Homeownership remains cheaper than renting nationally and in all of the 100 largest metro areas. But rising mortgage rates have narrowed the gap between the cost of buying and the cost of renting. The 30-year fixed rate is now 4.80%, compared with 3.75% one year ago (according to the Mortgage Bankers Association, or MBA). This jump in rates has raised the cost of buying relative to renting. As a result, buying is 35% cheaper than renting today, versus being 45% cheaper than renting one year ago.

How can buying be so much cheaper than renting when home prices and mortgage rates are both climbing? The key reason: both rates and prices are rising from very low levels and are still below their long-term historical norms. But the rent versus buy math depends on your local market, as rising rates and prices have pushed a handful of metros very close to the tipping point when renting becomes cheaper.

Before going further into the data, here’s how we do the math. To calculate whether renting or buying a home costs less, we take the following steps:

- Calculate the average rent and for-sale price for an identical set of properties. For this report we looked at all the homes listed on Trulia for sale and for rent from June to August 2013. We estimate prices and rents for similar homes in similar neighborhoods in order get a direct apples-to-apples comparison. We are NOT just comparing the average rent and average price of homes on the market, which would be misleading because rental and for-sale properties are very different: most importantly, for-sale homes are roughly 50% bigger, on average, than rentals.

- Calculate the initial total monthly costs of owning and renting, including maintenance, insurance, and taxes.

- Calculate the future total monthly costs of owning and renting, taking into account price and rent appreciation as well as inflation.

- Factor in one-time costs and proceeds, like closing costs, downpayment, sales proceeds, and security deposits.

- Calculate the net present value to account for opportunity cost of money.

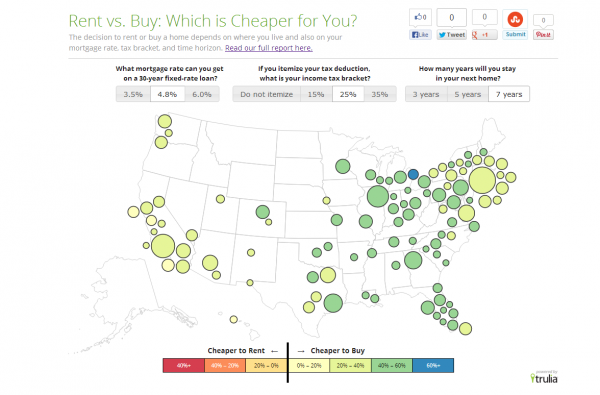

To compare the costs of owning and renting, we assume people get a 4.8% mortgage rate on a 30-year fixed-rate loan with 20% down; itemize their federal tax deductions and are in the 25% tax bracket; and will stay in their home for seven years. Under these assumptions, buying is 35% cheaper than renting nationwide, taking into account all of the costs and proceeds from buying or renting over the entire seven-year period. We also look at alternative scenarios by changing the mortgage rate, the income tax bracket for tax deductions, and the number of years that one stays in the home. The full methodology is available here.

Our interactive Rent vs. Buy Map shows how the math changes under alternative assumptions. And if you’re interested, check out our detailed methodology which explains our entire approach step-by-step.

Best of all: today we launched our new Rent vs. Buy Calculator, which lets you compare the cost of renting and buying based on whatever assumptions, prices, rents, and scenarios you like, using the same math that powers our interactive map and this report. Check it out and find out what’s the cheaper option for you.

San Francisco Bay Area Close to Tipping in Favor of Renting

Buying a home is cheaper than renting in all of the 100 largest metro areas, but buying ranges from being 65% cheaper in Detroit to just 4% cheaper in San Jose. In fact, owning is now cheaper by just 10% or less in San Jose, San Francisco, and Honolulu – that’s a big change from one year ago, when buying was 24% cheaper than renting in Honolulu, 28% in San Francisco, and 31% in San Jose. Even in markets with minimal year-over-year price increases, buying today isn’t as great of a deal versus renting compared with last year. For example, home prices rose just 1.7% year-over-year in Philadelphia, but buying is now 40% cheaper than renting compared to being 46% cheaper one year ago.

