metros where booms and busts were more common in the past. This is another sign that people seem to think prices go up but not down. Will government help to prevent another bubble? Perhaps the new mortgage rules will help – but the more cynical answer is “no.” The most recent bubble was more severe than earlier housing bubbles, and if we didn’t previously learn from the past, then why should we learn from it now? In short: housing bubbles look almost inevitable. Whether you’re buying a home, selling a home, or setting housing policy, remember that the next housing bubble is probably just a matter of time. But, as Trulia’s Bubble Watch shows, that time is not now.

Notes: To get our estimate of over- or undervalued prices, we averaged together several measures of prices relative to fundamentals, including the price-to-income ratio, the price-to-rent ratio (national only), and the deviation of price growth from trend. We compared current values of these measures to the long-term average, excluding the most extreme quarters from the long-term average. We used the Trulia Price Monitor for current price trends as well as the Case-Shiller national index, the Federal Housing Finance Agency (FHFA) national expanded-data index, the FHFA all-transactions price indexes for metros, national and metro per-capita income from the U.S. Bureau of Economic Analysis, and national owner-equivalent rents from the U.S. Bureau of Labor Statistics. Our historical time series goes as far back as the early 1980s, depending on the data source. We tested our approach by seeing how well our over-/under-valuation measure would have predicted metro-level price drops in the housing crash. The correlation between metro-level price over- or-undervaluation in 2006 Q1 and the subsequent metro-level peak-to-trough price decline was -0.83.