In good economic times as well as in bad, financial hardship can always strike. And when it does, people might have to cut back on housing, which is typically the largest household expense. However, cutting housing costs involves hard tradeoffs: moving can be expensive and a hassle, and living with family, friends, or strangers can be a challenge. To understand how people might make these tradeoffs, we asked 2,048 Americans in late March and early April 2014 the following question:

“If you experienced a major financial hardship (e.g., lost your job, unexpected medical bills), and you needed to cut back significantly on your housing costs, which of the following would you most likely do? Please select all that apply.”

Here’s what they told us.

Everyone’s Top Cost-Cutting Strategy: Downsizing

Facing financial hardship that required cutting back on housing, nearly 2 in 5 people (38%) would move to a smaller home — more than any other option by a wide margin. In fact, twice as many people would prefer downsizing than the next most popular actions of (1) renting out part of their home to a roommate or housemate or (2) moving to a more affordable neighborhood. Far fewer people would take the more radical actions of living in their car or not paying the rent or mortgage.

| How Would You Cut Your Housing Costs If Hit With A Major Financial Hardship? | Share |

| Move to a smaller home/apartment | 38% |

| Rent out part of my home to a roommate/housemate | 19% |

| Move to a more affordable neighborhood in the same city, metro area, or region | 19% |

| Move to a more affordable city, metro area, or region | 16% |

| Move into my parents’ home | 14% |

| Move into my children’s (or other relative’s) home | 8% |

| Rent out part of my home to vacationers/visitors | 6% |

| Live in my car, office, or another place that’s not intended as housing | 5% |

| Move into a non-relative’s home | 4% |

| I would stay in my current home but stop paying the rent or mortgage | 4% |

Grouping together similar options, nearly half (48%) of people would move to a smaller home or a more affordable location; just 21% would rent out part of their home, and only 20% would move in with someone else. That means people would rather change where they live than whom they live with.

Downsizing, in fact, was the top option chosen by every demographic group, beating out all other actions for every age group, income group, and both homeowners and renters. But other cost-cutting actions were much more appealing to some groups than others – with age differences being particularly important.

Middle-Aged Folks More Reluctant to Move

Millennials (aged 18-34) are more willing than older age groups to move into someone else’s home or rent out part of their own home. Young adults are, of course, more likely to have the option of moving in with their parents than older adults do, but they’re also far more likely than older adults to move in with a non-relative or rent to a roommate.

| How Would You Cut Your Housing Costs If Hit With A Major Financial Hardship? | Age 18-34 | Age 35-54 | Age 55+ |

| Move to a smaller home/apartment | 39% | 35% | 40% |

| Rent out part of my home to a roommate/housemate | 26% | 16% | 16% |

| Move to a more affordable neighborhood in the same city, metro area, or region | 25% | 16% | 18% |

| Move to a more affordable city, metro area, or region | 19% | 12% | 17% |

| Move into my parents’ home | 30% | 13% | 3% |

| Move into my children’s (or other relative’s) home | 8% | 6% | 9% |

| Rent out part of my home to vacationers/visitors | 10% | 4% | 4% |

| Live in my car, office, or another place that’s not intended as housing | 8% | 5% | 1% |

| Move into a non-relative’s home | 9% | 3% | 2% |

| I would stay in my current home but stop paying the rent or mortgage | 2% | 6% | 3% |

However, when it comes to downsizing, older adults (55+) are as willing as the youngsters. It’s the middle-aged (35-54 year-olds) who would be least likely to downsize or move to a cheaper location; they’re especially reluctant to move to a more affordable city (about one-third less likely to do so). These 35-54 year-olds would also be twice as likely to stop paying the rent or mortgage in order to avoid moving as other age groups would be, though few people in any age group would take that step.

Why are the middle-aged more reluctant to move? Relative to other age groups, they’re more likely to have jobs, kids at home, or both – and are therefore more tied to a school district or local labor market. They also might have more resources to weather a financial hardship since they have more savings, on average, than younger adults, and are less likely to have retired than older adults.

