In our last Rent vs. Buy Report, we looked at whether it is cheaper for millennials to buy a home than rent. In most cases, it was. But what about those looking to buy their retirement home? For this edition, we take a look at the whether it is cheaper for retirees to rent or buy in their golden years and found that:

- Nationally, buying is slightly cheaper than renting compared to last year. For all households (retiring or not) who move every seven years and can afford to put 20% down, it’s 34.8% cheaper to buy – becoming slightly cheaper from 34.2% last year. Locally, buying ranges from being 52.3% cheaper than renting in New Orleans versus just 14.4% cheaper in Honolulu.

- For retirees, buying is cheaper than renting in all major metros by 41.8% At the city level, Florida offers the best deals on purchasing a home over renting, and popular retirement communities such as Sun City, Ariz., and The Villages, Fla., offer some of the widest margins.

- Does renting ever make more sense for retirees? Buying in retirement is only better than renting if retirees care about leaving inheritance. If retired households don’t care about the equity in their home at the end of their life, renting a home is better option in 98 of the 100 cities with the most retirees. This is because the value of the equity in a home is a significant contributor to the financial benefits of homeownership. If we leave out this value because retirees don’t care about it, the benefits of homeownership compared to renting fall.

Buying Slightly Cheaper than Last Year

Trulia’s biannual Rent vs. Buy Report assumes a 30-year fixed rate mortgage with a 20% down payment and 25% tax bracket for households moving every seven years. With these assumptions, buying is 34.8% cheaper than renting on a national basis, based on March home values and rents. That’s slightly better than a year ago, when buying was about 34.2% cheaper. Why? Interest rates dropped a bit year-over-year to 3.86% from about 3.89%, which makes it slightly less expensive to take out a mortgage.

Those trying to decide whether to buy or rent a home this spring will have the easiest decision in the South. Eight of the 10 metros that offer the largest financial advantage of homeownership are there, with Philadelphia and Detroit being the only non-Southern market to make the list. Buying a home in the Big Easy will be the easiest on your wallet: after seven years of homeownership, buying a home is 52.3% cheaper in New Orleans than renting. Buying a home up the road in Baton Rouge, La., isn’t a bad deal either, where homeownership is 51.3% cheaper.

| Where Buying a Home Beats Renting | ||||

| # | U.S. Metro | Median Home Value, March 2016 | Median Rent, March 2016 | % Cheaper to Buy than Rent |

| 1 | New Orleans, LA | $168,870 | $1,450 | -52.3% |

| 2 | Baton Rouge, LA | $159,362 | $1,350 | -51.3% |

| 3 | Columbia, SC | $121,115 | $1,150 | -51.1% |

| 4 | Detroit, MI | $61,363 | $850 | -50.6% |

| 5 | Fort Lauderdale, FL | $208,049 | $1,750 | -49.7% |

| 6 | Birmingham, AL | $124,897 | $1,100 | -49.1% |

| 7 | Philadelphia, PA | $134,208 | $1,200 | -49.1% |

| 8 | Miami, FL | $249,326 | $1,975 | -48.7% |

| 9 | Memphis, TN | $110,757 | $1,095 | -48.4% |

| 10 | West Palm Beach, FL | $228,703 | $1,850 | -48.1% |

| Note: Negative numbers mean that buying costs less than renting, while positive numbers means buying is more expensive than renting. Data for all metros and all scenarios presented in this report can be downloaded here. | ||||

Potential homebuyers in the West and Northeast have a more difficult decision to make, although it’s still significantly cheaper to buy than rent. Seven of the 10 metros that offer the largest financial advantage of homeownership are in California, with Honolulu, New York, and Newark, N.J., the only non-Golden State markets where the margin is smallest. The financial advantage of homeownership is narrowest in Honolulu, but still 14.4% cheaper over seven years with 20% down. In San Jose, Calif., the margin is just 15.7%. Those considering buying a home in the other eight metros where the financial advantage is narrowest should fear not: it is at least 21% cheaper to buy a home than rent one.

