To go to college, or not to go? That is a question many millennials ask themselves. A college degree undeniably comes with perks, including better long-term job prospects and higher lifetime earnings. But many millennials who get a college degree must pay back student loans, making it more difficult to save for a down payment in the short run.

So why does this matter? Well, saving for a down payment is one of the biggest obstacles to homeownership. In fact, according to a recent Trulia survey*, 30% of 25-30 year olds in the U.S. said that they are currently trying to save for a down payment in the next two years. Moreover, there’s been much discussion about the impact of student loan debt on the ability of recent graduates to save for a down payment and buy a home.

So the real question is – if owning a home is part of your personal American Dream, is a college degree a necessary pre-cursor to being able to afford a down payment and securing the keys? The answer depends on where you want to buy a home.

Can You Really Save Up for a Down Payment?

A common approach to figuring out how long it will take to save for a down payment to buy a home is to calculate a 20% down payment (the ideal amount home buyers should put down) using the median housing price of a metro area, and assume that a would-be homebuyer is saving 10% of what they make each year (for which we’ll use the annual median household income). To get the number of years that it will take for a household to save for a home, you then divide the 20% down payment by the amount saved each year.

So, if the median house is priced at $200,000 and the median household income is $50,000, it would take eight years for the median household to save for a down payment.

| Median Priced Home: | $200,000 |

| 20% Down Payment on Median Priced Home: | 20% x $200,000 = $40,000 |

| Median Annual Income: | $50,000 |

| 10% of Income Saved Each Year: | 10% x $50,000 = $5,000 |

| # of Years Required to Save Down Payment: | $40,000 / $5,000 = 8 Years |

However, eight years isn’t really an accurate estimate of how long it will take to save for a down payment because both home prices and household income can change during those eight years. For example, if you’re not getting a raise at the same rate at which home prices are rising, it will take longer to save for a down payment and vice versa. Additionally, this calculation doesn’t factor in student debt repayment, which is one obstacle to homeownership for college-educated millennials. The average college-educated American has about $26,000 in student loan debt, which translates into an average monthly payment of about $280 per month on a 10-year repayment plan. Moreover, approximately 30% of young millennial households have a 4-year college degree and 70% do not.

A more accurate method (which we used here in this study) is to estimate how much home prices and household income change over time, and calculate the point in time at which cumulative household savings equals the down payment required at that future time period. This calculation also factors in student debt repayment and how that takes away from a household’s saving power.

To estimate how much the required down payment will grow over time, we used the 20-year Federal Housing Finance Agency (FHFA) home price growth rate for each of the 100 largest U.S. metros given the current median listing home prices on Trulia. For household income growth, we used data from the Census’ 2013 American Community Survey (ACS) to identify the difference in income between fully-employed 25-30 year olds and 45-50 years olds with and without a college degree to extrapolate how much money each group is expected to make over time. Doing so takes into account the fact that households tend see the largest increase in income over this 20-year period. We then assume a 20% down payment requirement and 10% savings rate for each group. For the college-educated group, we assume that they’ve signed up for a 10-year repayment plan on their student loans and subtracted the average monthly student loan payment ($280) from their savings for the first 120 months. Last, we identify the specific month in the future at which each group – those with and without college degrees — has saved up enough for a 20% down payment on a median priced home in their respective housing market.