In Expensive Neighborhoods: Tourists Wanted

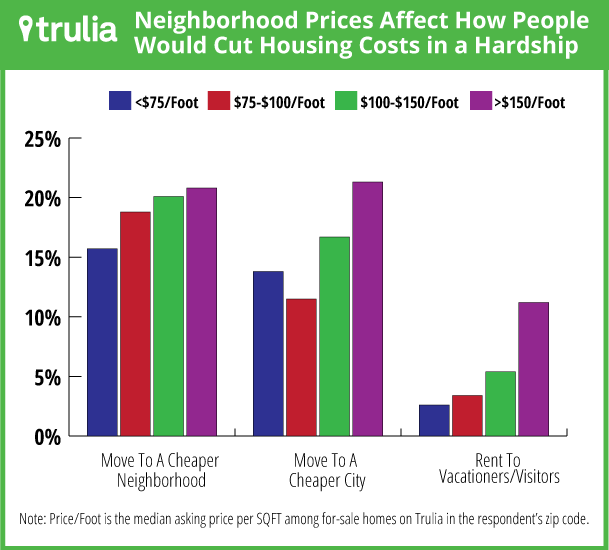

Your strategy for cutting housing costs depends not only on who you are, but also on where you live. We compared responses by neighborhood housing costs, based on Trulia’s median asking price per square foot among homes for sale in the respondent’s zip code.

Respondents living in more expensive neighborhoods would be more likely to move to a cheaper neighborhood or city if a major financial hardship struck. After all, if you’re already in an expensive neighborhood, there are other neighborhoods that are cheaper by comparison.

Beyond that, though, living in an expensive neighborhood gives you another kind of option: renting part of your home to vacationers or visitors. People in expensive neighborhoods would be at least twice as likely to rent to vacationers or visitors as people in other neighborhoods.

Renting Can Set You Free

When financial hardship strikes, renters believe they have more options to reduce their housing costs than homeowners do. Renters would be more likely than owners to take all but one of the cost-cutting actions offered. Even after adjusting for demographic differences between renters and owners, renters would be more likely than owners to downsize, rent to a roommate, move to a cheaper neighborhood or city, or live out of their car – and these differences are statistically significant. There’s only one action that homeowners would be more likely than renters to take: stop paying the rent or mortgage.

| How Would You Cut Your Housing Costs If Hit With A Major Financial Hardship? | Renters | Owners |

| Move to a smaller home/apartment | 43% | 37% |

| Rent out part of my home to a roommate/housemate | 25% | 16% |

| Move to a more affordable neighborhood in the same city, metro area, or region | 25% | 16% |

| Move to a more affordable city, metro area, or region | 20% | 14% |

| Move into my parents’ home | 19% | 12% |

| Move into my children’s (or other relative’s) home | 9% | 7% |

| Rent out part of my home to vacationers/visitors | 7% | 5% |

| Live in my car, office, or another place that’s not intended as housing | 7% | 3% |

| Move into a non-relative’s home | 6% | 3% |

| I would stay in my current home but stop paying the rent or mortgage | 3% | 4% |

Why are renters open to more cost-cutting options? Moving is cheaper and easier for renters than for homeowners, who face closing costs and possibly also a loss if they’re underwater; in addition, owners might lose the benefit of a low mortgage rate they’ve locked in.

Homeownership may have many advantages, but renting might make it easier to cut housing costs if it suddenly becomes necessary. That’s the lesson: for people at higher risk of facing future financial hardship, renting could be a safer choice even if homeownership is within their reach today.

SURVEY METHODOLOGY

This survey was conducted online within the United States between March 28 to April 1, 2014, among 2,048 adults (aged 18 and over), by Harris Poll on behalf of Trulia via its Quick Query omnibus product. Figures for age, sex, race/ethnicity, education, region and household income were weighted where necessary to bring them into line with their actual proportions in the population.

All sample surveys and polls, whether or not they use probability sampling, are subject to multiple sources of error which are most often not possible to quantify or estimate, including sampling error, coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments. Therefore, Harris Interactive avoids the words “margin of error” as they are misleading. All that can be calculated are different possible sampling errors with different probabilities for pure, unweighted, random samples with 100% response rates. These are only theoretical because no published polls come close to this ideal.

Respondents for this survey were selected from among those who have agreed to participate in Harris Interactive surveys. The data have been weighted to reflect the composition of the adult population. Because the sample is based on those who agreed to participate in the Harris Interactive panel, no estimates of theoretical sampling error can be calculated.