| Where the Financial Advantage of Buying is Slimmest | ||||

| # | U.S. Metro | Median Home Value, March 2016 | Median Rent, March 2016 | % Cheaper to Buy Than Rent |

| 1 | Honolulu, HI | $607,003 | $2,500 | -14.4% |

| 2 | San Jose, CA | $923,315 | $3,500 | -15.6% |

| 3 | Sacramento, CA | $334,378 | $1,686 | -21.7% |

| 4 | Oakland, CA | $631,109 | $2,800 | -22.1% |

| 5 | Orange County, CA | $643,483 | $2,850 | -23.2% |

| 6 | San Francisco, CA | $1,058,474 | $4,300 | -24.3% |

| 7 | Ventura, CA | $533,202 | $2,575 | -25.4% |

| 8 | Newark, NJ | $329,034 | $2,200 | -25.8% |

| 9 | New York, NY | $398,630 | $2,300 | -27.1% |

| 10 | Los Angeles, CA | $520,060 | $2,500 | -27.1% |

| Note: Negative numbers mean that buying costs less than renting, while positive numbers means buying is more expensive than renting. Data for all metros and all scenarios presented in this report can be downloaded here. | ||||

Looking for a Retirement Home That’s Cheaper to Buy? Head to the Sunshine State

When it comes to the rent vs. buy math, retirees are different. Using 2014 American Community Survey Data, we found that those aged 65 and over tend to move about every 15 years* instead of seven, and over half would fall into the 15% federal tax bracket** instead of 25%. With those assumptions, buying is 41.8% cheaper than renting nationally. Even in metros with the slimmest margin, such as Honolulu, buying the median valued home is at least 27% cheaper than renting it. In New Orleans, the margin is 58.1%.

However, retirees may be looking to compare the costs of buying in specific cities, rather than metropolitan areas. As one heads into retirement, metro wide factors – such as commute times, employment prospects, or proximity to good schools – might become less important, while city-level factors – such as proximity to other retired households – might become more so.