Where You Can Save for a Down Payment Fast

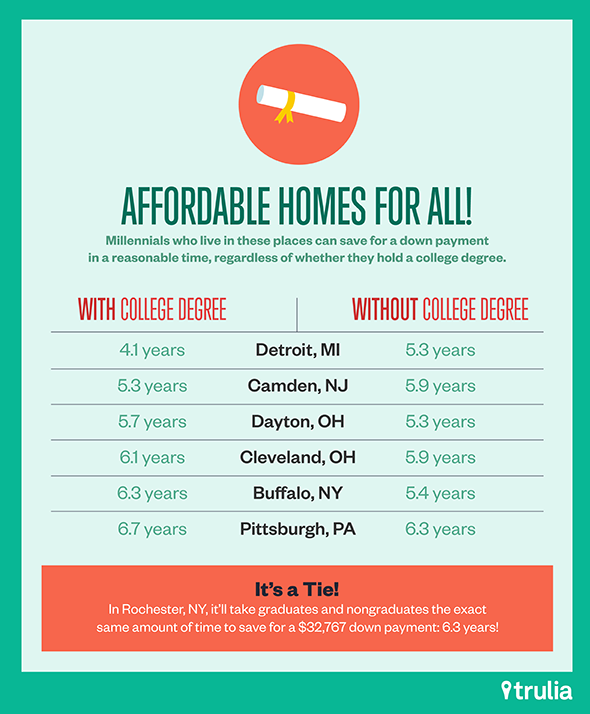

First, the good news: there are many housing markets in the U.S. where a Millennial will be able to make enough money to save for a down payment in a reasonable time, regardless of whether they hold a college degree. Topping the list is Detroit, where a 25-30 year old could save for a down payment in 4.1 years with a college degree and 5.3 years without. Dominating the rest of the list are metros in Ohio where would-be homeowners in Akron, Dayton, Cleveland and Toledo can save for a down payment in six years or less.

| Where You Can Save a 20% Down Payment Fast | ||||||

| With a College Degree | Without a College Degree | |||||

| # | U.S. Metro | Years Needed to Save for Down Payment | Required Down Payment at Time of Purchase | U.S. Metro | Years Needed to Save for Down Payment | Required Down Payment at Time of Purchase |

