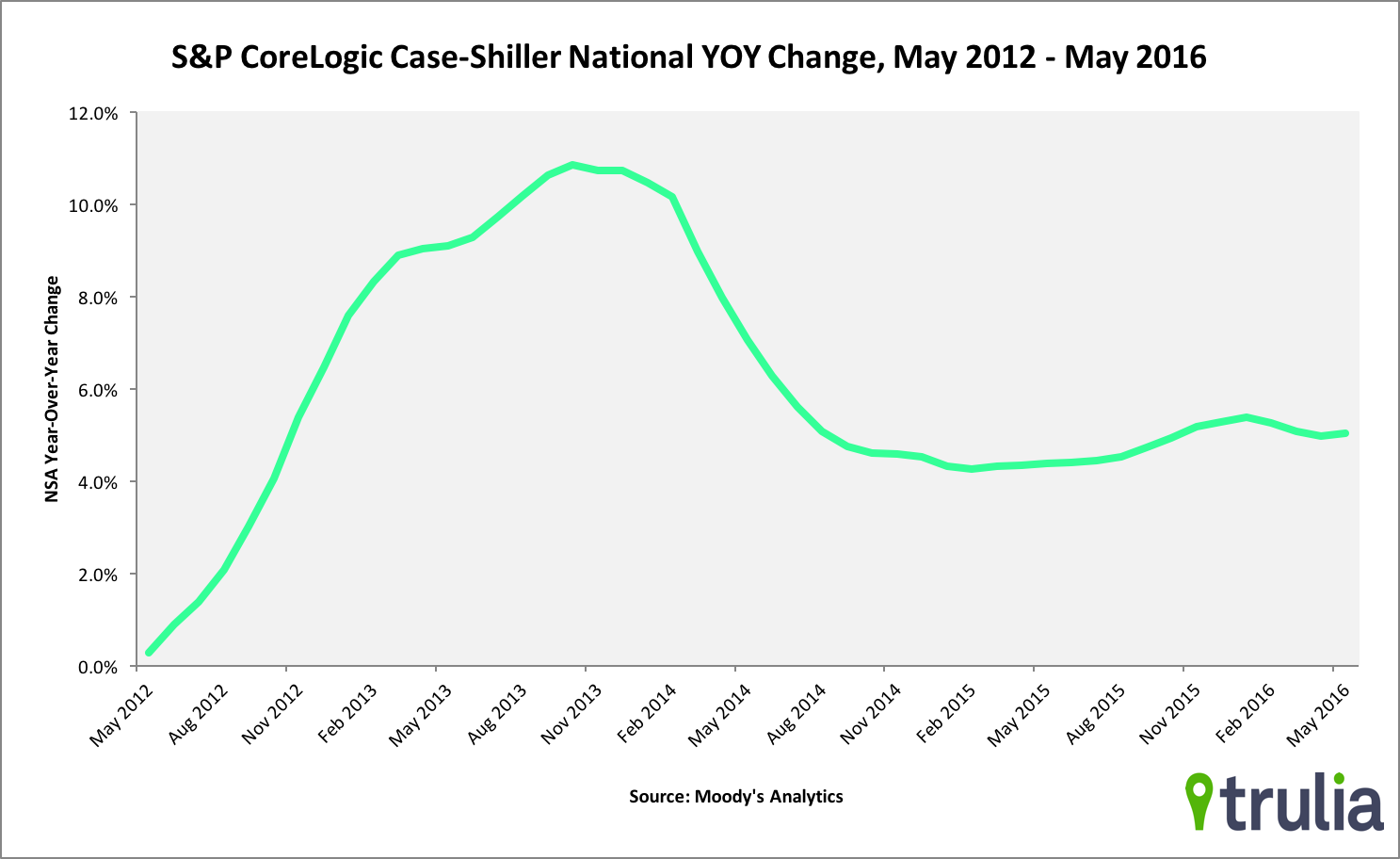

- The U.S. housing market continues to cool, as May represents the fourth straight month of flat or decreasing year-over-year price gains.