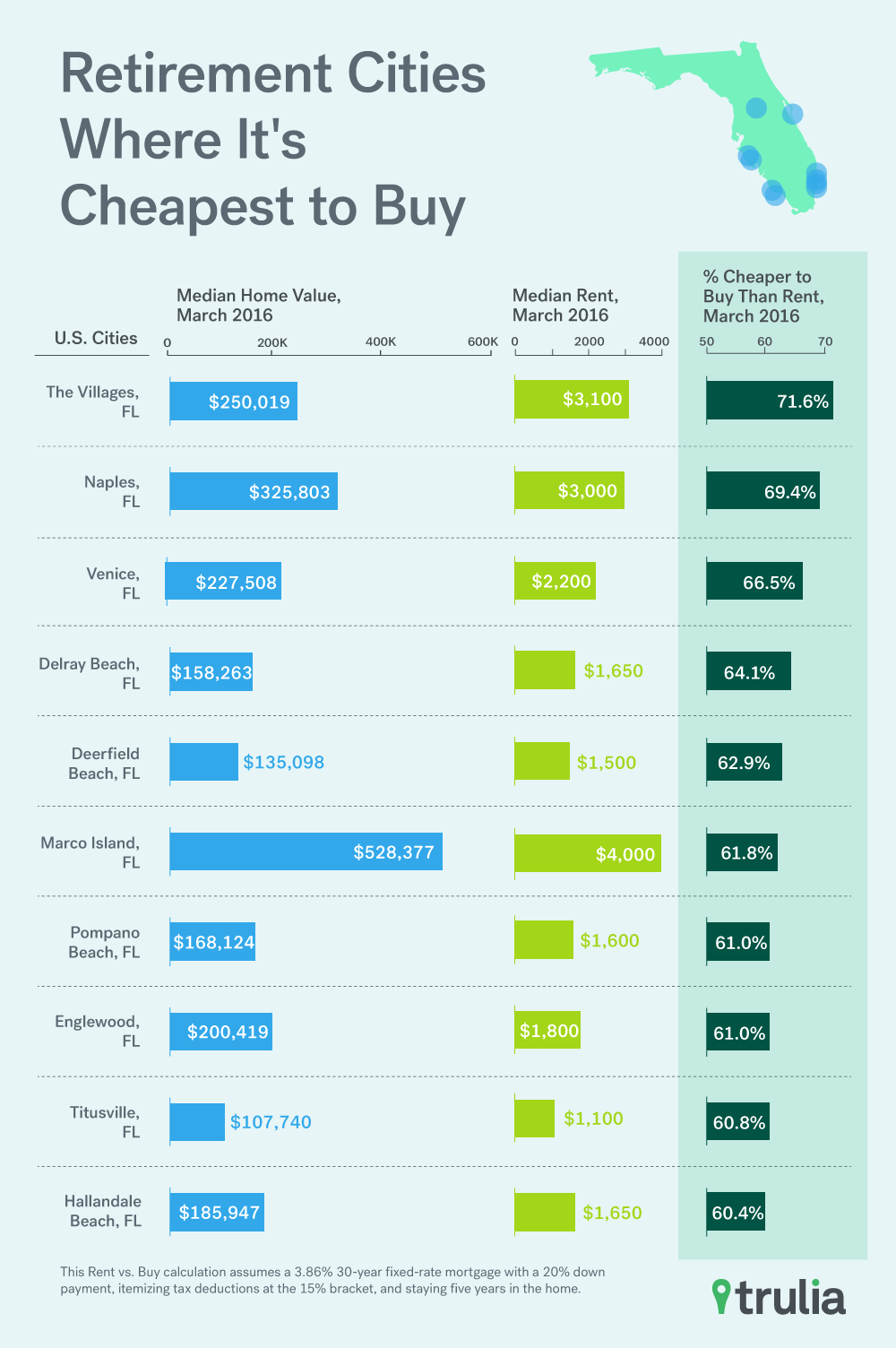

To help shed light on which cities might offer the best financial advantages of homeownership in retirement, we ran the numbers for the 100 U.S. cities with the largest share of residents aged 65 and older. It’s cheaper to buy a retirement home in each one of these cities than to rent one. However, the gap ranges from 71.6% cheaper in The Villages, Fla. to just 18.7% cheaper in Rancho Palos Verdes, Calif., And there’s even better news for those looking to retiree under the sun: each of the 10 cities that offer the largest financial advantage of homeownership are in the Sunshine State.

| Retirement Cities Where it’s Cheapest to Buy | ||||

| # | U.S. Metro | Median Home Value, March 2016 | Median Rent, March 2016 | % Cheaper to Buy Than Rent |

| 1 | The Villages, FL | $250,019 | $3,100 | -71.6% |

| 2 | Naples, FL | $325,803 | $3,000 | -69.4% |

| 3 | Venice, FL | $227,508 | $2,200 | -66.5% |

| 4 | Delray Beach, FL | $158,263 | $1,650 | -64.1% |

| 5 | Deerfield Beach, FL | $135,098 | $1,500 | -62.9% |

| 6 | Marco Island, FL | $528,377 | $4,000 | -61.8% |

| 7 | Pompano Beach, FL | $168,124 | $1,600 | -61.0% |

| 8 | Englewood, FL | $200,419 | $1,800 | -61.0% |

| 9 | Titusville, FL | $107,740 | $1,100 | -60.8% |

| 10 | Hallandale Beach, FL | $185,947 | $1,650 | -60.4% |

| Note: Of the 100 U.S. cities with the largest share of residents aged 65 and over. Negative numbers mean that buying costs less than renting. Data for all metros and all scenarios presented in this report can be downloaded here. | ||||