| 1 | Detroit, MI | 4.1 | $21,644 | Detroit, MI | 5.3 | $22,145 |

| 2 | Camden, NJ | 5.3 | $43,348 | Dayton, OH | 5.3 | $26,339 |

| 3 | Dayton, OH | 5.7 | $26,534 | Buffalo, NY | 5.4 | $32,483 |

| 4 | Akron, OH | 5.9 | $29,861 | Akron, OH | 5.7 | $29,718 |

| 5 | Cleveland, OH | 6.1 | $30,437 | Toledo, OH | 5.8 | $27,875 |

| 6 | Buffalo, NY | 6.3 | $33,055 | Camden, NJ | 5.9 | $43,993 |

| 7 | Rochester, NY | 6.3 | $32,767 | Cleveland, OH | 5.9 | $30,343 |

| 8 | Toledo, OH | 6.6 | $28,322 | Rochester, NY | 6.3 | $32,767 |

| 9 | Pittsburgh, PA | 6.7 | $37,838 | Pittsburgh, PA | 6.3 | $37,556 |

| 10 | Kansas City, MO | 6.8 | $39,330 | Syracuse, NY | 6.4 | $35,329 |

Where You Can Save Faster Without a College Degree

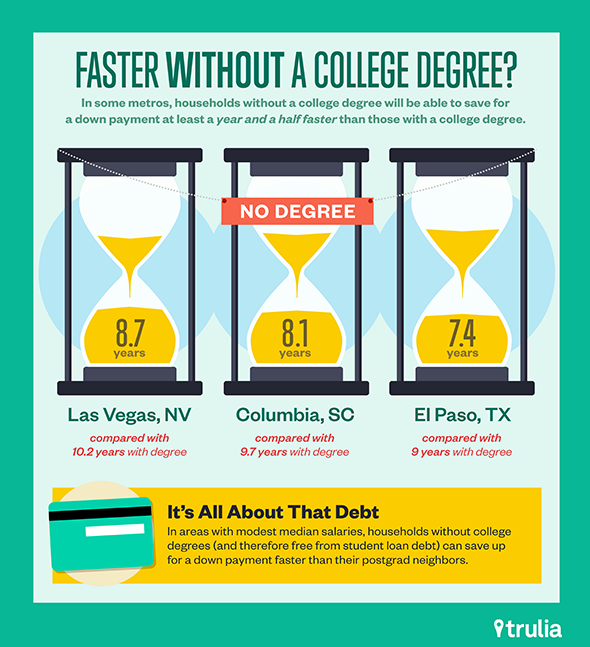

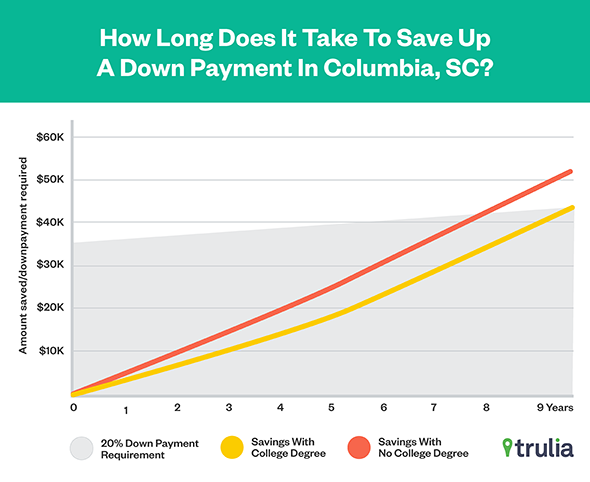

What’s more is that in several of these housing markets, millennial households without a college degree can actually save for a down payment faster than college-educated households. For example, in metros like Columbia, El Paso and Las Vegas, 25-30 year old households without a college degree will be able to save for a down payment at least a year and a half faster than those with a college degree.

| Where You Can Save at Least 1 Year Faster Without a College Degree | ||||

| # | U.S. Metro | Years Needed to Save without College Degree | Years Needed to Save with College Degree | Difference |

| 1 | Columbia, SC | 8.1 | 9.7 | -1.6 years |

| 2 | El Paso, TX | 7.4 | 9.0 | -1.6 years |

| 3 | Las Vegas, NV | 8.7 | 10.2 | -1.5 years |

| 4 | Daytona Beach, FL | 10.8 | 11.9 | -1.1 years |

How is this possible? Two reasons. First, the boost in income that you get for having a college degree in these metros is small. Second, households with college degrees typically have student loan payments, which hinder their ability to save for a down payment.

Want To Be A California Homeowner? Go To College!

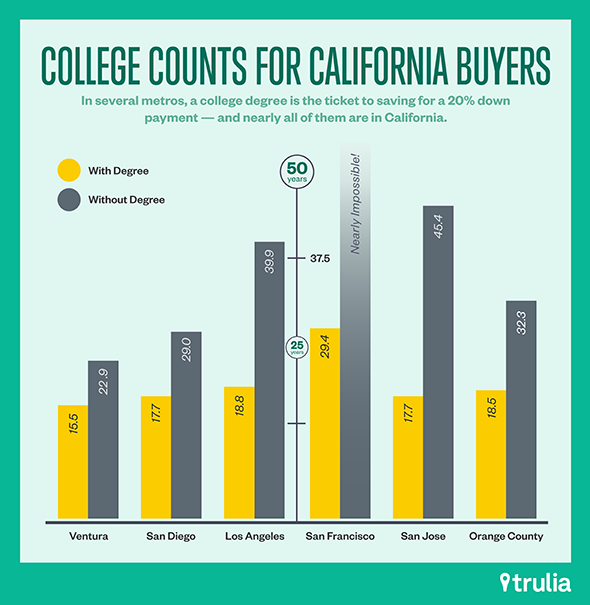

Next the bad news: there are several housing markets where a college degree is the ticket to saving for a 20% down payment, and nearly all of them are in California.

And even households with a college degree will start to show gray hairs by the time they’ve saved up enough to buy a home. For example, it will take 29.4 years for a 25-30 year old household to save up a 20% down payment on a median priced home in San Francisco, 18.8 years in Los Angeles, 18.5 years in Orange County and 17.7 years in San Diego and San Jose.

