Even on TV, from The Odd Couple to The Big Bang Theory, renters have always known that the easiest way to save on housing costs was to share a place – even if certain housemates drive you a little bit crazy.

In America’s biggest rental markets,[1] a renter can save on average 13% of his or her income by getting a housemate. While splitting a room with roommate(s) will save you money, the benefits of sharing a living space vary from city to city, home to home.

In conjunction with the launch of Trulia’s new Room For Rent feature which allows renters to post or search for rooms for rent, we examined how much renters save by having a roommate rather than living alone, and how big exactly are the savings in the context of income levels in the top 25 rental markets.

First, consider the cost of living alone:

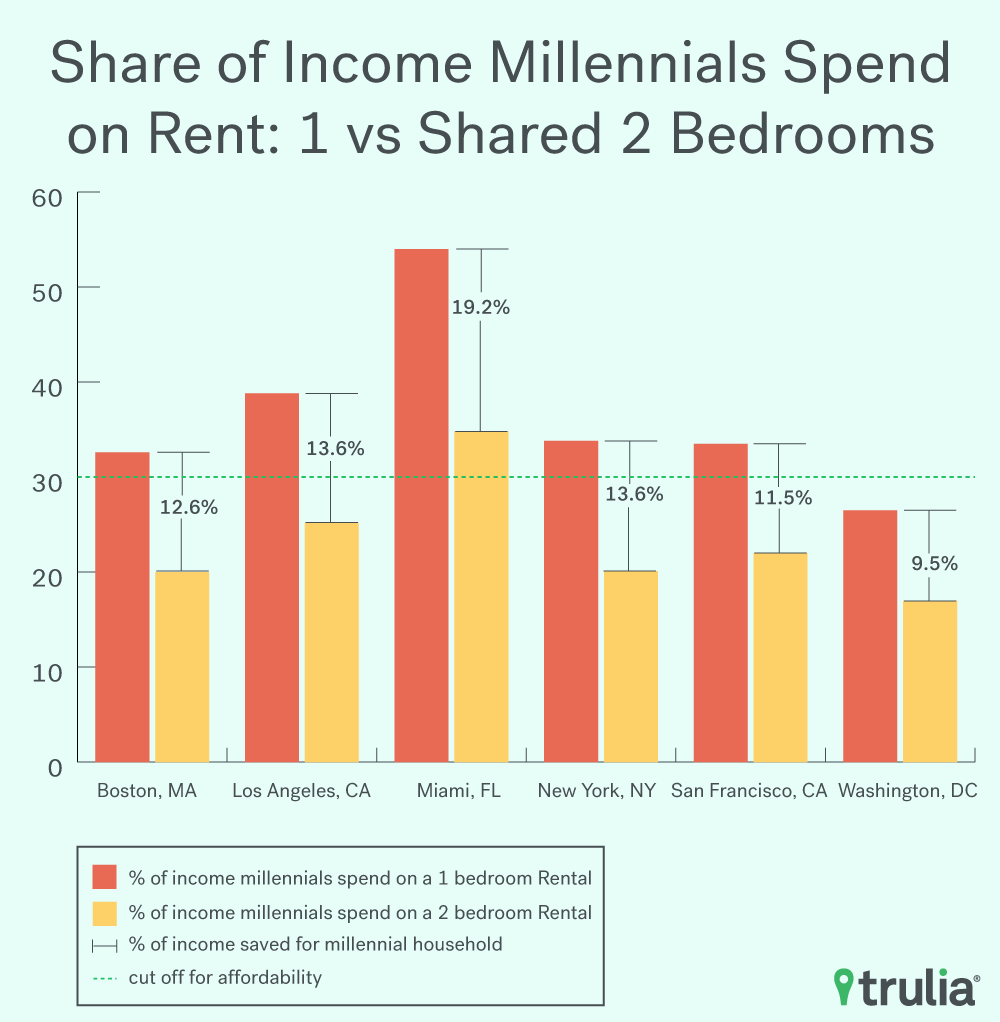

- A typical renter in Miami would need to spend 49.8% of income to rent a one-bedroom apartment. A typical millennial renter would need to spend 54%. San Francisco, (37.3% for typical renters, 33.5% for millennial renters), New York (34.3%, 33.8%), Los Angeles (33.7%, 38.8%) and Boston (32%, 32.6%) also show stark levels of unaffordability.

- In almost half of the top rental markets (12 out of 25), millennial renters would need to spend more than 30% of their income towards renting their own one-bedroom apartment. Spending more than 30% of household income on housing is considered unaffordable by government housing agencies.

- The crunch is especially acute for millennials. More than 20% of millennials live with roommates,[2] an 115-year high as of 2015. An astonishing 60% of millennials in America now either live with parents, siblings, other relatives or roommates, also an 115-year high.

[1] Top 25 rental markets

[2] RELATE variable in the U.S. Census American Community Survey data was used to determine the relationship to the head of household. For the purposes of this analysis, I consider non-relatives, which includes unmarried partners, as being roommates.