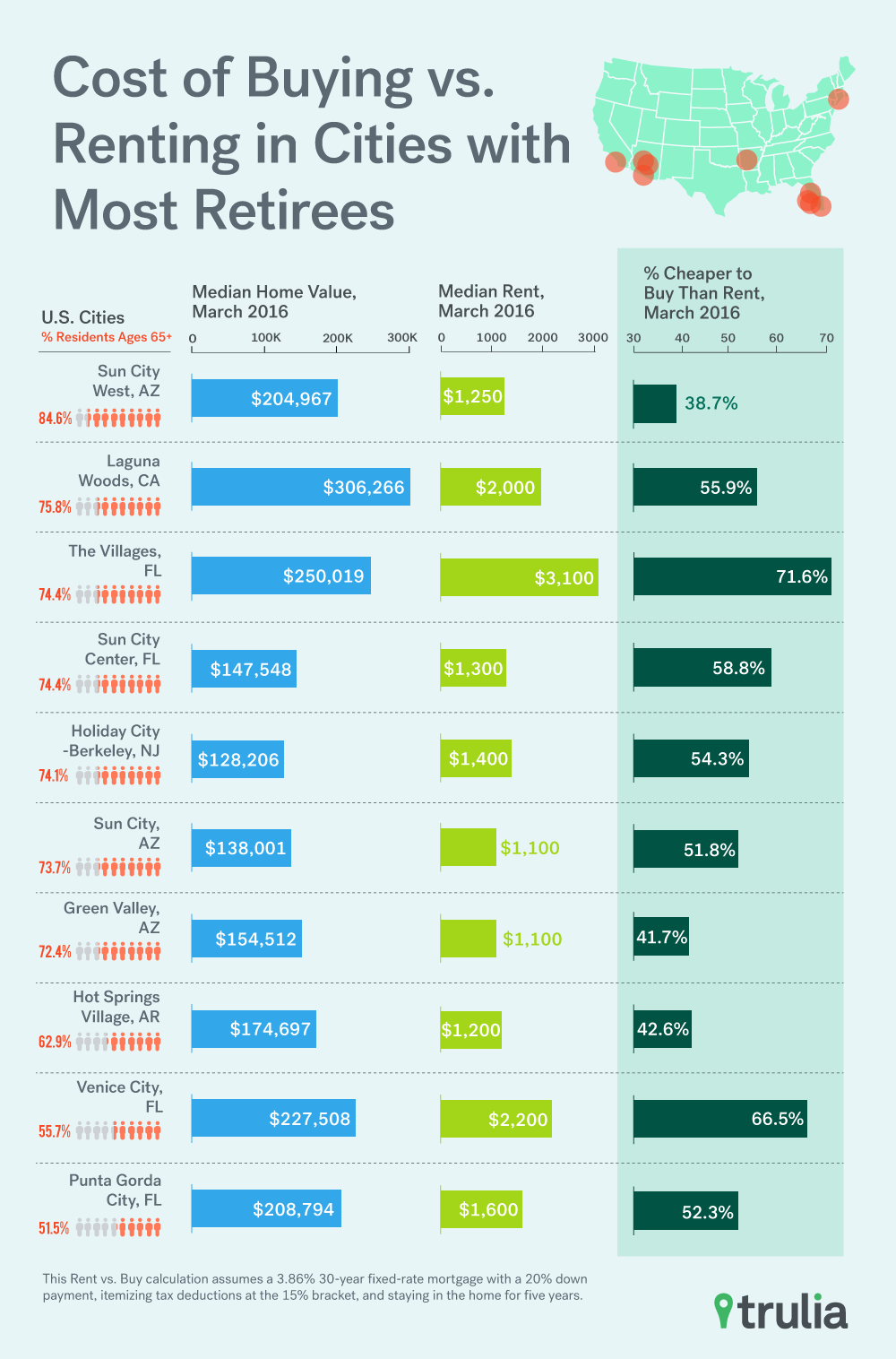

If being near other retirees is important, there’s more good news. In the 10 cities with the most retirees, buying is at least 38% cheaper than renting, but ranges up to 71.6% in The Villages. Although four of the U.S. cities with the most retirees are in Florida, those looking for a drier heat to retire in have options: another four are either in Arizona or Southern California, and in each one of those markets the cost of buying is between 38% and 55.9% cheaper than renting.