| Where Saving For a 20% Down Payment Takes Decades | ||||||

| With College Degree | Without a College Degree | |||||

| # | U.S. Metro | Years Needed to Save for Down Payment | Required Down Payment at time of purchase | U.S. Metro | Years Needed to Save for Down Payment | Required Down Payment at time of purchase |

| 1 | San Francisco, CA | 29.4 | $560,590 | San Francisco, CA | Not Possible | N/A |

| 2 | Los Angeles, CA | 18.8 | $196,616 | San Jose, CA | 45.4 | $665,508 |

| 3 | Orange County, CA | 18.5 | $235,959 | Los Angeles, CA | 39.9 | $353,270 |

| 4 | San Diego, CA | 17.7 | $192,081 | Orange County, CA | 32.3 | $347,842 |

| 5 | San Jose, CA | 17.7 | $289,072 | San Diego, CA | 29.0 | $262,589 |

| 6 | Honolulu, HI | 16.0 | $165,588 | Oakland, CA | 27.3 | $267,605 |

| 7 | Oakland, CA | 15.6 | $193,453 | Ventura County, CA | 22.9 | $230,929 |

| 8 | Ventura County, CA | 15.5 | $189,325 | New York, NY | 20.2 | $149,905 |

| 9 | Denver, CO | 14.3 | $125,314 | Fairfield County, CT | 20.1 | $185,494 |

| 10 | Cape Coral–Fort Myers, FL | 13.3 | $74,130 | Honolulu, HI | 18.0 | $173,574 |

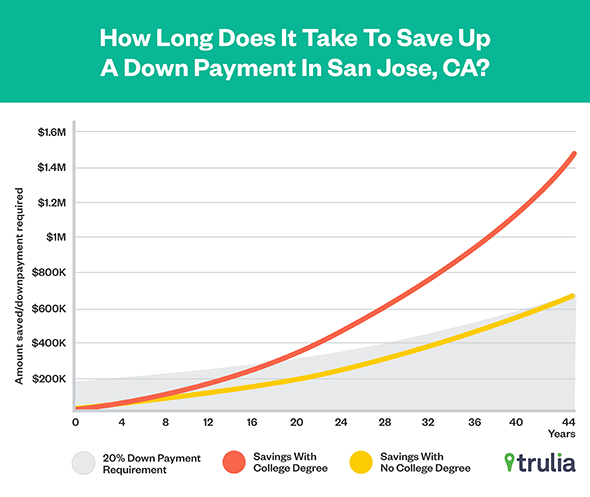

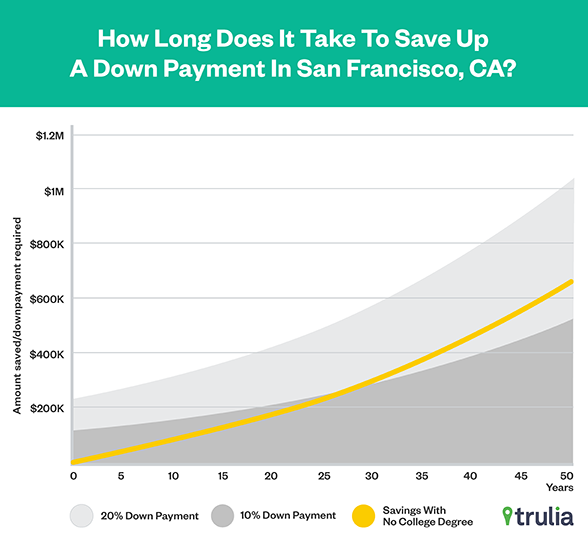

The news gets even worse for those that don’t have a college degree. In pricey San Francisco, saving up for a 20% down payment is impossible. Why? Because prices are high and rising fast, so the monthly increase for the required down payment outpaces the increase in the total monthly household savings during a typical lifespan. And in other California metros, young millennials without college degree will be old and gray (or possibly in the grave) by the time they’ve saved enough for a 20% down payment – 45.4 years in San Jose, 39.9 years in Los Angeles, 32.3 years in Orange County, 29.0 years in San Diego, 27.3 years in Oakland and 22.9 years in Ventura County.

No College Degree? Try a 10% Down Payment.

Just because you don’t have a college degree, doesn’t mean you should completely abandon your dreams of homeownership. While a 20% down payment is the “traditional” amount that allows borrowers to avoid costly mortgage insurance, it is not uncommon for homebuyers to put 10% down (however, we recommend putting down as large of a down payment as you can afford). In the long run, putting 20% down will save you money, but putting 10% down can get you into a home in less than half the time. How is this possible? Because price appreciation outpaces income growth for that cohort, so the required down payment for a home increases faster than the marginal increase in monthly savings contributions.