In all 25 top rental markets, savings from sharing a two-bedroom apartment with a roommate rather than renting your own one-bedroom apartment can be quite large.

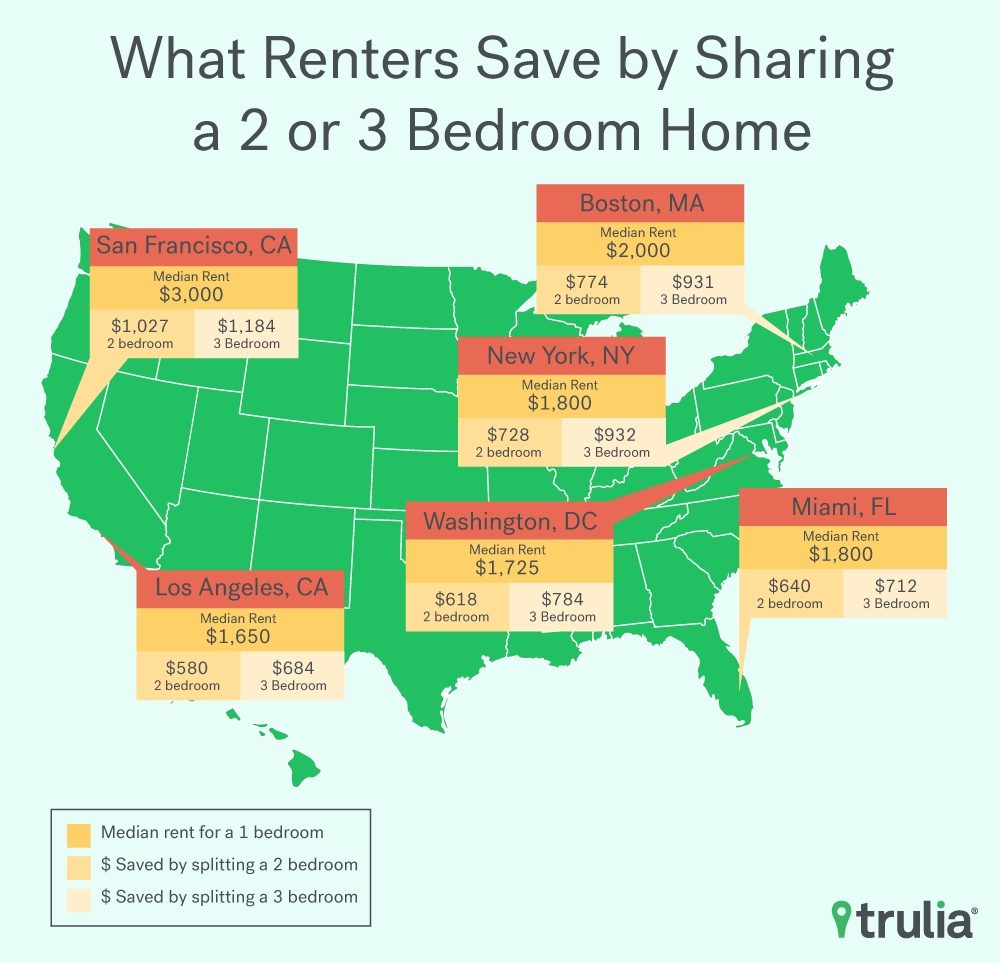

- In Miami, by splitting a two-bedroom apartment, a renter could save an amount equivalent to 17.7% of the median household income or $640 per month: New York 13.9% or $730 per month, San Francisco 12.8% or $1,030 per month, Boston 12.4% or $770 per month, Los Angeles 11.9% or $580 per month and Philadelphia 11.2% or $440 per month.

- Even in markets with the lowest amount of potential savings, the savings are still significant. In Minneapolis, which has the lowest potential savings, a renter could save equivalent to 5.3% of median household income or $310 per month: in St. Louis, 5.7% or $260 per month, Dallas 6% or $310 per month, Baltimore 6.6% or $400 per month and Phoenix 6.6% or $300 per month.

- For millennial households, the savings look even bigger in most metros (as you can see from the last column of the table below). For instance, in Miami the savings are equivalent to 19.2% of the median millennial household income; in Los Angeles, 13.6%.

- In all of the top 25 rental markets (with Miami being an exception), splitting a two-bedroom apartment between two people makes the rent affordable (where each renter spends less than 30% of their income on rent) for those making the median household income and even for those making only the median household income for millennials.

Money Saved By Renting a Two-Bedroom Home with a Roommate Rather Than Renting a One Bedroom

- If you decided to share a three-bedroom house between roommates in lieu of renting your own one-bedroom unit, your savings would be even further amplified.

- In Miami, going triple would save you 19.7% of the median household income; in New York, 17.8%; Boston, 14.9%; San Francisco 14.7% and Los Angeles 14%.

