Trulia’s Bubble Watch reveals whether home prices are overvalued or undervalued relative to their fundamental value by comparing prices today with historical prices, incomes, and rents. The more prices are overvalued relative to fundamentals, the closer we are to a housing bubble – and the bigger the risk of a future price crash.

Recent price changes, by themselves, cannot tell us whether this is a housing bubble; neither can a simple comparison of nominal price levels today to where they were in the past. Asking prices in Las Vegas, for instance, are up almost 60% from their lowest point during the bust, and asking prices in Pittsburgh and Dallas are now above their 2006 highs. But none of those facts takes fundamentals into account, so none can tell us whether those local markets are in a housing bubble.

Bubble watching is as much art as it is science because there’s no definitive measure of fundamental value. To try to put numbers on it, we look at the price-to-income ratio, the price-to-rent ratio, and prices relative to their long-term trends using multiple data sources, including the Trulia Price Monitor as a leading indicator of where home prices are heading. We then combine these various measures of fundamental value rather than relying on a single factor, because no one measure is perfect. Trulia’s first Bubble Watch report, from May 2013, explains our methodology in detail. Here’s what we found.

Bubbles Haven’t Broken the Surface Nationally

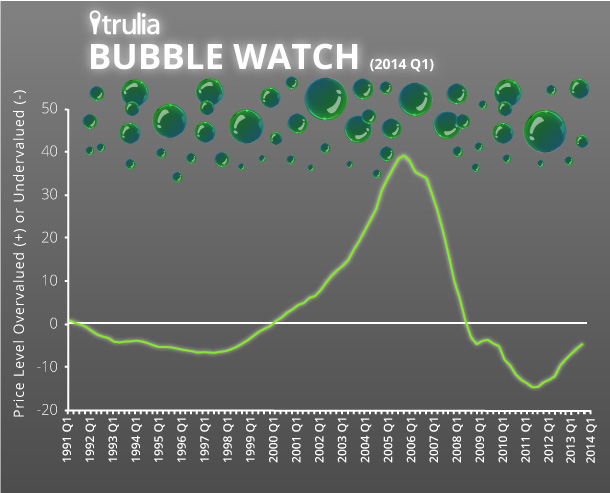

We estimate that home prices nationally are 5% undervalued in the first quarter of 2014 (2014 Q1), which means we’re not in a nationwide housing bubble. Remember that prices reached a high of 39% overvalued in 2006 Q1, then dropped to being 15% undervalued in 2011 Q4. One quarter ago (2013 Q4) prices looked 6% undervalued, and one year ago (2013 Q1) prices looked 10% undervalued (see note at end of post about the trend over time). This chart shows how far current prices are from a bubble:

Local Warning Signs Bubbling Up, Especially Along California Coast

Turning from the national view to the local scene, home prices are above their fundamental value in 19 of the 100 largest metros. Three of the five most overvalued housing markets are in southern California: Orange County, Los Angeles, and Riverside-San Bernardino; these three markets have also had sharp price increases over the past year. Looking across the whole state, prices in 8 of the 11 large California metros are overvalued now; the 3 exceptions are the undervalued inland metros of Fresno, Bakersfield, and Sacramento.

|

Top 10 Metros Where Home Prices Are Most Overvalued |

|||

| # | U.S. Metro |

Home prices relative to fundamentals, 2014 Q1 |

Year-over-year change in asking prices, February 2014 |

| 1 | Orange County, CA |

+16% |

16.9% |

| 2 | Los Angeles, CA |

+13% |

18.9% |

| 3 | Honolulu, HI |

+13% |

12.1% |

| 4 | Austin, TX |

+11% |

11.3% |

| 5 | Riverside–San Bernardino, CA |

+10% |

24.1% |

| 6 | San Jose, CA |

+8% |

14.5% |

| 7 | San Francisco, CA |

+7% |

16.5% |

| 8 | Miami, FL |

+6% |

12.4% |

| 9 | Fort Lauderdale, FL |

+6% |

18.0% |

| 10 | Ventura County, CA |

+6% |

17.1% |

| Note: positive numbers indicate overvalued prices; negative numbers indicate undervalued, among the 100 largest metros. Click here to see the price valuation for all 100 metros: Excel or PDF. | |||

