Homeownership remains cheaper than renting in all 100 largest U.S. metro areas. In fact, buying is 35% cheaper than renting now, compared with 33% cheaper one year ago. Paradoxically, home price growth nationally has outpaced rents over the past year. So what gives? Two things. First, the 30-year fixed-rate mortgage rate has fallen from 4.5% in 2014 to 3.87% today (as of April 15). Second, the 3.9% home price gain wasn’t much larger than the 3.7% gain in rents. In the past year, these two trends have made homeownership even more affordable compared with renting.

Trulia’s Rent vs. Buy Report assumes a traditional 30-year fixed rate mortgage with a 20% down payment. But for those looking to buy a home, apartment, or condo with homeowner association (HOA) fees, the extra cost could make renting a more attractive option.

Our method for calculating the total costs of buying and renting follows these steps:

- We use our quality-adjusted measure of home prices and rents, which allows an apples-to-apples comparison between rental and owner-occupied housing units. For this report, we looked at all the homes listed on Trulia for rent or sale in March 2015.

- We calculate the initial total monthly costs of owning and renting, including mortgage payments, maintenance, insurance, and taxes. We make a separate calculation that factors HOA fees into the rent vs. buy equation.

- We calculate the future total monthly costs of owning and renting, taking into account expected price and rent appreciation, as well as projected inflation.

- We factor in one-time costs and proceeds, including closing costs, down payment, sale proceeds, and security deposits.

- We calculate net present value, which tells us the opportunity cost of using money to buy a house instead of investing it. Net present value is the worth in today’s dollars of a future stream of payments and proceeds, taking into account expected interest rates.

To compare the costs of owning and renting, we assume buyers get a 3.87% mortgage rate on a 30-year fixed-rate loan with 20% down; itemize their federal tax deductions and are in the 25% tax bracket; and will stay in their home for seven years. Under these assumptions, buying is 35% cheaper than renting nationwide, considering all costs and proceeds from buying or renting over the seven-year period. You can read our methodology here.

The interactive Rent vs. Buy map shows how the math changes under alternative assumptions for mortgage rates, income tax brackets, number of years in the home, and HOA fees, if any. To estimate HOA costs, we combed through Trulia’s for-sale listings and calculated the median homeowner’s fee for each of the 100 largest metro areas.

Trulia’s Rent vs. Buy Calculator lets you compare renting and buying costs using whatever assumptions about prices, rents, and other factors you want, including HOA fees. It uses the same math that powers our interactive map and this report.

Tougher Call between Renting and Buying in Honolulu and California

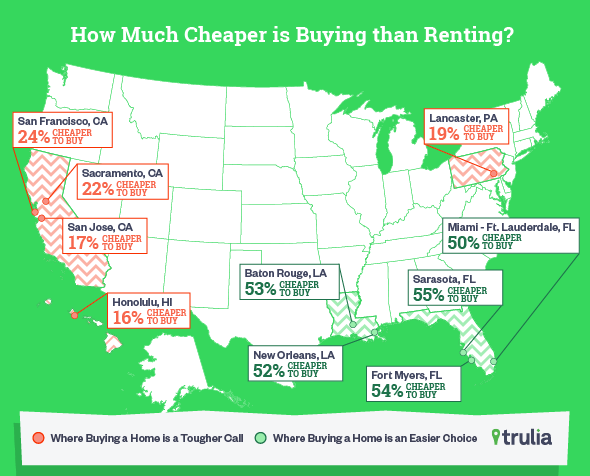

While homeownership is 35% cheaper than renting nationwide, the gap differs vastly across metros, largely because each market has its own typical prices and rents, as well as distinct patterns in property taxes and home-price appreciation. Taking all these factors into account, buying a home ranges from being 16% cheaper than renting in Honolulu to being 55% cheaper in Sarasota, FL.

Generally, it’s a closer call in California and an easier call in the South. What’s more, in seven of the 10 housing markets where buying has the smallest edge over renting, the buying advantage actually increased in the past year. On the other end of the spectrum, the buying advantage widened in six of the 10 markets where buying has the biggest edge.

| Where Buying a Home is a Tougher Call | ||||

| # | U.S. Metro | Cost of Buying vs. Renting (%), Spring 2015 | Cost of Buying vs. Renting (%), Spring 2014 | Difference (% points), 2015 vs. 2014 |

| 1 | Honolulu, HI | -16% | -10% | -7% |

| 2 | San Jose, CA | -17% | -11% | -6% |

| 3 | Lancaster, PA | -19% | -16% | -3% |

| 4 | Sacramento, CA | -22% | -22% | 0% |

| 5 | San Francisco, CA | -24% | -17% | -7% |

| 6 | Ventura, CA | -25% | -25% | 0% |

| 7 | Los Angeles, CA | -26% | -24% | -2% |

| 8 | Madison, WI | -26% | -24% | -2% |

| 9 | Seattle, WA | -26% | -23% | -3% |

| 10 | Modesto, CA | -27% | -32% | 5% |

| Where Buying a Home is an Easier Choice | ||||

| # | Metro | Cost of Buying vs. Renting (%), Spring 2015 | Cost of Buying vs. Renting (%), Spring 2014 | Difference (% points), 2015 vs. 2014 |

