Each month, Trulia’s Housing Barometer charts how quickly the housing market is moving back to “normal.” We summarize three key housing market indicators: construction starts (Census), existing home sales (NAR), and the delinquency-plus-foreclosure rate (LPS First Look). For each indicator, we compare this month’s data to (1) how bad the numbers got at their worst and (2) their pre-bubble “normal” levels.

In March 2013, construction starts and the delinquency + foreclosure rate improved:

- Construction starts rocketed to a new post-bubble high. Starts were at a 1,036,000 seasonally adjusted annualized rate – up 7% month-over-month and 47% year-over-year – which is the highest level since June 2008. In March, 38% of new starts were in multi-unit buildings, compared with the typical level of 20%. Construction starts are now 55% of the way back to the normal level of 1.5 million from their low during the bust.

- Existing home sales went down a bit. Sales fell 0.6% in March to a seasonally adjusted annualized rate of 4.92 million homes. That’s a 10% increase over one year ago. Excluding distressed sales, conventional home sales were up 23% year-over-year in March. Also, inventory rose even on a seasonally adjusted basis for the second month in a row. Overall, existing home sales are 66% back to normal.

- The delinquency + foreclosure rate dropped yet again. The share of mortgages in delinquency or foreclosure dropped to 9.96% in March, down from 10.18% in February and 10.98% in March 2012. The combined delinquency + foreclosure rate is 48% back to normal and at its lowest level since October 2008.

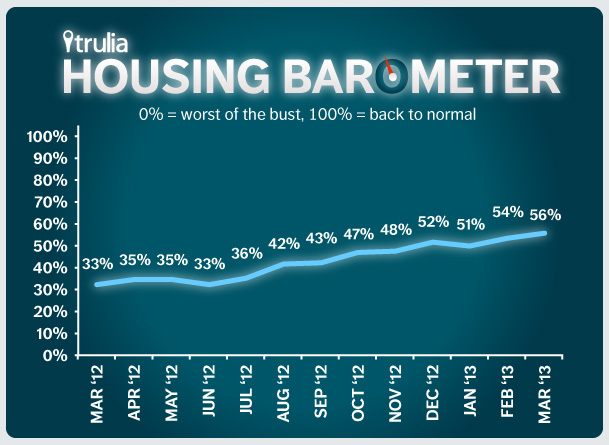

Averaging these three back-to-normal percentages together, the housing market is now 56% of the way back to normal, up from 54% in February and 43% six months ago in September. One year ago, the market was only 33% back to normal – so the last year has been a significant recovery. Furthermore, this month’s improvement is even better than it looks with the shift of sales from distressed to conventional and early signs that the inventory crunch may be easing, which will bring some relief to would-be homebuyers.