Prices are most undervalued today in several Midwest and Connecticut markets. Eight of the 10 most undervalued housing markets had single-digit price gains or slight price drops in the past year, though Detroit and Chicago had double-digit price gains.

|

Top 10 Metros Where Home Prices Are Most Undervalued |

|||

| # | U.S. Metro |

Home prices relative to fundamentals, 2014 Q1 |

Year-over-year change in asking prices, February 2014 |

| 1 | Detroit, MI |

-20% |

18.7% |

| 2 | Lake County-Kenosha County, IL-WI |

-18% |

9.5% |

| 3 | Cleveland, OH |

-18% |

8.9% |

| 4 | Palm Bay–Melbourne–Titusville, FL |

-17% |

5.0% |

| 5 | Toledo, OH |

-17% |

4.9% |

| 6 | Memphis, TN-MS-AR |

-16% |

9.2% |

| 7 | Hartford, CT |

-16% |

-2.3% |

| 8 | Fairfield County, CT |

-16% |

5.1% |

| 9 | Chicago, IL |

-16% |

14.2% |

| 10 | New Haven, CT |

-16% |

-0.2% |

| Note: positive numbers indicate overvalued prices; negative numbers indicate undervalued, among the 100 largest metros. Click here to see the price valuation for all 100 metros: Excel or PDF. | |||

How Widespread are Local Bubble Worries?

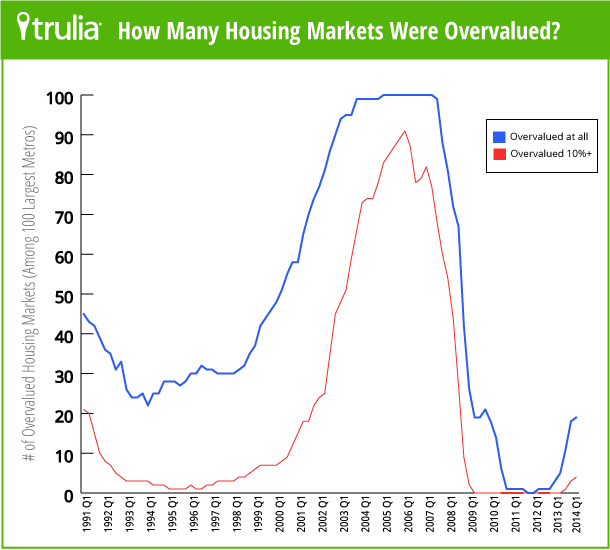

The number of housing markets where prices look overvalued is rising, but the number of overvalued markets is still low compared with the longer-term historical view. In 2014 Q1, prices were overvalued in 19 of the 100 largest metros, which is the highest number since 2009 Q4; furthermore, prices were overvalued by more than 10% in 4 large metros, which is the highest number since 2008 Q4. However, at the height of the bubble, all 100 were overvalued, and 91 were overvalued by more than 10%.

Aside from last decade’s boom and bust, there are typically both overvalued and undervalued metros at any given time. During the 1990s, when national prices looked modestly undervalued, at least 20 metros were overvalued at any given point during that decade. The bubble and bust of the 2000s were unusual in that all 100 metros looked overvalued at the peak in 2006 and all were undervalued at the bottom in 2011. Last decade’s bubble was rooted in the national housing finance system, rather than localized price speculation. Today, several markets are now more than 10% overvalued, but the majority still look undervalued.

Trulia’s Bubble Watch shows that national price levels today are roughly in line with fundamentals, like incomes, rents, and historical price paths. Even though recent double-digit price gains look unsustainable, current national price levels are not cause for alarm. Sharp price gains, like we’ve had in 2012 and 2013, are not the sign of a bubble unless price levels look high relative to fundamentals. Furthermore, the slowdown in price gains make it less likely that we’re heading for another bubble. The key region to watch is coastal California, especially southern California, where prices are most overvalued today.

Note: each quarter’s Bubble Watch includes minor revisions to previous estimates because the underlying data sources are often revised or updated. To compare the national or metro trend over time, look at the current report’s historical numbers, not previously reported numbers.