| 1 | Sarasota, FL | -55% | -56% | 1% |

| 2 | Fort Myers, FL | -54% | -52% | -2% |

| 3 | Baton Rouge, LA | -53% | -50% | -3% |

| 4 | New Orleans, LA | -52% | -53% | 1% |

| 5 | Miami–Fort Lauderdale, FL | -50% | -52% | 2% |

| 6 | Columbia, SC | -50% | -46% | -4% |

| 7 | Chattanooga, TN | -50% | -45% | -5% |

| 8 | Oklahoma City, OK | -50% | -46% | -3% |

| 9 | Charleston, SC | -49% | -45% | -4% |

| 10 | Tampa, FL | -49% | -49% | 0% |

| Note: Negative numbers mean that buying costs less than renting. For example, buying a home in New Orleans is 52% cheaper than renting in 2015. Trulia’s Rent vs. Buy calculation assumes a 3.87% 30-year fixed-rate mortgage with a 20% down payment, itemizing tax deductions at the 25% bracket, and staying seven years in the home. Year-over-year differences are rounded to the nearest percentage point, and the difference was calculated before rounding; therefore, the rounded difference might not equal the difference between the rounded shares. Click here to download the full Rent vs. Buy cost considerations for the 100 largest U.S. metros. | ||||

HOA Fees Can Make a Big Difference in the Rent vs. Buy Decision

If you are a homeowner association member, you need to factor in your HOA fee into your monthly housing costs. What these fees cover varies, but they can include everything from landscaping and maintaining public spaces to utilities and cable TV. The fee amounts also vary and, in some areas, you might have to pay a lot.

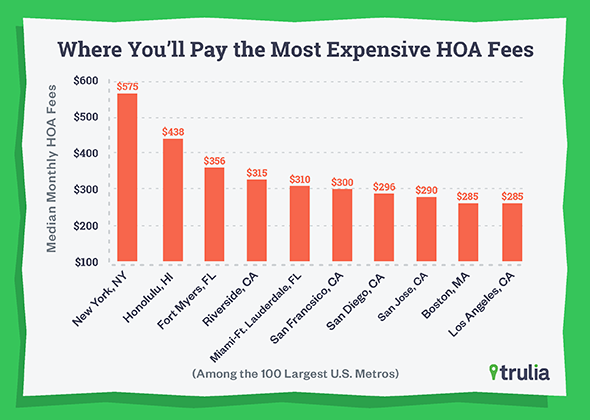

The New York and Honolulu metropolitan areas top the list of markets with the most expensive HOA fees, with medians of $575 and $438 per month respectively. Fort Myers, FL, Riverside, CA, and Miami, FL round out the top five with median HOA fees between $310 and $356. In these high-fee markets, HOA costs can make a significant difference in whether it’s better to rent or buy.

To understand how much difference these costs make, we’ve factored in the median HOA fee for each of the 100 largest metros in our rent vs. buy analysis. If you want to know how much a homeowner fee on a specific property will affect your housing costs, Trulia’s rent vs. buy calculator allows you to plug in the fee amount in the advanced settings.

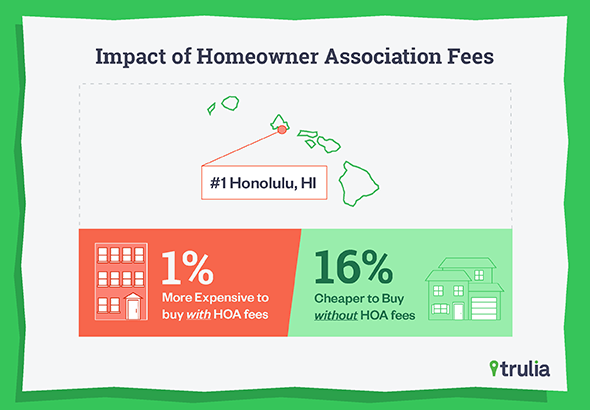

When we factor in the median HOA fee, the buying advantage almost disappears in some markets. In the New York metro area, buying a home becomes just 4% cheaper than renting, compared with 27% cheaper without the fee. And in the Honolulu metro, renting actually enjoys a 1% advantage when HOA fees are considered.

