Each month, we look at three measures in the monthly jobs report to see whether housing is helping jobs and whether jobs are helping housing. Residential construction employment shows whether housing is helping jobs. Job growth for young adults (key age group for household formation) and job growth in “clobbered metros” (those hit hardest in the housing bust) show whether jobs are helping housing.

The September jobs report – released this morning – was grim for housing. Although residential construction jobs are outpacing overall job growth, the most recent quarters (Q2 and Q3) had slower construction job gains. Worse, the job market isn’t improving in the areas where it would most help housing demand: among young adults, and in clobbered metros.

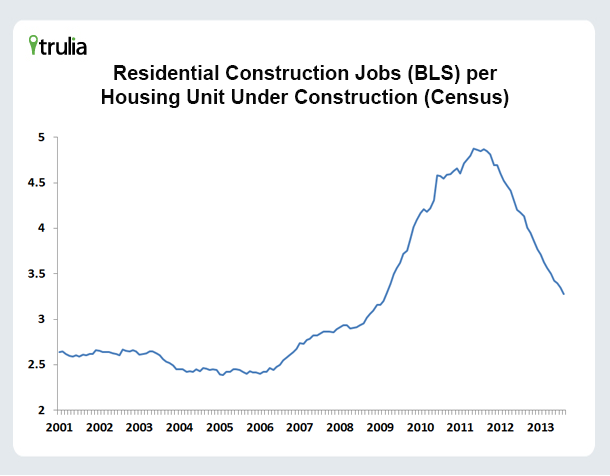

- Residential construction employment, including residential specialty trade contractors, was up 5.0% year-over-year — ahead of overall national employment growth of 1.7%. But construction job growth is slowing. After adding 29k jobs in 2012 Q4 and 40k jobs in 2013 Q1, residential construction added just 16k jobs in 2013 Q2 and 19k jobs in 2013 Q3. Furthermore, construction employment is growing much more slowly than construction activity: the number of units under construction grew 32% YoY in August. That’s because construction employment is higher than normal relative to the level of construction activity (explained here). There are now 3.3 employed residential construction workers for every unit under construction, as of August 2013, compared with 2.6 before the bubble, as the graph (either below or attached) shows:

- Young adults still aren’t working. Employment among 25-34 year-olds, the prime age group for housing demand, is still well below pre-bubble levels. Just 75.0% of them are employed – no change from one year ago, in September 2012. That’s closer to the low point during the recession (73-74%) than to the pre-bubble normal (78-80%). Without a job, young people are much more likely to live with their parents instead of becoming renters or home buyers.

- Job growth in “clobbered metros” was 1.6% year-over-year (in August, the most recent metro jobs data) – a bit below national job growth of 1.7% for the same period. We define clobbered metros as the areas with the biggest price declines during the bust and the highest vacancy rates now: job growth in those markets is especially important for housing demand. Among clobbered metros, year-over-year job growth was especially strong in Tampa and Fort Lauderdale, but flat in Miami and negative in Detroit, where employment dropped 0.7% since last August.