- May’s new home sales numbers bounced back slightly from April’s sharp fall. This should put to rest any concern that last month’s decline was a sign of waning demand, as buyers continue to snap up new homes at near post-recession highs.

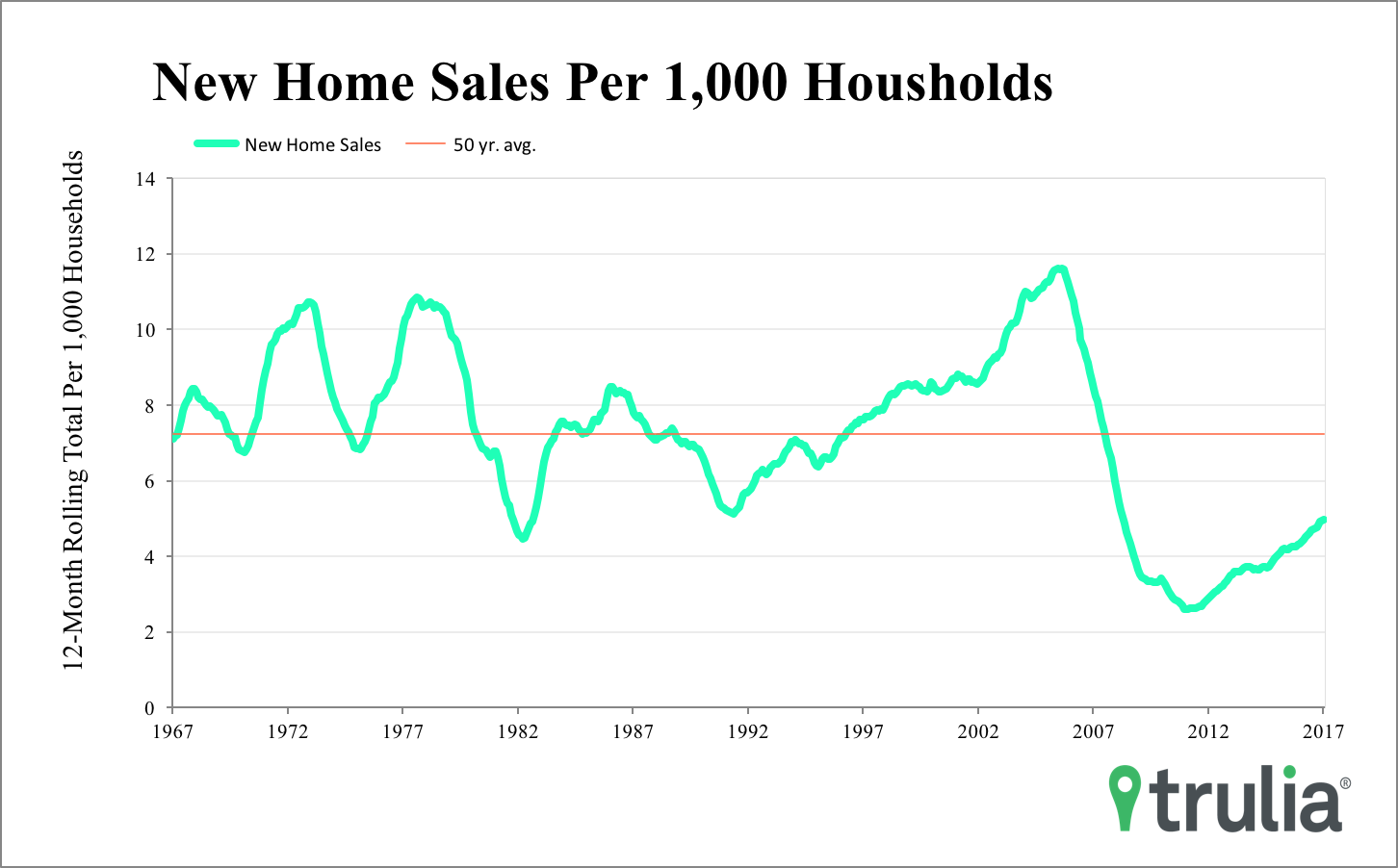

- Despite May’s good news, new home sales still have a long way to go to reach historic norms. When taking into account the U.S. population, new home sales are still about 69% of the long-run average. However, we think this reflects fundamental supply, rather than demand, problems in the housing market as buyers look for an inventory relief they can get.