Without those fees, buying is 16% cheaper than renting. In some other markets, even though it’s still cheaper to buy a home with HOA fees than to rent, the swing can be large. For example, Melbourne, FL’s median HOA fee of $266 per month on a median-price house makes buying there 23% cheaper than renting, a swing of 22 percentage points from 45% cheaper without the fee. Other metros with similar swings include Youngstown, OH (48% vs. 28%), Fort Myers, FL (54% vs. 34%), and Riverside, CA (34% vs. 16%).

|

Where HOA Fees Matter Most in Rent vs. Buy Math |

||||

| # | U.S. Metro | Cost of Buying vs. Renting with HOA Fee (%), Spring 2015 | Rent Vs. Buy Difference with and without HOA Fees (% points) | Median Monthly HOA Fee ($) |

| 1 | Honolulu, HI | 1% | 17% | $438 |

| 2 | New York, NY | -4% | 24% | $575 |

| 3 | San Jose, CA | -8% | 9% | $290 |

| 4 | Lancaster, PA | -13% | 6% | $67 |

| 5 | Portland, OR | -14% | 13% | $220 |

| 6 | Los Angeles, CA | -15% | 11% | $285 |

| 7 | San Francisco, CA | -15% | 9% | $300 |

| 8 | Madison, WI | -15% | 10% | $152 |

| 9 | San Diego, CA | -15% | 12% | $296 |

| 10 | Ventura, CA | -16% | 9% | $230 |

By contrast, metros like Baton Rouge, LA and Oklahoma City, OK—where the median HOA fee will set you back only $30 and $22 per month respectively—are a bargain compared with New York and Honolulu. Furthermore, HOA fees in those areas are relatively cheap relative to median house prices, so they hardly affect the renting vs. buying calculation. In places where buying is the best deal even with HOA fees, the added monthly costs reduce the buying advantage by just 1-2 percentage points.

| Where HOA Fees Are a Drop in the Bucket | ||||

| # | U.S. Metro | Cost of Buying vs. Renting with Median HOA Fee (%), Spring 2015 | Rent Vs. Buy Difference with and without HOA Fees (% points) | Median Monthly HOA Fee ($) |

| 1 | Baton Rouge, LA | -51% | 2% | $30 |

| 2 | Sarasota, FL | -51% | 5% | $92 |

| 3 | New Orleans, LA | -48% | 4% | $63 |

| 4 | Oklahoma City, OK | -48% | 2% | $22 |

| 5 | Columbia, SC | -47% | 3% | $33 |

| 6 | Jackson, MS | -47% | 2% | $27 |

| 7 | Charleston, SC | -46% | 3% | $43 |

| 8 | Houston, TX | -46% | 3% | $44 |

| 9 | Greenville, SC | -46% | 3% | $38 |

| 10 | Memphis, TN | -46% | 2% | $25 |

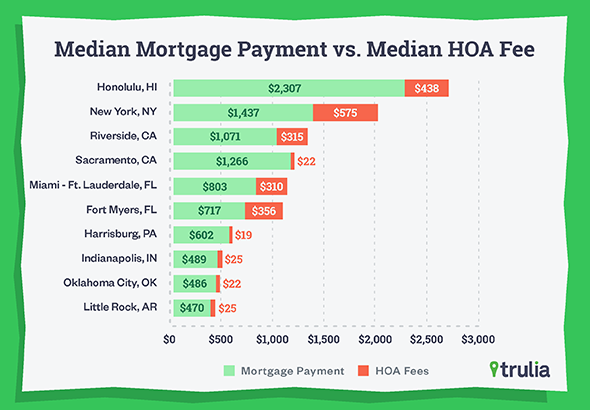

To see how much HOA fees add to your monthly mortgage costs, we’ve compared the median monthly mortgage payment with the median fee in the five lowest and highest HOA markets. In markets with the highest HOA fees, the effect is substantial. In Honolulu, the extra hit is 19% and, in Fort Myers, FL, a whopping 50%. But, in markets with the lowest HOA fees, the change is slight. HOA fees add just 2% to your monthly mortgage payment in Sacramento, CA, and just 5% in Little Rock, AR, Indianapolis, IN, and Oklahoma City, OK.

Furthermore, it’s not hard to come up with plausible scenarios in which HOA fees help make buying cost more than renting. Suppose a homebuyer wants to buy a condo with HOA fees. If this buyer is not itemizing tax deductions, only stays put for five years, and qualifies only for a 4.5% mortgage rate, then buying ends up costing more than renting in 29 of the 100 largest metros.

Those 29 metros include not only pricey coastal markets, but also in markets like Madison, WI, Milwaukee, WI, and Minneapolis-St. Paul, MN. In this scenario, buying costs 28% more than renting in New York City and 41% more expensive in Honolulu. So the moral of the story is: A condo might be within reach of most first-time homebuyers, but when you take HOA fees into account, it may make renting cheaper than buying.

Still, at the end of the day, if your dream home comes with HOA fees, it isn’t necessarily a deal breaker. Considering that some HOA fees bundle expenses you’d have to pay anyway, such as garbage, water, sewer, and building maintenance, the HOA fee could turn out to be a good deal. So when considering a home with HOA fees, be sure to find out exactly what those fees cover and factor it in to your overall housing budget.

Note: the detailed methodology and assumptions behind our Rent Vs. Buy model are here. Additionally, for our comparison of HOA fees, we used the median HOA fee of all properties in metro listed on Trulia in 2014.