Trulia’s Bubble Watch reveals whether home prices are overvalued or undervalued relative to their fundamental value by comparing prices today with historical prices, incomes, and rents. The more prices are overvalued relative to fundamentals, the closer we are to a housing bubble – and the bigger the risk of a future price crash.

Trulia’s first Bubble Watch report, from May 2013, explains our methodology in detail. We look at the price-to-income ratio, the price-to-rent ratio, and prices relative to their long-term trends, using multiple data sources, including the Trulia Price Monitor as a leading indicator of where home prices are heading. We then combine these various measures of fundamental value rather than relying on a single factor, because no one measure is perfect. Here’s what we found.

Prices Far From Bubble Territory

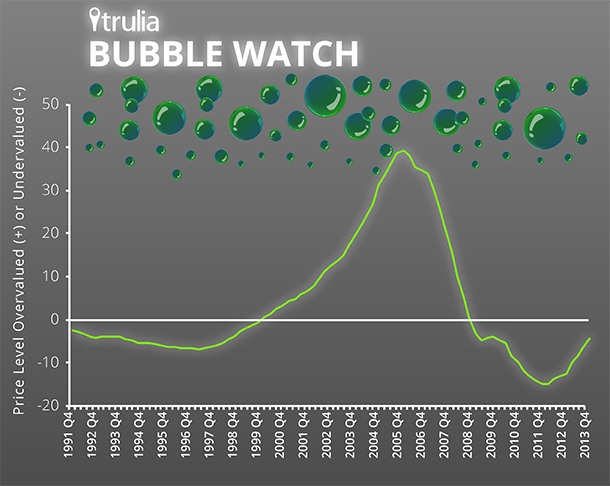

We estimate that home prices nationally are 4% undervalued in the fourth quarter of 2013 (2013 Q4), which means we’re nowhere near another housing bubble. To put this in perspective, prices were as much as 39% overvalued in 2006 Q1, at the height of last decade’s bubble, then dropped to being 15% undervalued in 2011 Q4. One quarter ago (2013 Q3) prices looked 6% undervalued; one year ago (2012 Q4) prices looked 13% undervalued (see note at end of post). This chart shows how far current prices are from a bubble:

Bubbling Local Markets: Orange County and Los Angeles

At the metro level, home prices are above their fundamental value in 17 of the 100 largest metros. Most of these overvalued metros are only slightly so: of the 17 overvalued metros, just two – Orange County and Los Angeles – look at least 10% overvalued. (Austin rounds up to 10% but is actually slightly below.) Several California metros also stand out for having both overvalued prices AND sharp price increases, including Orange County, Los Angeles, Oakland, and Riverside-San Bernardino.

|

Top 10 Metros Where Home Prices are Most Overvalued |

|||

| # | U.S. Metro |

Home prices relative to fundamentals, 2013 Q4 |

Year-over-year change in asking prices, October 2013 |

| 1 | Orange County, CA |

+13% |

23.4% |

| 2 | Los Angeles, CA |

+12% |

22.5% |

| 3 | Austin, TX |

+10% |

11.7% |

| 4 | Oakland, CA |

+7% |

29.6% |

| 5 | Riverside–San Bernardino, CA |

+7% |

26.9% |

| 6 | Houston, TX |

+6% |

13.9% |

| 7 | San Jose, CA |

+6% |

19.1% |

| 8 | San Francisco, CA |

+5% |

15.6% |

| 9 | Honolulu, HI |

+5% |

2.9% |

| 10 | San Antonio, TX |

+4% |

11.1% |

| Note: positive numbers indicate overvalued prices; negative numbers indicate undervalued, among the 100 largest metros. Click here to see the price valuation for all 100 metros: Excel or PDF. | |||

Prices are most undervalued today in several Ohio and Florida markets. Even with the huge gains in the past year, prices are still 14% undervalued in Detroit and 13% undervalued in Las Vegas, which would have made the most undervalued list if we extended it to 11.

|

Top 10 Metros Where Home Prices Most Undervalued |

|||

| # | U.S. Metro |

Home prices relative to fundamentals, 2013 Q4 |

Year-over-year change in asking prices, October 2013 |

| 1 | Cleveland, OH |

-20% |

6.6% |

| 2 | Akron, OH |

-19% |

2.9% |

| 3 | Palm Bay–Melbourne–Titusville, FL |

-19% |

8.6% |

| 4 | Dayton, OH |

-18% |

4.5% |

| 5 | Toledo, OH |

-18% |

6.1% |

| 6 | Lakeland–Winter Haven, FL |

-17% |

14.7% |

| 7 | Detroit, MI |

-14% |

24.5% |

| 8 | Jacksonville, FL |

-14% |

9.3% |

| 9 | Hartford, CT |

-14% |

1.3% |

| 10 | West Palm Beach, FL |

-14% |

7.7% |

| Note: positive numbers indicate overvalued prices; negative numbers indicate undervalued, among the 100 largest metros. Click here to see the price valuation for all 100 metros: Excel or PDF. | |||

Despite Climbing Prices, This is Not Last Decade’s Bubble

If prices nationally are 4% undervalued, why are so many people worried that a new bubble is forming? Because prices have risen quickly over the past year, and even with the recent slowdown in the past few months, rising prices stoke bubble fears. The October 2013 Trulia Price Monitor reported that asking prices were up 11.7% year-over-year – roughly the same sharp increase in as in 2004 Q3, when the housing bubble was inflating.

But, aside from similar sharp price increases, the housing market today is very different than it was in 2004 Q3. The key is that the level of prices, relative to fundamentals, is much lower today than in 2004 Q3. Our Bubble Watch shows that prices were 24% overvalued in 2004 Q3, compared with 4% undervalued today. At the metro level, 99 of the 100 largest markets were overvalued in 2004 Q3, and 74 of 100 were overvalued by at least 10%. Today, just 17 metros are overvalued, and just 2 by at least 10%.

|

Prices Today versus Last Decade’s Bubble |

||

|

2013 Q4 |

2004 Q3 |

|

| Year-over-year change in home prices* |

11.7% |

11.8% |

| Bubble Watch national index |

-4% |

+24% |

| # of 100 largest metros overvalued |

17 |

99 |

| # of 100 largest metros overvalued 10% or more |

2 |

74 |

| *Home prices based on Trulia Price Monitor (October 2013) and average of FHFA expanded and Case-Shiller national indices (2004 Q3). | ||

Today looks different from 2004 Q3 in two other important ways, too. First: unlike mid-last decade, we are not overbuilding. New home starts today are approximately 40% below normal levels. Second: mortgage lending for new-home purchases is tight today, unlike last decade when mortgages were, if anything, too easy to get. Therefore, even though prices are rising today as fast as they were during last decade’s bubble, today’s price gains are a post-crash rebound, not a new bubble. Today, unlike last decade, prices are slightly undervalued, construction is low, and mortgage credit remains tight.

Note: each quarter’s Bubble Watch includes minor revisions to previous estimates because the underlying data sources are often revised or updated.