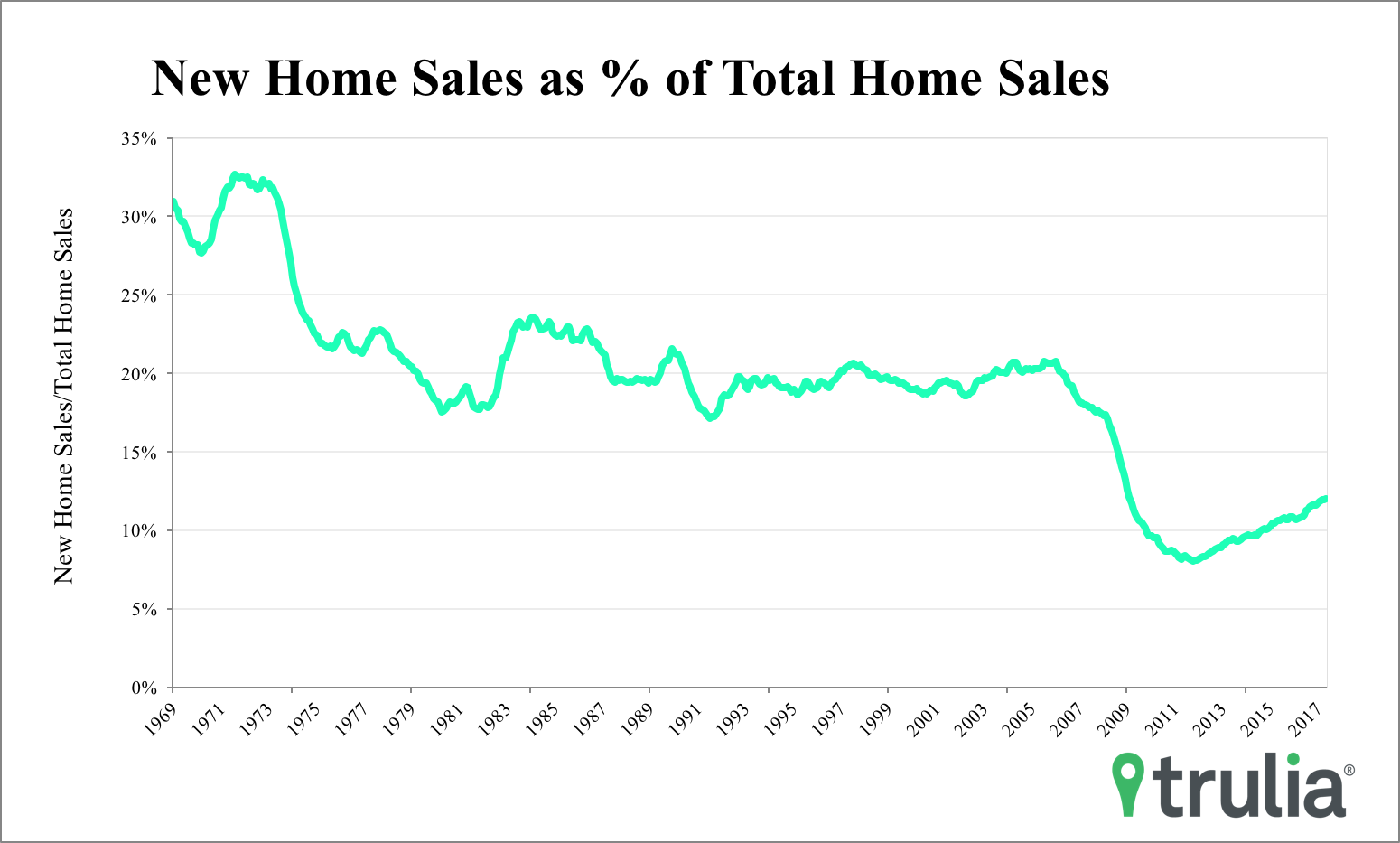

- The balance between new and existing home sales continues askew with historic norms. The share of new home sales as a total of all home sales needs to about double to meet the 50-year average. This is especially telling given existing home sales themselves are well below their historic norms.

