So, who’s getting their own room?

It’s a question growing families ponder when they find a new home – or the home they already live in — as the kids get older or an elderly grandparent comes to stay.

And across America, space is gradually getting tighter. In the nation’s largest 100 metro areas, 14.7% of households had less bedrooms than family members, up 0.5 percentage points from 14.2% in 2009.

We took a look at those markets to find out where families are more likely to be doubling up. We found that renter families living with kids particularly are feeling the squeeze. Larger and more expensive metros tend to feel the squeeze more so than smaller metros do.

We decided to shed a bit more light on the space constraints that modern day renters face in the largest rental markets. Using U.S. Census 2014 5-year American Community Survey data for this study, we identify how many bedrooms each household needs based on the number of children and the number of married couples in the family.

First, we isolate households that contained one family. Married couples were assumed to need only one bedroom while non-married adults as well as children were assumed to each need one bedroom.

Nationwide, Renters Face Tighter Squeeze Than Homeowners

- The difference between owners and renters is stark – only 8.1% of households who own experience space crunch. On the other hand, 26.4% of households who rent experience space crunch.

- The percentage of owner-households experiencing space crunch was 0.3 percentage points higher at 8.4% in 2009. So owner-households squeezed for space actually decreased from 2009 to 2014. The percentage of renter-households experiencing space crunch rose 0.6 percentage points from 25.8% in 2009.

- Strikingly, the average family size for renter households (2.3) is lower than that for homeowner households (2.6), and yet renter households were crunched for space more often than homeowner households were.

- Renters who have at least one child living with them are squeezed the most. Almost half, or 49.6%, of such renter-households with children experience space crunch.

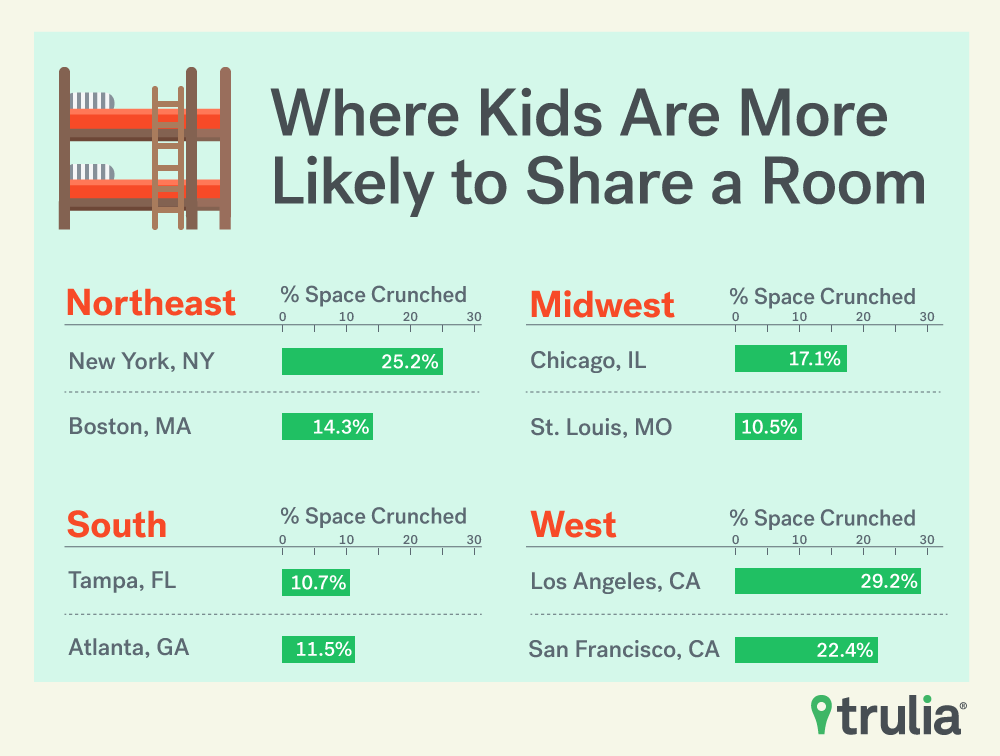

Coastal Metros Experience Tighter Squeeze Than Inland Metros

- When looking at both renter and homeowner households containing one family, Los Angeles has the highest proportion of households experiencing space crunch (29.2%). LA is followed by New York (25.2%), then by Fresno (24.6%).

- Homeowners in Richmond (4.1%) experience the least space crunch, followed by Cape Coral, Fla. (4.1%), then by North Port, Fla. (4.2%), then by Deltona (4.7%), then by Albany (5.0%). Compare these homeowner-households to renter-households in Los Angeles (29.2%), Fresno (24.6%), Bakersfield (22.4%), New York (25.2%), and Orange County (19.5%), where renters most frequently experience space crunch.

- Owner households in Winston-Salem, N.C., (+0.8 percentage points), Albuquerque, N.M., (+0.7), Louisville, Ky., (+0.5), Oklahoma City (+0.4), and Nashville, Tenn., (+0.4) saw the biggest increases in space crunch from 2009 to 2014, while renter households in places such as Salt Lake City (+3.8), and Baltimore (+3.3) saw the biggest increases in space crunch from 2009 to 2014.

Have Kids? May Need To Teach Them To Share

Looking at households living with kids, we found the following:

- Renter households living with children are crunched the most in Los Angeles (67.9%). LA was followed by New York (61.8%) and Fresno (59.8%),

- Orange County showed renters living with children having the most disadvantage compared to homeowners living with children (40.7-percentage-point difference), followed by Newark (40.1 percentage points), and Los Angeles (39.4 percentage points).

Finally, when looking at the top 25 rental markets, we found, unsurprisingly, that bigger rentals were more expensive. Rent for three bedroom apartments is 35% higher than rents for 1 bedroom apartments.[1] However, in these markets, we found the median family income of renters living with children is only 21.4% higher than that of renters living without a child. These data points show that higher incomes earned by renters living with children are not enough to make up for the higher rent demanded by larger homes.

[1] The percent difference in median rent of 3 bedroom apartments and that of 1 bedroom apartments for each county was weighted by the listing sample size of each county to arrive at the weighted median percent difference between 3 bedroom and 1 bedroom apartments of 35%.

Methodology

U.S. Census 5-year 2014 American Community Survey data were used for this study. First, we used the 100 largest metro areas in the US. Then, we narrowed it down to 25 metro areas with the most renter occupied units as per the 2010 Census data. Our metro area definitions follow metropolitan divisions when available, then metropolitan statistical areas. We used head-of-household records for this study. We only use household records that have one family living in the household and also only those records that report a valid number of bedrooms in the residential unit. We then calculate the number of adults living in the household by subtracting the number of children from the family size. We then define the number of adult units as the number of non-married adults + the number of married couples. We calculate the number of non-married adults for a given household by subtracting 2 x {number of couples} from the number of adults in the household. We define and calculate the number of bedrooms needed for the household by summing the number of adult units with the number of children. If a household lives in a residential unit with a number of bedrooms less than the number of bedrooms needed, we consider the household to be space-crunched. Identical logic was applied to the 5-year 2009 ACS data, which we used to compare 2014 against 2009. All income numbers found in this report are based on the Total Family Income from 5-year 2014 ACS data. This data were adjusted for inflation using Bureau of Labor Statistic’s CPI-U data in order to be expressed in May 2016 dollars. Rent figures found in this report were compiled using data generated by rental units that were listed on our website from January to the end of June of 2016.