| Cost of Buying vs. Renting in Cities with Most Retirees | |||||

| # | U.S. Metro | % Residents Aged 65+ | Median Home Value, March 2016 | Median Rent, March 2016 | % Cheaper to Buy Than Rent |

| 1 | Sun City West, AZ | 84.6% | $204,967 | $1,250 | -38.7% |

| 2 | Laguna Woods, CA | 75.8% | $306,266 | $2,000 | -55.9% |

| 3 | The Villages, FL | 74.4% | $250,019 | $3,100 | -71.6% |

| 4 | Sun City Center, FL | 74.4% | $147,548 | $1,300 | -58.8% |

| 5 | Holiday City-Berkeley, NJ | 74.1% | $128,206 | $1,400 | -54.3% |

| 6 | Sun City, AZ | 73.7% | $138,001 | $1,100 | -51.8% |

| 7 | Green Valley, AZ | 72.4% | $154,512 | $1,100 | -41.7% |

| 8 | Hot Springs Village, AR | 62.9% | $174,697 | $1,200 | -42.6% |

| 9 | Venice, FL | 55.7% | $227,508 | $2,200 | -66.5% |

| 10 | Punta Gorda, FL | 51.5% | $208,794 | $1,600 | -52.3% |

| Note: Of the 100 U.S. cities with the largest share of residents aged 65 and over. Negative numbers mean that buying costs less than renting. Data for all metros and all scenarios presented in this report can be downloaded here. | |||||

If You Don’t Have, Or Like Your Heirs, Renting Might Be the Better Choice in Retirement

Our rent vs. buy equation takes into account the value of the equity in your home when you sell, which is important if you need to buy another home. The grim reality for most retirees is that their retirement home will likely be last home they’ll purchase, so any remaining equity in the house will be passed on to heirs. But what if you don’t have any, or don’t care to pass on anything to the ones you do have?

When we omit the value of home equity in our rent vs. model, it’s actually more expensive to buy a retirement home than rent one in 98 of the 100 cities with the largest 65+ populations. The only two cities where it’s cheaper to buy are the The Villages, Fla. and Danville, Va., where it’s 14% and 7.1% cheaper, respectively.

To recap, it is slightly cheaper to buy than rent this year compared to last, which is mostly due to a small drop in mortgage rates. Potential homebuyers in the South have a much easier decision to make than those in the West. For retirees, the decision is even easier, regardless of which city they looking to retire in. But for those old-timers who aren’t concerned about leaving anything to the youngin’s, renting is the cheaper option in their golden years.

Rent vs. Buy Methodology

Trulia calculates the costs of buying and renting by:

- We use our quality-adjusted measure of home prices and rents, which allows an apples-to-apples comparison between rental and owner-occupied housing units. We looked at median home value and rent in March 2016 in each of the largest 100 metros.

- We calculate the initial total monthly costs of owning and renting, including mortgage payments, maintenance, insurance, and taxes.

- We calculate the future total monthly costs of owning and renting, taking into account expected price and rent appreciation, as well as projected inflation.

- We factor in one-time costs and proceeds, including closing costs, down payment, sale proceeds, and security deposits.

- We calculate net present value, which reveals the opportunity cost of using money to buy a house instead of investing it. Net present value is the worth in today’s dollars of a future stream of payments and proceeds, taking into account expected interest rates.

Trulia’s Rent vs. Buy Calculator lets you compare renting and buying costs using other assumptions about prices, rents, and other factors. It uses the same math that powers this report. You can read our extended methodology here.

Mortgage rates are from the Mortgage Bankers Association, April 1.

(*) 2014 American Community Survey Data shows that Americans aged 65 or older move approximately every 15 years.

(**) 2014 American Community Survey Data shows that approximately 55% of US households aged 65 and over would fall into the 15% tax bracket.