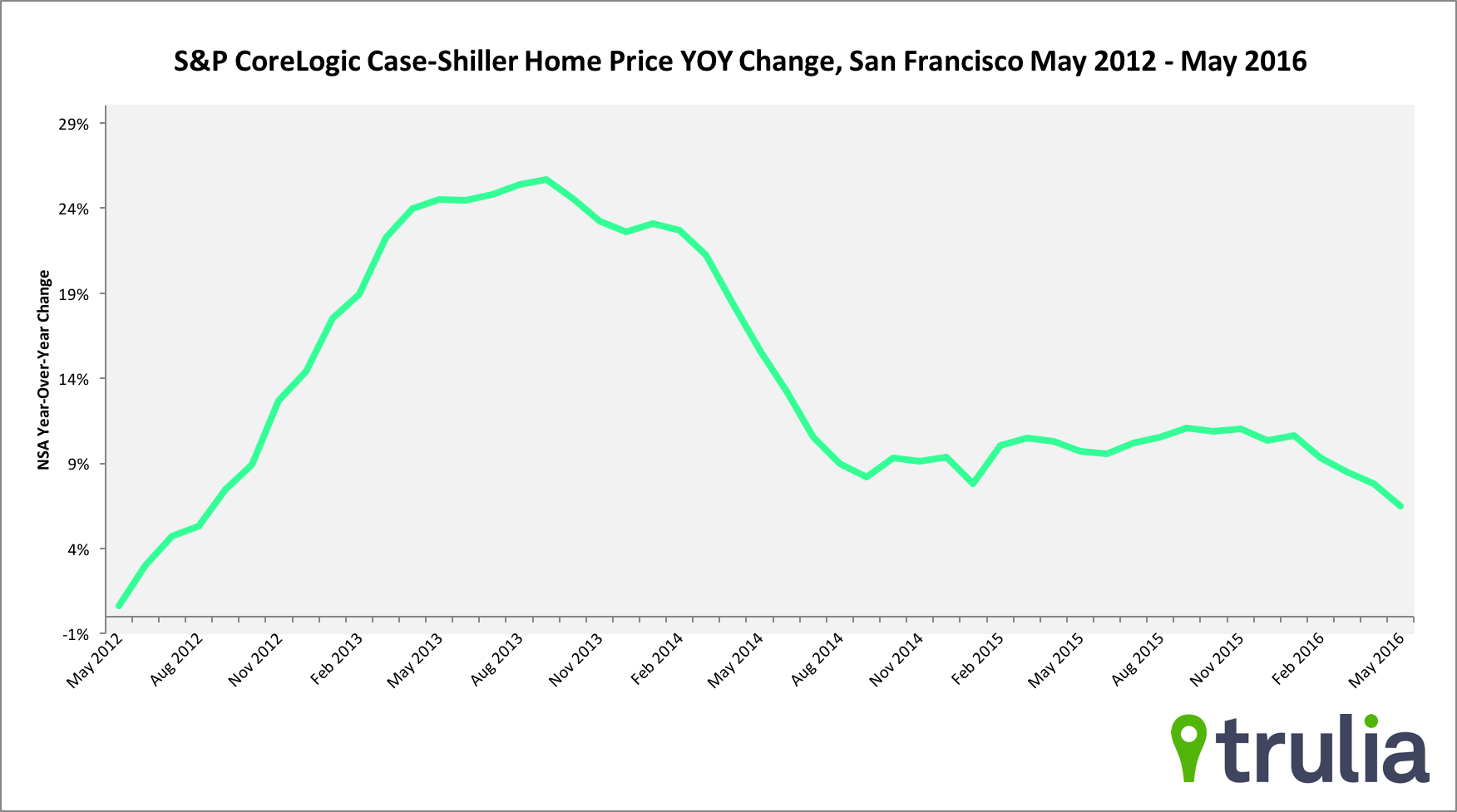

- Home price growth in San Francisco home prices drops for the fourth straight month, signaling the city by the bay may have seen its day.

- Though Western markets continue to dominate price growth, several markets east of the Mississippi are picking up. Year-over-year price growth Minneapolis and Washington, D.C both reached 22 month highs.

Today’s S&P/Case-Shiller National Home Price Index increased 5% year-over-year in May, which is the 49th consecutive month of positive gains. However, May is also the fourth straight month in which the year-over-year increase was smaller than the previous month. This is a sign that the U.S. housing market may be cooling in the wake of double digit price appreciation between 2012 and 2014. While the S&P/Case-Shiller National Home Price Index is an important metric to watch, it’s worth noting that the measure is more reflective of price movements in premium homes rather than middle or lower-tier homes.

Prices in last month’s three hot markets – Portland, Seattle, and Denver – continue to lead the pack with increases between 9.5% to 12.3%. Though Western markets continue to dominate price growth, several markets east of the Mississippi are picking up. Year-over-year price growth Minneapolis and Washington, D.C., both reached 22 month highs.

Finally, growth in San Francisco home prices continues a noticeable slowdown with a year-over-year increases of 6.5%, which is the smallest annual gain since August 2012. The continued slowdown suggests the San Francisco housing market may finally be entering a phase of normalcy after years of sustained price appreciation, although persistent increases have left homebuyers struggling to find affordable homes.

New Home Sales Surge in June, Now 10.6% of Sales

- New home sales jumped sharply in June, and marked the best month since February 2008. This is a continued sign that demand for homes remains solid and aptly reflects increasing homebuilder confidence.

- The share of all home sales composed of new homes ticked upward to 10.6% in June, as new home sales continue to slowly ease the crunch of low existing inventory.

New home sales, as measured by the U.S. Census Bureau, jumped in June, and marked the best month for new home sales since February of 2008. The share of all sales made up of new homes ticked up to 10.6% from 10.4%, suggesting that new inventory continues to slowly relieve home buying pressure otherwise constrained by low inventory.