Construction activity came to a near-halt after the housing bubble burst. The number of new residential units authorized in 2009, 2010, and 2011 was less than one-third of the level during the boom. In 2011, construction activity picked up slightly from 2009 and 2010, as the housing recovery began, with permits for new multifamily buildings leading the construction recovery. Multifamily construction has increased because rental demand rose during the recession as people chose not to – or were unable to – buy or keep their homes. Just this past year, rents rose 5.6 percent nationally according to the Trulia Rent Monitor, and that encourages builders to construct new multifamily buildings.

As always, housing is local. Construction is gearing up in some markets and remains dormant in others. These patterns are critical for understanding the future of cities, for two reasons.

First: construction activity is a bet on future growth. Developers will build only in areas where they expect housing demand in the future. Of course they can bet wrong, and that’s what happened during the housing bubble; construction in many metros far exceeded housing demand, and lots of newly built homes were (and still are) vacant. Still, construction is a clear signal of builder confidence in an area.

Second: construction shapes urban form. Housing units live a long time and are rarely destroyed, so new construction has a long-term impact on density and sprawl. The primary tool that officials have to affect density, sprawl and urban form is deciding what type of new construction, if any, to allow in different communities.

What do construction patterns say about the future of cities in America? This week the U.S. Census Bureau released data on construction permits issued by localities in 2011, including whether those permits were for single-family homes or units in multi-family buildings.

Metros with the Most Construction Permits

| Metro | Construction permits, 2011 | Percent of permitted units in

multi-family buildings, 2011 |

| Houston, TX | 31,271 | 27 percent |

| Dallas, TX | 18,686 | 49 percent |

| Washington, DC | 16,501 | 51 percent |

| New York, NY | 13,973 | 91 percent |

| Austin, TX | 10,239 | 39 percent |

| Los Angeles, CA | 9,895 | 77 percent |

| Phoenix, AZ | 9,081 | 20 percent |

| Seattle, WA | 8,664 | 47 percent |

| Atlanta, GA | 8,634 | 28 percent |

| San Antonio, TX | 7,127 | 38 percent |

More permits were issued in the Houston metro area than in any other metro, by far. Four of the top ten metros were in Texas. But this list is dominated by large metro areas, and we’d expect bigger areas to have more construction activity. Looking instead at the number of permits issued per 1,000 existing housing units shows the impact of construction on metro areas relative to their size. Here are the top and bottom ten metro areas by construction activity, among the largest 100 metro areas:

Most Construction Activity

| Metro | Construction permits per 1000

housing units, 2011 |

| El Paso, TX | 15.36 |

| Austin, TX | 14.49 |

| Raleigh, NC | 13.66 |

| Houston, TX | 13.55 |

| Charleston, SC | 12.80 |

| Dallas, TX | 11.26 |

| Little Rock, AR | 10.53 |

| Baton Rouge, LA | 9.51 |

| Washington, DC | 9.44 |

| Columbia, SC | 8.74 |

Least Construction Activity

| Metro | Construction permits per 1000

housing units, 2011 |

| Detroit, MI | 0.86 |

| Long Island, NY | 1.65 |

| Providence, RI | 1.70 |

| Springfield, MA | 1.77 |

| Chicago, IL | 1.83 |

| Cleveland, OH | 1.85 |

| New Haven, CT | 1.90 |

| Dayton, OH | 1.95 |

| Toledo, OH | 2.00 |

| Ventura County, CA | 2.02 |

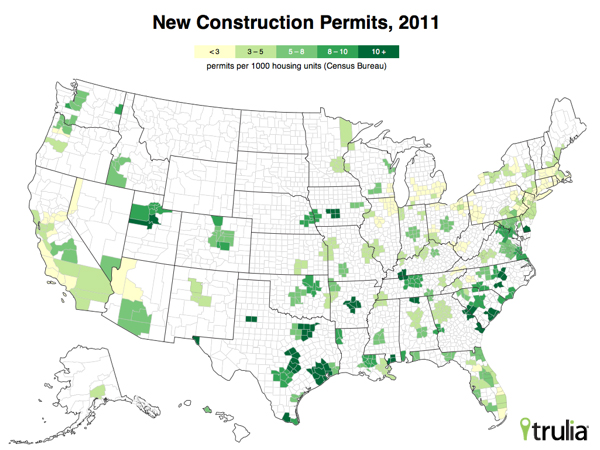

The rate of construction is highest in metros within Texas and the Carolinas and lowest in the Northeast and Midwest. The map shows the pattern across America. The rate of construction is higher across the Texas, the mid-South and Mountain states, but lower in New England, the Great Lakes, South Florida and most of coastal California.

Two factors stand out to explain which areas have the most construction. The first is long-term employment growth, which is the best guide to future housing demand. The second is smaller recent price declines: metros where prices fell less during the bust had less overbuilding and are therefore ready to absorb new housing. Among the ten metros with the highest rate of construction, all had above-average job growth over the past ten years, and none had experienced the huge home price declines that the hardest-hit areas did during the crash. Builders and developers are betting on metros with solid histories of job growth that escaped the worst of the housing crisis.

What does construction activity mean for urban form? The mix of single-family versus multi-family permits is a strong guide. Multifamily construction is higher density than single-family construction, and single-family construction is more sprawling. For the U.S. overall, one-third of the construction permits in 2011 were for multi-family units. But the multi-family share ranged widely among the largest metros, from 91 percent of permits issues in the New York metro and 86 percent in San Francisco all the way down to 2 percent in Dayton, OH, and 3 percent in Palm Bay-Melbourne-Titusville, FL. In Houston, where more permits were issued in 2011 than anywhere else, just 27 percent were for multi-family units. But not all of Texas is sprawling: in Dallas, 49 percent of permits were in multi-family units, well above the national average. In Los Angeles – which used to be the poster-child for sprawl – 77 percent of new permits were for multifamily units. Among the top permit-issuing places, Phoenix has the lowest share of multi-family permits at 20 percent, along with Houston (27 percent) and Atlanta (28 percent).

The future of sprawl, therefore, is not California. Houston, Phoenix, and Atlanta are America’s current capitals of low-density construction. Builders are betting on future growth in the South, in Texas, and in the Southwest, and they’re building single-family homes to meet that demand.