The housing crisis hurt some states especially hard. In those states, like Florida and Nevada, the Republican presidential candidates couldn’t ignore housing. But in states that weathered the housing crisis better, the candidates won’t spend precious money and attention on housing policy.

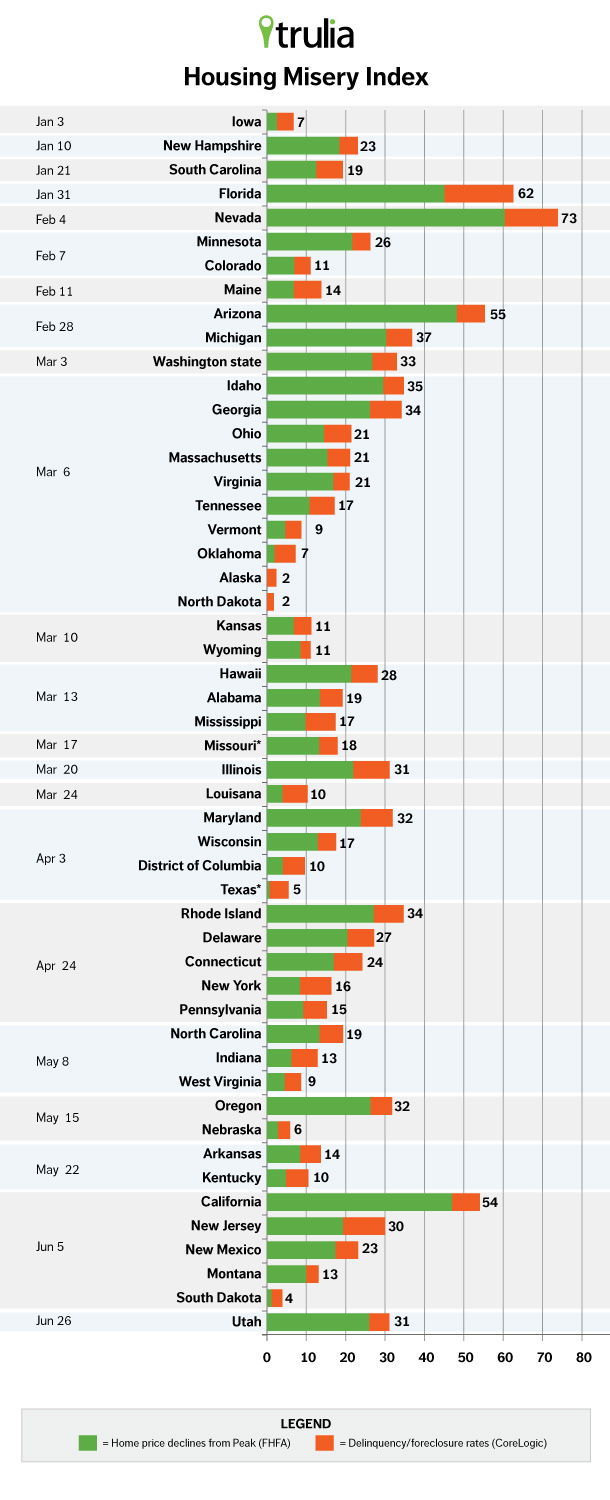

To see which states are suffering most, we created a Housing Misery Index. Like the original Misery Index, which adds together unemployment and inflation, our Housing Misery Index takes two important indicators of a state’s housing market and simply adds them together. For every state, we add (1) the percentage change in home prices from the peak until today, from FHFA, and (2) the percent of mortgages either severely delinquent or in foreclosure, from CoreLogic.

Why these two indicators? First, big price drops lead to more underwater borrowers and less household wealth, which hurt the housing market and hold back economic recovery. Second, defaults and foreclosures damage consumer confidence in the housing recovery, and foreclosures cause pain not only for people who lose their homes but also for their neighbors.

States That Are Most Miserable When It Comes To Housing

| State | Housing Misery Index |

| Nevada | 73 |

| Florida | 62 |

| Arizona | 55 |

| California | 54 |

| Michigan | 37 |

| Idaho | 35 |

| Rhode Island | 34 |

| Georgia | 34 |

| Washington state | 33 |

| Maryland | 32 |

Note: Index is sum of peak-to-2011Q4 price decline (FHFA) and 2011Q4 delinquency (90+ days) plus foreclosure rate (CoreLogic). Top ten states ranked by the housing misery index are shown.

Nevada, Florida, Arizona and California top the housing misery list: they all had huge price declines and lots of foreclosures. The gap in the index between California at #4 and Michigan at #5 is big, so the top four states are much more miserable than the rest. States with bigger price declines tend to have more delinquencies and foreclosures. However, some states have delinquency and foreclosure rates that are out of line with price declines: Florida, New Jersey, New York, Illinois and other states where foreclosures must go through the courts have more homes stuck in foreclosure than states with similar price drops, boosting their misery index scores.

What does the housing misery index mean for the election? If candidates want to talk about what voters want most, they should focus on housing issues where it’s clearly a pain point for voters. This means that after next week, we probably won’t hear much about housing from the presidential candidates again until the summer. This chart presents the housing misery index for all states, in order of the Republican primary and caucus calendar:

The 2012 Republican Primaries and the Housing Misery Index

Note: Index is sum of peak-to-2011Q4 price decline (FHFA) and 2011Q4 delinquency (90+ days) plus foreclosure rate (CoreLogic). Missouri’s caucus is March 17 even though its primary was February 7. Texas’s primary is scheduled for April 3 but could be delayed. Idaho’s caucus is March 6 even though its non-binding primary is May 15.

Note: Index is sum of peak-to-2011Q4 price decline (FHFA) and 2011Q4 delinquency (90+ days) plus foreclosure rate (CoreLogic). Missouri’s caucus is March 17 even though its primary was February 7. Texas’s primary is scheduled for April 3 but could be delayed. Idaho’s caucus is March 6 even though its non-binding primary is May 15.

In the two most miserable states – Florida and Nevada – the Republicans have come and gone: there they argued about housing without presenting bold new ideas. The third most-miserable state — Arizona – votes next Tuesday (along with Michigan), and the last of the top four – California – doesn’t vote until June 5. That’s a long quiet period between Arizona and California if the candidates choose to pipe up about housing only in the states where the market is really hurting.

If one of the Republicans wakes up with a great new housing idea in March, when and where will we hear about it? Any housing speeches for Super Tuesday (March 6) should be given on the trail in Idaho or Georgia, which have the highest housing misery index of the many states voting that day. Among states voting in April, Rhode Island and Maryland has the highest misery index; in May, it’s Oregon. Those are where candidates should deliver their springtime housing speeches.

But if candidates save their housing ideas for the most miserable states, next week’s Arizona primary could be the last time we hear about housing until June in California.