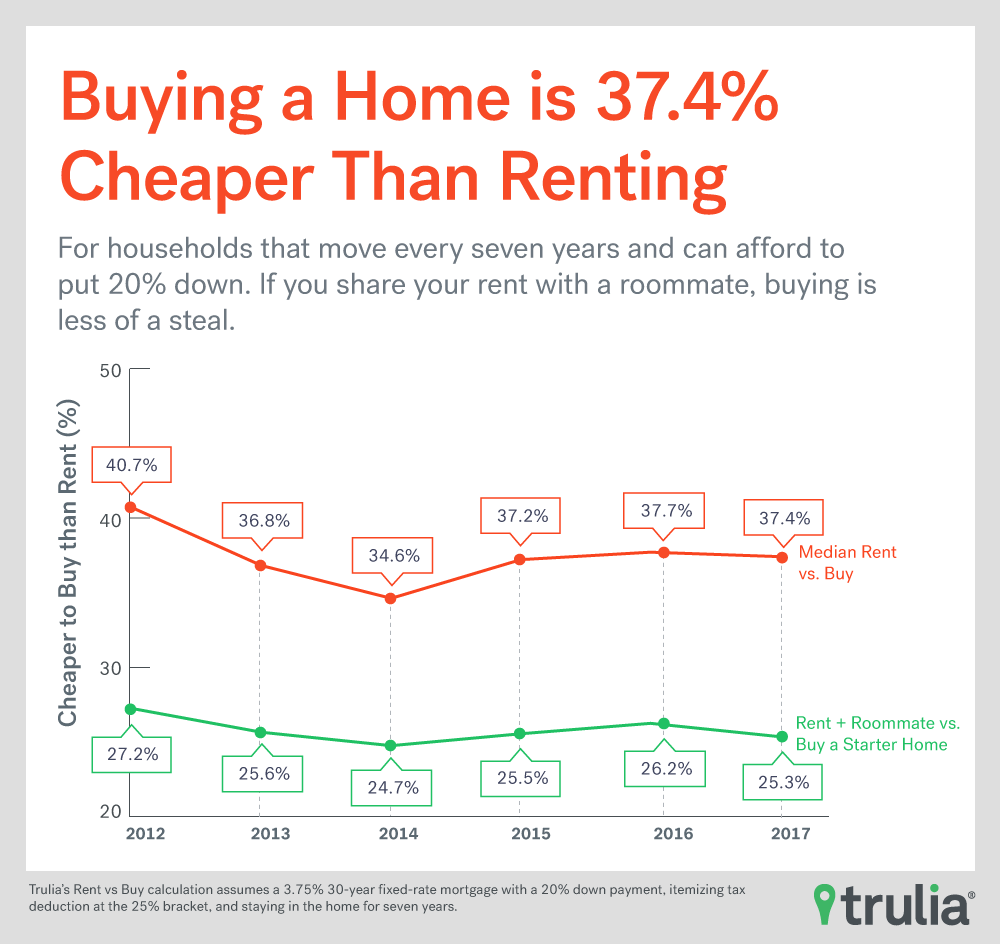

Since we started keeping track in 2012, it’s been a better deal to buy than rent in America’s largest housing markets – and for much of that time it hasn’t been close. But does the equation change for renters who share their rent with a roommate?

The answer is it depends a lot on where you live.

For this edition of Rent vs. Buy we examined the discount of renting with a roommate and what that means in terms whether or not buying a starter home is a better financial decision.