The biggest factor narrowing the gap between the cost of buying and the cost of renting is rising mortgage rates – which affect the entire country. In fact, the benefit of buying relative to renting shrank in nearly all of the 100 largest metros over the past year: only in Springfield, MA did the gap widen, from buying being 47% cheaper than renting last year to being 49% cheaper than renting today. Nationally, rising mortgage rates account for about 8 points of the 10-point shift from buying being 45% cheaper than renting one year ago to being 35% cheaper now. The other 2 points are due to prices rising faster than rents. (How did we figure that out? If you used today’s prices and rents in the rent vs. buy calculation but used a 3.5% mortgage instead of a 4.8% mortgage, buying would be 43% cheaper than renting – 2 points less than last year.)

Because fluctuating mortgage rates can affect the rent versus buy math, we identified the mortgage rate “tipping point” at which renting becomes cheaper than buying, given current prices and rents. If rates keep rising, San Jose will tip first in favor of renting, at 5.2%. Already today, at 4.8%, buying is just 4% cheaper than renting in San Jose. The tipping point is below 6% in San Francisco and Honolulu as well, and below 8% in New York, Los Angeles, and seven other major metros. Nationally, the mortgage rate tipping point is 10.5%, and it’s 20% or higher in Detroit, Gary, and Cleveland.

|

Where Buying a Home is a Tougher Call |

||||

| # | U.S. Metro |

Cost of Buying vs. Renting (%), Summer 2013 |

Cost of Buying vs. Renting (%), Summer 2012 |

Mortgage Rate Tipping Point When Renting Becomes Cheaper Than Buying, Summer 2013 |

| 1 | San Jose, CA |

-4% |

-31% |

5.2% |

| 2 | San Francisco, CA |

-9% |

-28% |

5.7% |

| 3 | Honolulu, HI |

-10% |

-24% |

5.8% |

| 4 | Orange County, CA |

-20% |

-34% |

7.0% |

| 5 | New York, NY-NJ |

-21% |

-31% |

7.5% |

| 6 | San Diego, CA |

-21% |

-34% |

7.3% |

| 7 | Los Angeles, CA |

-21% |

-32% |

7.3% |

| 8 | Ventura County, CA |

-22% |

-33% |

7.5% |

| 9 | Oakland, CA |

-23% |

-43% |

7.5% |

| 10 | Sacramento, CA |

-26% |

-39% |

8.2% |

|

Where Buying a Home is a No-Brainer |

||||

| # | U.S. Metro |

Cost of Buying vs. Renting (%), Summer 2013 |

Cost of Buying vs. Renting (%), Summer 2012 |

Mortgage Rate Tipping Point When Renting Becomes Cheaper Than Buying, Summer 2013 |

| 1 | Detroit, MI |

-65% |

-70% |

32.8% |

| 2 | Gary, IN |

-58% |

-63% |

20.6% |

| 3 | Memphis, TN-MS-AR |

-55% |

-61% |

19.0% |

| 4 | Cleveland, OH |

-54% |

-60% |

20.0% |

| 5 | Kansas City, MO-KS |

-53% |

-57% |

18.0% |

| 6 | Warren–Troy–Farmington Hills, MI |

-53% |

-61% |

18.4% |

| 7 | Dayton, OH |

-53% |

-61% |

19.5% |

| 8 | Grand Rapids, MI |

-52% |

-57% |

17.7% |

| 9 | West Palm Beach, FL |

-52% |

-59% |

17.1% |

| 10 | Akron, OH |

-51% |

-55% |

18.2% |

Note: Negative numbers indicate that buying costs less than renting. For example, buying a home in Detroit is 65% cheaper than renting in 2013. Trulia’s rent vs. buy calculation assumes a 4.8% 30-year fixed-rate mortgage, 20% down, itemizing tax deductions at the 25% bracket, and 7 years in the home. Click here to download the full Rent vs. buy cost considerations for the 100 largest U.S. metros: (PDF) or (Excel)

