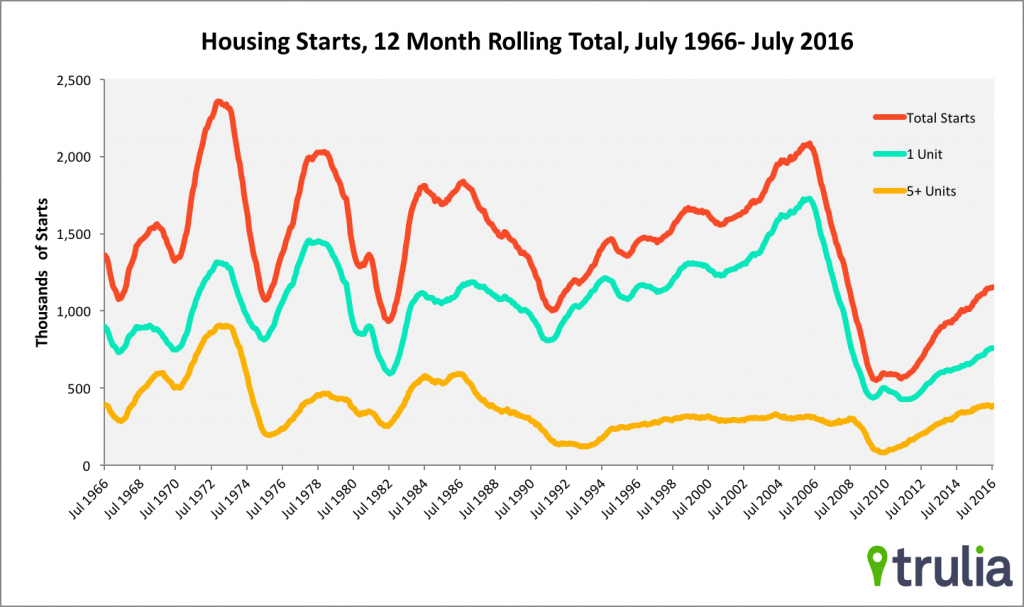

- The rate of housing start growth is slowing. July represents the fourth straight month where the 12-month rolling total was flat or less than the previous month. Still, the total was the most starts in a 12-month period since May 2008.

- Single-family starts are still growing at double-digit rates. Supply-constrained homebuyers should rest assured that relief is on the way.

- The wave of single-family starts this year still isn’t showing signs of rising the tide for construction jobs. The number of construction jobs per housing starts hit a 10-year low in July, likely due to persistent labor shortages.

New housing starts grew solidly in July, but the rate was flat compared to June. The 12-month rolling total of starts-which is a less volatile measure of new construction activity-grew 8.5% year-over-year in July to 1,154,600 starts, which is flat from the previous month. While flat, this represents the most starts in a 12-month period since May 2008. The 12-month rolling total remains flat at 80% of the 50-year average of 1,442,163 starts.

Starts of single-family units continue to show strong growth over the past year, increasing 10.4% from a 12-month rolling total of 687,200 in July 2015 to 758,700 in July 2016. The share of multifamily starts in 5+ unit buildings showed a renewed increase in growth, jumping to 5.9% year-over-year in July from 3.2% in June.

Last, the number of units currently under construction per residential construction job turned downward again to 2.5 in July, which represents a 10-year low. Despite the recent increase in single-family starts, a combination of labor shortages as well as sustained multifamily construction (which tends to use less labor per unit) is keeping the residential sector from supporting more job growth.