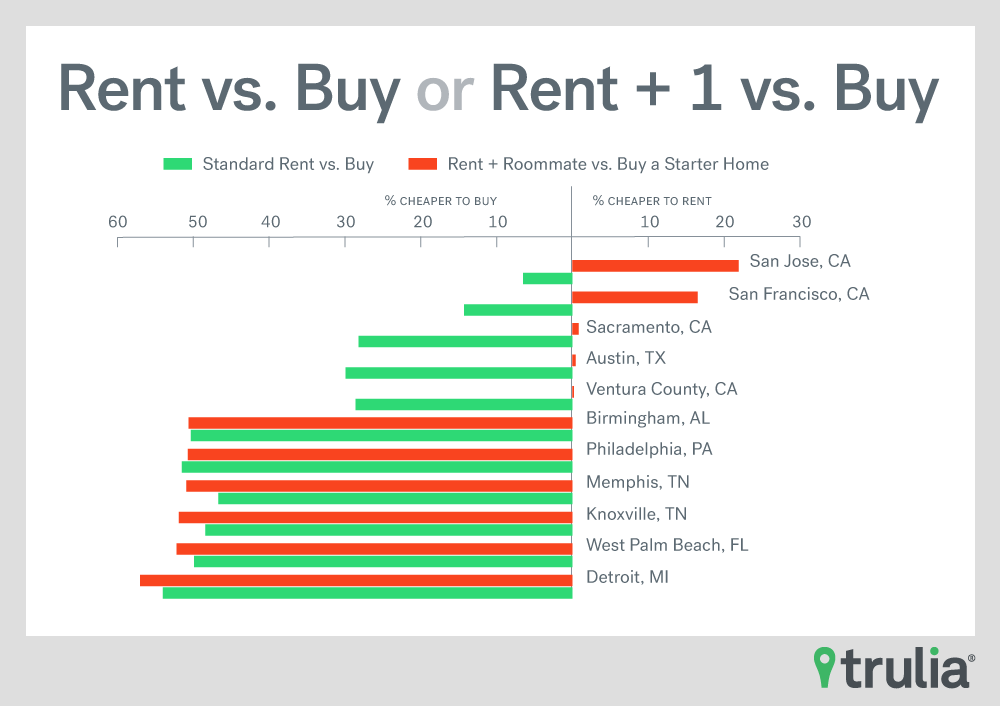

Roommates matter. If you have a roommate you are better off renting than buying your first home alone in places like San Jose, Calif., San Francisco and Austin, Texas. In San Jose you can save 21.9% by splitting the rent instead of buying a starter home.

Trulia’s Rent vs. Buy report traditionally assumes that a single income earner or household is weighing the option between paying the full rent for a typical housing unit and buying an average priced home (you can make your own calculations using Trulia’s new Rent vs. Buy Calculator here). The truth is that those who rent often have a roommate.

In a recent report Trulia found that more than 20% of millennials live with a roommate, representing a 115-year high as of 2015. Home seekers transitioning from renting to buying will be purchasing a home for the first time and will likely be on the hunt for more affordable starter homes.

In this spirit, this report focuses on assessing the renting versus buying equation for those that are deciding between renting with a roommate or taking the plunge on a starter home. Our usual assumptions still hold true—buyers will be taking on a 30-year fixed rate loan and fronting a 20% down payment, and the decision to rent or buy hinges on staying in the same place for seven years.

Here’s how renting with a roommate compares to buying a starter home:

- Renting with a roommate is overwhelmingly the better option over buying a starter home in the nation’s two most expensive markets. In San Francisco and San Jose, Calif. the savings from sharing a rental compared to buying are a whopping 16.5% and 21.9%, respectively. Austin, Texas, Sacramento and Ventura County, Calif., are other metro areas where renting with others outweighs buying, but just barely.

- This is the best time to split the rent instead of buying in San Jose. The savings from renting with a roommate over buying a starter home are the highest they have been in five years, representing a 22.7 percentage point advantage over this option in 2012.

- Detroit sees the greatest savings (57%) from buying even when splitting the rent, and buying a starter home in West Palm Beach, Fla., is a bargain over renting with a roommate, where you save 52.2%.

<!–[if IE 9]>

<!–[if IE 9]><![endif]–>

Sharing Is More Than Caring, It’s Economic Sense

While the standard rent vs. buy analysis reveals buying is cheaper than renting in all of the nation’s 100 largest metros, this doesn’t hold true for those choosing between renting with a roommate and buying a starter home. In fact, in San Jose and San Francisco astronomical rents and even higher home prices means that remaining a renter with a roommate makes more financial sense than buying. Sacramento, Austin and Ventura County round out the other metros where renting is better than buying. Portland, Ore., is right on the cusp of favoring renting with a roommate rather than buying, and in San Diego and Orange County, Calif., the margin favors buying by just 3.5% and 3.6%, respectively.

In San Francisco, halving the median rent brings it down to $2,100, but it still means that a renter with a roommate will be paying more than the full median rent in 83 of the largest 100 metros. The typical starter home in the City by the Bay costs more than the median price of a home everywhere except San Jose and Oakland, Calif. With housing costs in the stratosphere in places like San Francisco, the decision to share costs with another renter makes good financial sense.