For example, millennials without a college degree in San Francisco will actually be able to save for a 10% down payment in 28.5 years, compared to not being able to save for a 20% down payment ever. And in other expensive metros, the number of years to save for a down payment is cut by more than half. In pricey San Jose, the time is cut from 45.4 years to just 15.4; in Los Angeles it drops from 39.9 to 12.8 years; Orange County drops from 32.3 to 11.6 years and San Diego moves from 29.0 to only 11.8 years.

| Saving 20% Down vs. 10% Down in the Most Expensive Housing Markets Without a College Degree | ||

| U.S. Metro | # of Years to Save 20% Down Payment | # of Years to Save 10% Down Payment |

| San Francisco, CA | Not Possible | 28.5 |

| San Jose, CA | 45.4 | 15.4 |

| Los Angeles, CA | 39.9 | 12.8 |

| Orange County, CA | 32.3 | 11.6 |

| San Diego, CA | 29.0 | 11.8 |

| Oakland, CA | 27.3 | 11.3 |

| Ventura County, CA | 22.9 | 9.8 |

| New York, NY | 20.2 | 8.8 |

| Fairfield County, CT | 20.1 | 9.3 |

| Honolulu, HI | 18.0 | 8.3 |

To recap, student loans payments temporarily hinder households saving for a down payment. But because college-educated households earn more in the long-run, a college degree is about the only way to save for a down payment in some of the most expensive markets. However, households without a household degree should fear not – saving up for a 10% down payment is disproportionally faster because of higher appreciation in house prices relative to income during the additional years of saving for 20% down

METHODOLOGY

To estimate how a college degree impacts the ability to save for a down payment, we take a three step-approach:

(1) Estimate income, income growth, and monthly savings for each month into the future.

We use 2013 ACS data on annual median incomes for households headed by 25-30 year olds with and without a college degree for each of the largest 100 metropolitan areas. Next, we use the median annual income of households headed by 45-50 year olds with and without college degrees to project household income growth for each cohort. In addition, we assume a 2% inflation-adjusted increase in pay, and a generous savings account interest rate of 1%. Doing so takes into account the fact that household income tend to increase over time, both because of inflation but also because of life-cycle effects. We then assume each household saves 10% of their monthly income for a down payment, but subtract the average student loan payment of $280 from the college-educated cohort’s savings for the first 10 years (estimated payment on the average student loan debt is available here: https://studentloans.gov/myDirectLoan/mobile/repayment/repaymentEstimator.action).

(2) Estimate median prices, price growth, and the estimated down payment for each month into the future.

We estimate the 20% down payment on the median priced home for each metro in each month. To do this, we use the FHFA 20-year growth rate to the June 2015 median house price listing on Trulia for each metro weighted by a 2% inflation rate. Doing so takes into account the fact that house prices change during the period in which a household is saving for a down payment.

(3) Estimate the month in the future when each cohort can buy a home.

We calculate the month in time when cumulative monthly household savings equals the required 20% down payment for each cohort, and then convert the number of months into a yearly figure. We calculate the number of years to save for a 10% down payment in similar manner.

* This survey was conducted online within the United States between May 26th and 28th, 2015 among 2,026 adults (aged 18 and over) by Harris Poll on behalf of Trulia via its Quick Query omnibus product. Figures for age, sex, race/ethnicity, education, region and household income were weighted where necessary to bring them into line with their actual proportions in the population.Propensity score weighting was used to adjust for respondents’ propensity to be online.

All sample surveys and polls, whether or not they use probability sampling, are subject to multiple sources of error which are most often not possible to quantify or estimate, including sampling error, coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments. Therefore, the words “margin of error” are avoided as they are misleading. All that can be calculated are different possible sampling errors with different probabilities for pure, unweighted, random samples with 100% response rates. These are only theoretical because no published polls come close to this ideal.

Respondents for this survey were selected from among those who have agreed to participate in our surveys. The data have been weighted to reflect the composition of the adult population. Because the sample is based on those who agreed to participate in our panel, no estimates of theoretical sampling error can be calculated