- By splitting a three-bedroom apartment, renters can save bundles of money. Even in St. Louis whose implied savings is the lowest amongst the top rental markets, splitting a three-bedroom apartment saves you $312 per month, which is still very good. In San Francisco, you’d be saving a whopping $1,200 per month; $940 per month in Oakland, Calif., and $930 per month in New York and Boston.

Money Saved By Renting a Three-Bedroom Home with Roommates Rather Than Renting a One Bedroom

We calculated how much additional money a renter can save by splitting a three-bedroom apartment versus a two-bedroom apartment as shown in the table below. Of course, if you did not already have two other roommates in mind, it would require additional effort on your part in finding the right people and coordinating the home search. But hey, nothing comes for free in this free-market capitalist world, not even a couple of hundred bucks.

| Metro | How much do you save by splitting 2 beds vs renting 1 bed, Per Month | How much do you save by splitting 3 beds vs renting 1 bed, Per Month | How much more do you save by splitting 3 beds instead of 2, Per Month |

| New York, NY | $727.94 | $931.90 | $203.97 |

| Oakland, CA | $764.34 | $936.34 | $171.99 |

| Washington, DC | $617.58 | $783.79 | $166.20 |

| Orange County, CA | $657.64 | $819.95 | $162.31 |

| Cambridge-Newton-Framingham, MA | $752.03 | $910.88 | $158.85 |

| Boston, MA | $774.01 | $931.14 | $157.13 |

| San Francisco, CA | $1,027.32 | $1,184.25 | $156.93 |

| Atlanta, GA | $494.75 | $641.65 | $146.90 |

| Portland, OR | $485.17 | $630.67 | $145.50 |

| Newark, NJ | $457.58 | $600.93 | $143.35 |

| Denver, CO | $404.90 | $534.54 | $129.64 |

| San Diego, CA | $565.94 | $694.05 | $128.12 |

| Seattle, WA | $540.92 | $664.26 | $123.35 |

| Baltimore, MD | $394.83 | $505.94 | $111.11 |

| Los Angeles, CA | $579.85 | $683.44 | $103.59 |

| Philadelphia, PA | $438.03 | $539.34 | $101.31 |

| Chicago, IL | $467.23 | $567.01 | $99.78 |

| Dallas, TX | $308.43 | $405.40 | $96.97 |

| Riverside-San Bernardino, CA | $349.00 | $441.79 | $92.79 |

| Houston, TX | $424.04 | $510.20 | $86.16 |

| Minneapolis-St. Paul, MN | $309.28 | $395.39 | $86.11 |

| Tampa-St. Petersburg, FL | $317.29 | $395.25 | $77.96 |

| Miami, FL | $639.92 | $712.72 | $72.80 |

| St. Louis, MO | $259.41 | $312.16 | $52.75 |

| Phoenix, AZ | $301.85 | $347.75 | $45.89 |

The tradeoff: you will have less space for yourself, hence less privacy. Using Trulia rental listings data, we calculated the square footage each tenant will get when renting a one-, two- or three-bedroom home assuming each person got one bedroom. Nationally, renting your own one-bedroom will get you 729 square feet per person, a two-bedroom offers 517 square feet per person and a three-bedroom nets 475 square feet per person. We repeated this exercise for each metro and found this to be the case everywhere, which is not surprising.

| Metro Area | Square Feet Per Person, 1 Bedroom | Square Feet Per Person, 2 Bedroom | Square Feet Per Person, 3 Bedroom |

| Atlanta, GA | 800 | 588 | 512 |

| Baltimore, MD | 726 | 533 | 450 |

| Boston, MA | 650 | 475 | 400 |

| Cambridge-Newton-Framingham, MA | 700 | 516 | 450 |

| Chicago, IL | 789 | 550 | 467 |

| Dallas, TX | 700 | 565 | 562 |

| Denver, CO | 700 | 521 | 511 |

| Houston, TX | 742 | 548 | 555 |

| Los Angeles, CA | 735 | 540 | 501 |

| Miami, FL | 780 | 565 | 533 |

| Minneapolis-St. Paul, MN | 706 | 519 | 442 |

| New York, NY | 750 | 488 | 400 |

| Newark, NJ | 800 | 556 | 467 |

| Oakland, CA | 700 | 501 | 509 |

| Orange County, CA | 707 | 533 | 505 |

| Philadelphia, PA | 700 | 500 | 395 |

| Phoenix, AZ | 710 | 510 | 512 |

| Portland, OR | 700 | 493 | 502 |

| Riverside-San Bernardino, CA | 700 | 525 | 520 |

| San Diego, CA | 671 | 515 | 500 |

| San Francisco, CA | 750 | 552 | 510 |

| Seattle, WA | 695 | 518 | 533 |

| St. Louis, MO | 750 | 500 | 407 |

| Tampa-St. Petersburg, FL | 721 | 537 | 500 |

| Washington, DC | 716 | 530 | 492 |

Methodology