Where Renting with a Roommate Has Its Advantages

| Metro | Median Starter Home Price, Fall 2017 | Median Monthly Rent (split with roommate), Fall 2017 | % Cheaper to Buy Than Rent, Fall 2017 | Percentage Point Difference in Benefit from Renting with a Roommate (2012-2017) |

| San Jose, CA | $649,929 | $1,800 | 21.9% | 22.7 |

| San Francisco, CA | $778,667 | $2,100 | 16.5% | 17.0 |

| Sacramento, CA | $254,633 | $948 | 0.8% | 21.0 |

| Austin, TX | $206,133 | $883 | 0.4% | 16.9 |

| Ventura County, CA | $399,617 | $1,398 | 0.2% | 13.2 |

| Portland, OR-WA | $261,632 | $998 | -0.1% | 8.2 |

| San Diego, CA | $365,667 | $1,300 | -3.5% | 19.2 |

| Orange County, CA | $454,967 | $1,550 | -3.6% | 11.7 |

| Tacoma, WA | $203,333 | $900 | -6.3% | 4.2 |

| Seattle, WA | $321,650 | $1,225 | -7.1% | 7.3 |

Home prices continue to rise across the country, but only around half of the markets examined saw an increase of $100 or more in rent since last year. In 15 metros, rents were flat or decreased. As a result, the rent versus buy equation is shifting. Since five years ago, exactly half of the 100 largest metros saw the savings from buying a starter home decrease or stay the same. In a place like San Jose, the financial advantage of renting over buying is at a five year high.

<!–[if IE 9]>

<!–[if IE 9]><![endif]–>

In some areas, the median price of a starter home is relatively affordable. In eight of ten markets where buying a starter home is most advantageous compared to renting, starter homes are less than $100,000 and a starter home can be had for $16,463 in Detroit. Even when splitting the cost, rents are comparatively not as low. In West Palm Beach, half the rent is still more than the rent paid in Sacramento, where starter homes are more than double the price. In addition to Detroit and West Palm Beach, buying a starter home will save you more than 50% over renting with someone else over seven years in the metros of Birmingham, Ala., Philadelphia, Memphis, Tenn., and Knoxville, Tenn.

<!–[if IE 9]>

<!–[if IE 9]><![endif]–>

Where Being A Starter Homeowner Pays Off

| Metro | Median Starter Home Price, Fall 2017 | Median Monthly Rent (split with roommate), Fall 2017 | % Cheaper to Buy Than Rent, Fall 2017 | Percentage Point Difference in Benefit from Renting with a Roommate (2012-2017) |

| Detroit, MI | $16,463 | $450 | -57.0% | 6.9 |

| West Palm Beach, FL | $107,083 | $1,000 | -52.2% | 2.8 |

| Knoxville, TN | $47,467 | $600 | -51.9% | -11.2 |

| Memphis, TN | $42,667 | $575 | -50.9% | -5.5 |

| Philadelphia, PA | $59,933 | $650 | -50.7% | -4.2 |

| Birmingham, AL | $49,767 | $575 | -50.6% | -10.6 |

| Fort Lauderdale, FL | $106,333 | $900 | -46.4% | 10.8 |

| Columbia, SC | $59,533 | $600 | -45.3% | -8.4 |

| Kansas City, MO-KS | $74,800 | $698 | -44.9% | -10.2 |

| Toledo, OH | $42,900 | $545 | -43.8% | -13.3 |

While some of these metros have clear advantages of being a starter homebuyer, the question is whether or not these homes can be found in an era of tight inventory. Trulia’s recent Price and Inventory Watch found that starter home inventory dropped 20.4% year-over-year nationwide. Low inventory and stiff competition for house hunters may be enough of a deterrence for renters with roommates to stay put if the margin between renting and buying is slim.

If you are interested how your renting versus buying decision might pencil, check out Trulia’s own Rent vs. Buy Calculator.

Methodology

In this edition of Rent vs. Buy where we focus on roommates, our methodology in terms of determining rent and home prices differs slightly. For renting with a roommate we simply halve the median rent across metros, assuming that renters with roommates have access to the entire universe of homes. To find the median price of a starter home, we define the price cutoffs of each segment based on home value estimates of the entire housing stock, not listing price. For example, we estimate the value of each single-family home and condo and divide these estimates into three groups: the lower third we classify as starter homes.

In general, Trulia calculates the costs of buying and renting by:

- We use our quality-adjusted measure of home prices and rents, which allows an apples-to-apples comparison between rental and owner-occupied housing units. We looked at median home value and rent in September 2017 in each of the largest 100 metros.

- We calculate the initial total monthly costs of owning and renting, including mortgage payments, maintenance, insurance, and taxes.

- We calculate the future total monthly costs of owning and renting, taking into account expected price and rent appreciation, as well as projected inflation.

- We factor in one-time costs and proceeds, including closing costs, down payment, sale proceeds, and security deposits.

- We calculate net present value, which reveals the opportunity cost of using money to buy a house instead of investing it. Net present value is the worth in today’s dollars of a future stream of payments and proceeds, taking into account expected interest rates.

Trulia’s Rent vs. Buy Calculator lets you compare renting and buying costs using other assumptions about prices, rents, and other factors. You can read our extended methodology here.