- April’s new home sales numbers fell back significantly from March. While concerning at face value, there isn’t much need for worry: new home completions also fell sharply in March, which means there were fewer new homes ready for sale.

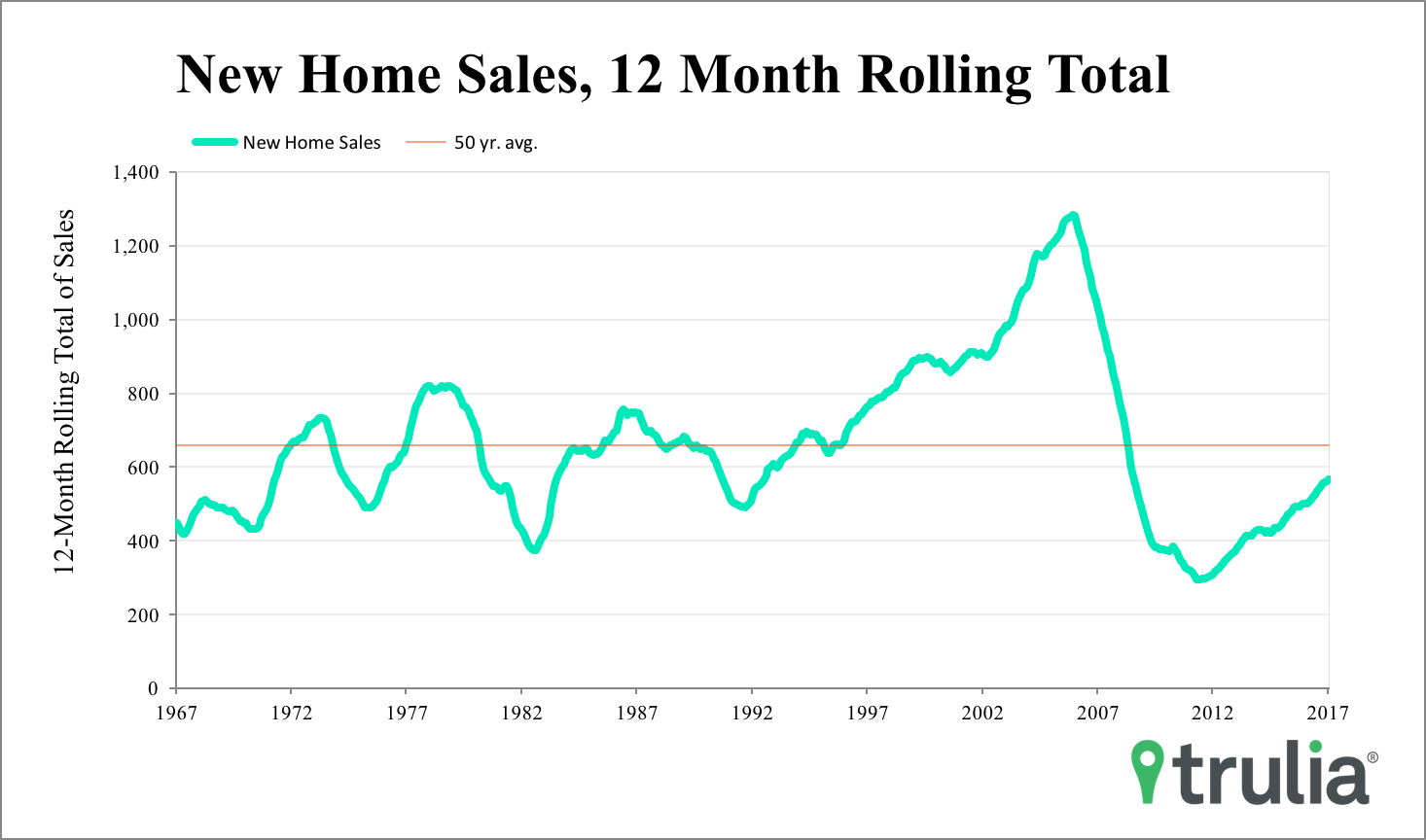

- Looking at the less volatile 12-month rolling total, new home sales look solid in April, growing year-over-year 13.7% year-over-year and inching up to 88.3% of the 50-year average.