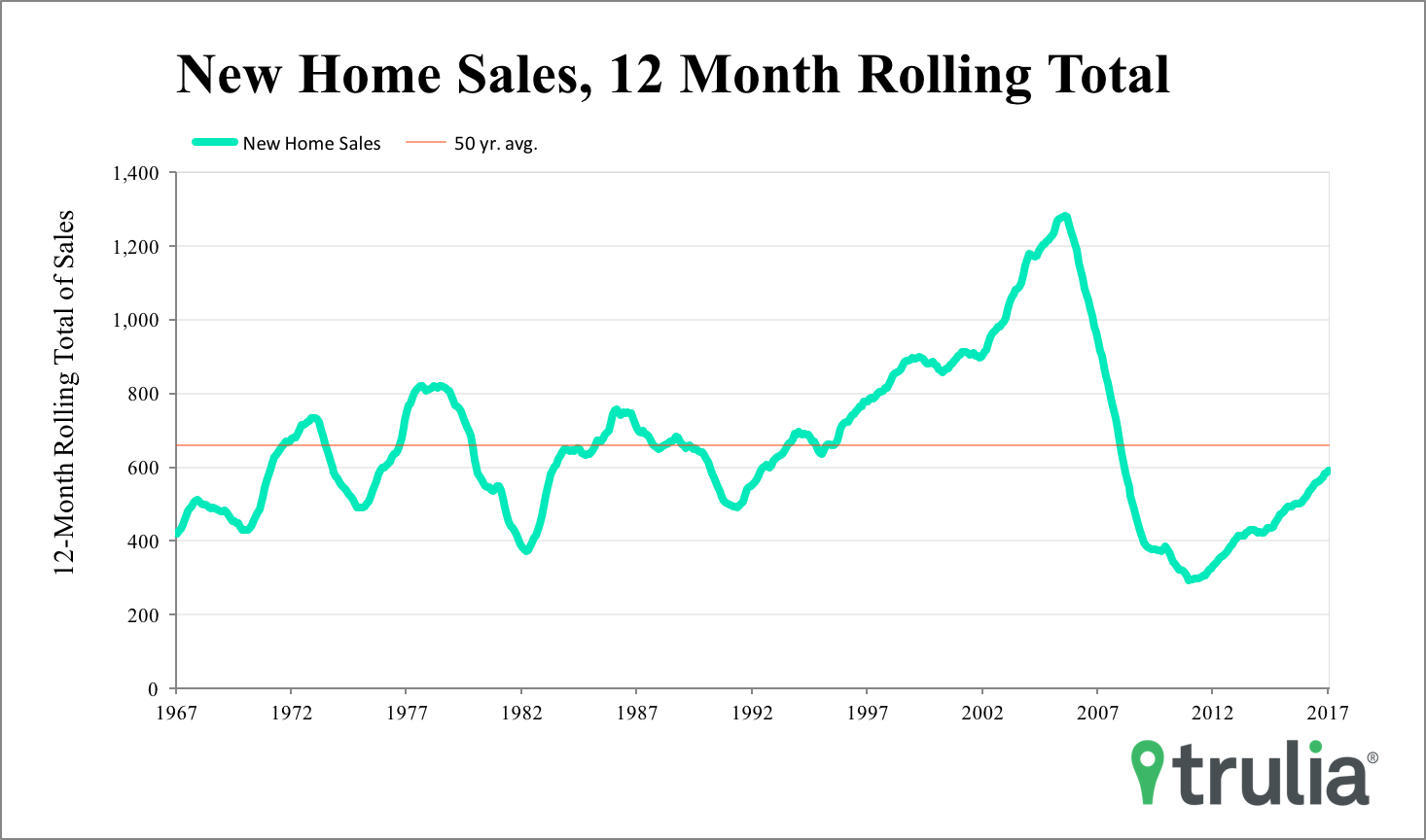

New home sales in May increased to a seasonally adjusted rate of 610,000, which is up 2.9% month-over-month and 8.9% year-over-year. However, May’s monthly numbers aren’t statistically significant (margin of error of 13% and 21.9%!), so we should take them with a grain of salt. A less volatile number to look at is the 12-month rolling total, which is up 14.1% year-over-year. This represents the most since June 2008. The increase over last year puts the 12-month total at 89.6% of the 50-year average.

However, the 12-month rolling total of new home sales compared to the 50-year average looks like there’s a lot more room to grow when taking into account the size of the U.S. population. New home sales per 1,000 U.S. households was 5 in May, which is only 68.8% back to normal.

The balance between new and existing home sales continues askew with historic norms. The share of new home sales as a total of all home sales needs to about double to meet the 50-year average. This is especially telling given existing home sales themselves are well below their historic norms. In May, new home sales made up about 11% of all home sales, which is slightly more than half of the pre-recession average of 21.5%. Clearly, home buyers are being stymied not only by a shortage of existing homes, but also new ones.