How the Tax Deduction Shifts the Rent vs Buy Math

A key factor affecting the rent-versus-buy math is whether you itemize deductions on your income taxes and what tax bracket you’re in. If you itemize, you can deduct mortgage interest payments (not principal payments) and property tax payments from your income before calculating how much you owe in taxes. You can deduct other things, too, like state and local taxes, charitable contributions, and more, though only 33% of taxfilers choose to itemize. Itemizing lowers the cost of buying relative to renting – especially if you pay taxes at a higher rate, because that means you’re deducting more. (By the way, we assume that you either itemize or you don’t, and then do the rent-versus-buy math. If you would itemize as a homeowner but wouldn’t as a renter, then the rent-versus-buy math is a little different – it falls between the itemizing and not-itemizing scenarios.)

Itemizing deductions has also been a hot issue in Washington, taking center stage for a moment in last year’s presidential campaign, and scaling back these deductions could become part of future federal budget negotiations. Let’s use our rent-versus-buy math to help sort out the impact of itemizing.

Itemizing lowers the cost of buying versus renting, but buying remains cheaper than renting almost everywhere even if you don’t itemize. Without itemizing – or if your tax situation means you get no benefit at all from itemizing – buying looks 22% cheaper than renting nationally. And buying still beats renting in 97 of the 100 largest metros – everywhere but San Jose, San Francisco, and Honolulu. Also, the mortgage rate tipping point falls to 7.5% if you don’t itemize, which is a lot lower than 10.5% but a lot higher than today’s 4.8%. The last time the 30-year fixed rate was 7.5% or higher was 13 years ago.

|

Itemize at 25% (baseline assumption) |

Do not itemize |

|

| Cost of buying versus renting nationally |

-35% |

-22% |

| Metros out of 100 where buying cheaper than renting |

100 |

97 |

| What is the national mortgage rate “tipping point” |

10.5% |

7.5% |

What Does It Mean for You?

Our analysis shows you whether buying is cheaper than renting on average nationwide and in the 100 largest metros. Our interactive Rent vs. Buy Map lets you explore how the math changes at different mortgage rates, different itemizing assumptions, and for different number of years of staying in your home. These are critical factors. Since we haven’t mentioned why how long you stay in your home matters, let’s review that. Staying put longer lowers the relative cost of owning for two reasons: (1) when you stay put longer, you spread the upfront and final closing costs over more years, and (2) staying longer typically gives you more home-price appreciation. Nationally, buying is 35% cheaper than renting if you stay put for 7 years, which is our baseline assumption. It falls to 27% for 5 years, and just 8% for 3 years.

It’s not hard to come up with plausible scenarios where renting beats buying. But see for yourself: our Rent vs. Buy Calculator lets you choose any mortgage rate, tax bracket, and length of time you stay in your home. It also lets you change all of the other assumptions. For instance: we assume you’ll pay 1% of the value of your home each year on renovations and maintenance, but feel free to make that much higher if you redo your kitchen every year or much lower if you think a leaky roof is just part of a home’s charm. If you live in a flood zone, use a much higher annual insurance cost than our baseline assumption (check our natural hazard maps to see if your dream home is in a flood zone); and if you think your home value will rise 10% per year forever, well, you’re wrong, but feel free to see what difference it would make.

Finally, don’t forget that the decision about renting versus buying is not just about the numbers. Each has its advantages. Buying gives you more control over your home, but renting gives you more flexibility. Each even has different financial benefits. Buying can, in effect, help you force yourself to save, but renting could let you invest your savings in a more diverse set of assets than a single house. Still, knowing the numbers is the right place to start.