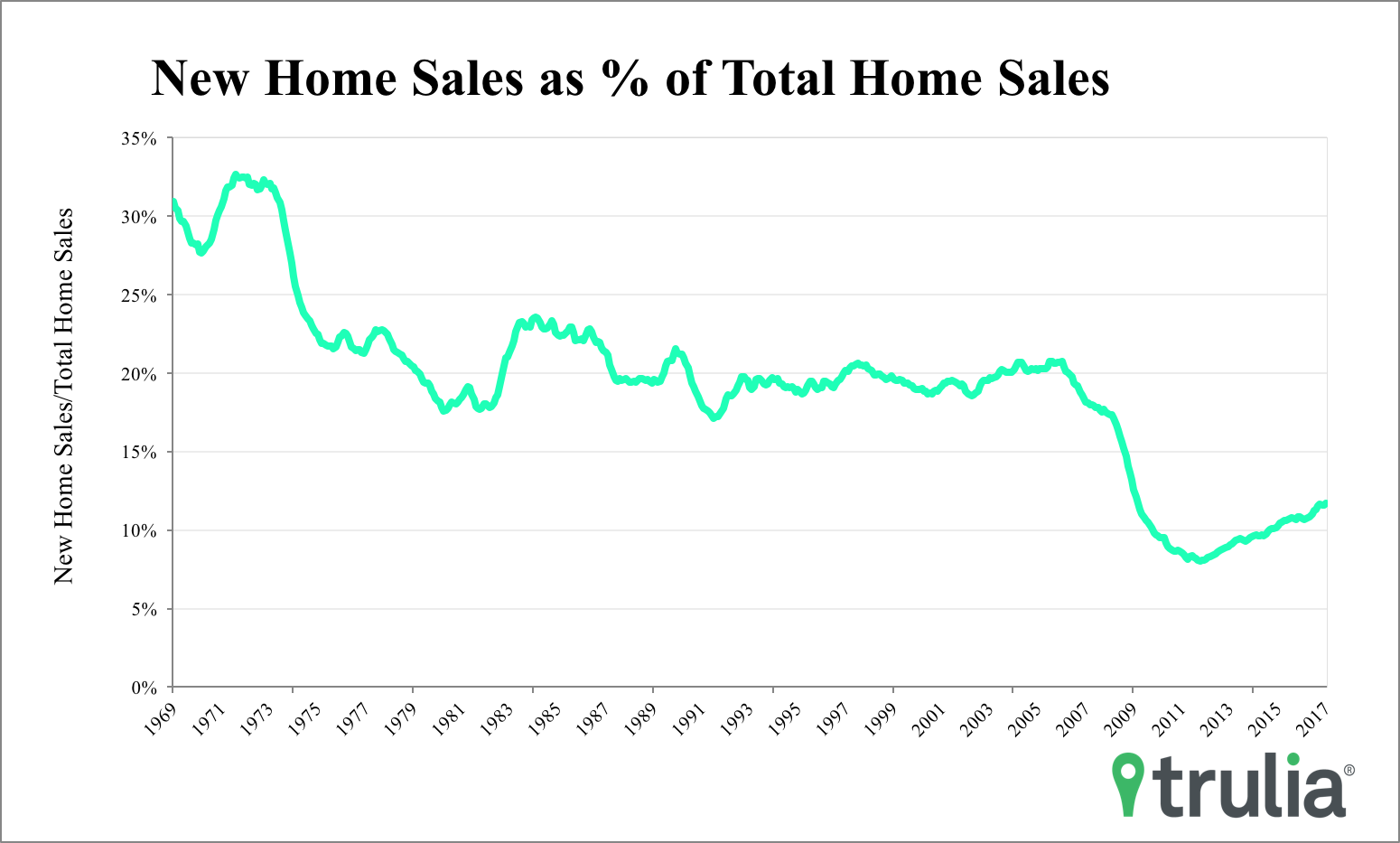

- How many new home sales do we need for the market to look normal? If we compare the share of new home sales to total sales, that share needs to more than double. In April, new home sales made up about 11.9% of all home sales, which is roughly half of the historical average of 23.6%.

New home sales in April fell to a seasonally adjusted rate of 569,000, which is down 11.4% month-over-month but up 0.5% year-over-year. However, April’s monthly numbers are just barely statistically significant (margin of error of 10.5%), so we should take them with a grain of salt. A less volatile number to look at is the 12-month rolling total, which is up 13.7% year-over-year. This represents the second most since July 2008. The increase over last year puts the 12-month total at 88.3% of the 50-year average.

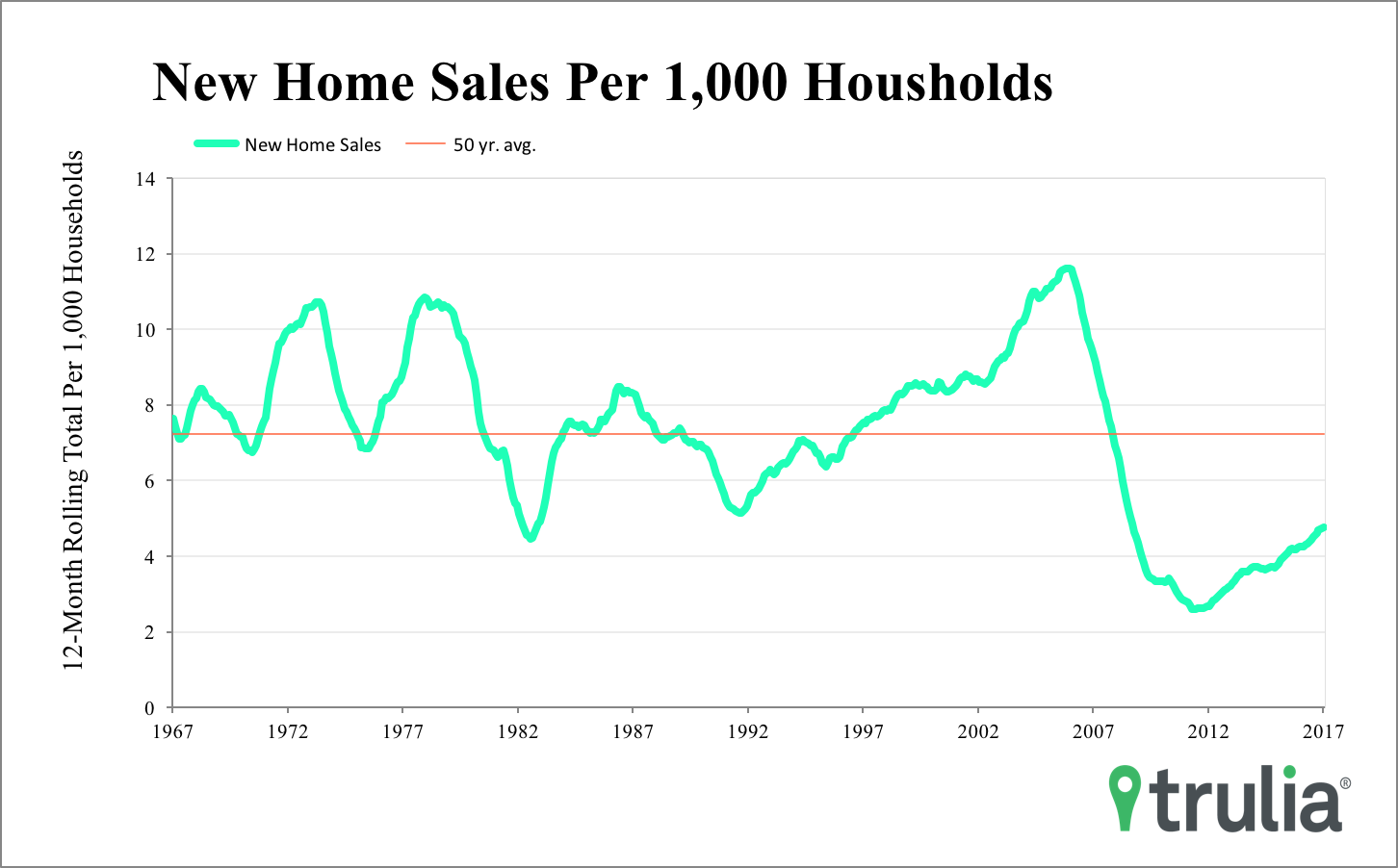

However, the 12-month rolling total of new home sales compared to the 50-year average looks like there’s a lot more room to grow when taking into account the size of the U.S. population. New home sales per 1,000 U.S. households was 4.9 in January, which is only 67.8% back to normal.

How many new home sales do we need for the market to look normal? If we compare the share of new home sales to total sales, that share needs to more than double. In April, new home sales made up about 11.9% of all home sales, which is roughly half of the historical average of 23.6%. While it’s been tough for homebuyers to buoy existing home sales because of low inventory, it looks like there is much potential for new homes sales to run higher.