In metros where housing costs are higher, out-of-towners’ searches skew towards relatively expensive neighborhoods. But in cheaper metros the opposite is true – out-of-towners target less pricey areas.

Most real estate agents would probably agree that it is important for sellers to know who their buyers are: specifically, are they local or are they searching from farther afield? Home buyers, too, could benefit from knowing the competition.

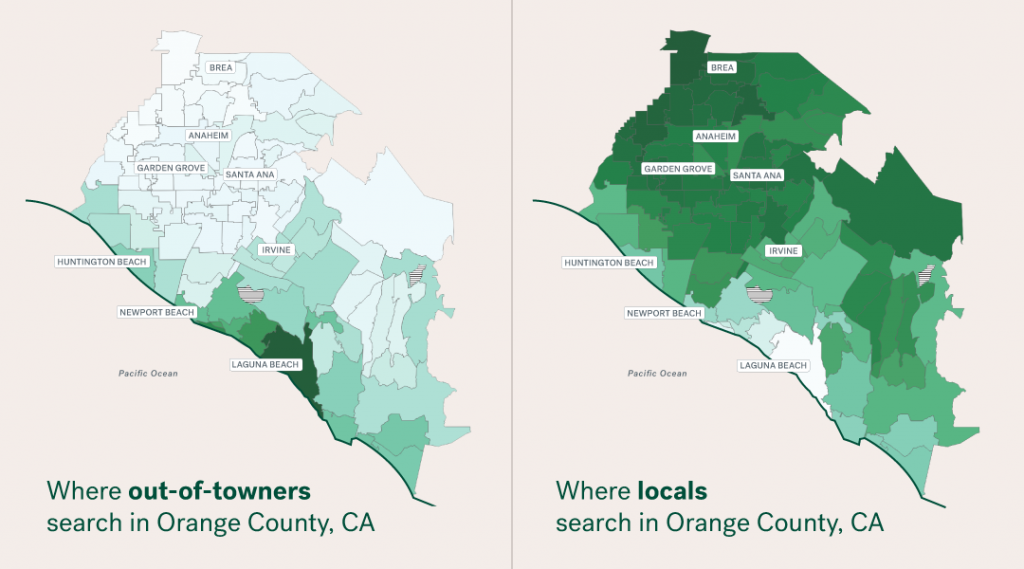

Why does the distinction between locals and out-of-towners matter? Because out-of-towners are often distinct from locals in terms of what they’re hoping to find. In the most expensive metros, searches from outside the region comprise a greater share of searches in the most expensive parts of town – think Palo Alto in the San Jose metro and Laguna Beach in Orange County, Calif. Out-of-towners searching in these pricey metros are often coming from pricier metros in the first place, suggesting that they are less encumbered than others by affordability concerns.

In the least expensive metros, the reverse is true—it’s locals who search in the expensive areas, and non-locals who search in the inexpensive ones. We see this localized search trend in the pricier suburbs in Wichita, Kan. and Albany, N.Y., for example. The fact that out-of-towners focus their search on inexpensive neighborhoods is consistent with the notion that they are drawn to these metros because of their low cost of housing in the first place.

In this report, we look at where searches into each neighborhood have been coming from. We determined the origins of all searches into each ZIP code and categorized them into locals—users within 100 miles of the ZIP code area or within the same metro—and out-of-towners. We then looked at the relationship between the median home value of each ZIP code and the share of searches in that ZIP emanating from locals.

Priced out Californians

While other states may bemoan the arrival of Californians impacting their local housing market, the buck doesn’t stop with the Golden State. Costly metros in the state see some of the strongest positive correlations between a ZIP code area’s median home value and the share of out-of-town searches – in other words, in metros like San Jose and Orange County out-of-towners accounted for a greater share of searches in expensive neighborhoods than they did in cheaper ones. This is probably because the out-of-towners attracted to these high-priced metros are largely coming from expensive metros as well, like New York and Los Angeles. Moreover, people who are unfamiliar with a metro area are likely to start their search in the neighborhoods with which they are most familiar with as outsiders (and which tend to be the priciest).

Median home values in San Jose are second-highest in the nation after San Francisco. With the median home value already north of $1 million, residents may be wondering who can afford the astronomical prices of high-end neighborhoods. The answer: often not San Joseans. Searches from outside the metro area are concentrated in the ZIP codes containing and surrounding the city of Palo Alto, home to Stanford University and the epicenter of Silicon Valley. ZIP code 94304 has the highest share of out-of-town searches at 37.2 percent of all searches, compared with just 18.2 percent metro-wide. It also boasts the highest median home values in the metro, at $4.3 million. Locals, on the other hand, aim farther south. ZIP 95023, making up the southeastern swath of the metro, has home values that are less than half the metro median — $529,000 as opposed to $1.2 million – with 85.9 percent of all searches coming from the region. This area, comprising the community of Hollister, represents some of the most affordable real estate still within (extremely lengthy) commuting distance of the main city centers of the Bay Area – including San Jose, San Francisco, and Oakland.

Orange County, Calif. also sees this relationship between home prices and searches. Outside interest is concentrated in the seaside resort town of Laguna Beach, which was home to a popular MTV reality TV show in the early 2000s, has home values that are about three times the metro median, at $2.2 million. For more palatable prices, local searches tend inland, especially toward the northwest area bordering the Los Angeles metro, in cities like La Habra and Buena Park. Their relative affordability—home values just under $600,000—and proximity to the job centers in Los Angeles make them a relatively more attractive choice for locals than non-locals.

Of course, not everyone searching in Laguna Beach actually intends to purchase a home there. Browsing seaside mansions may be a simple pastime for many, with no actual intent to buy. Indeed, many metros where we see a positive relationship between ZIP prices and outside searches feature neighborhoods famous for their opulence. The Hamptons in Long Island, Tribeca in New York and Beverly Hills in Los Angeles are all, unsurprisingly, not highly searched for by local New Yorkers or Angelenos. Search data certainly isn’t completely predictive of actual moves, but they can tell us about the aspirations of house hunters, no matter how far out of reach.

Locals Moving Up

At the other end of the spectrum are cheaper metros with out-of-town searches slanted toward cheaper areas instead. Since most homes are affordable to residents in these metros, it appears locals are able to search in the higher price categories of housing, perhaps moving toward trade-up or premium homes. Conversely, if out-of-towners searching in these metros are attracted to them because they are relatively inexpensive, that could explain their propensity to seek out homes in less pricey neighborhoods.

One example is Wichita, Kan. It’s in the top five least-expensive metros, and the median home requires only 22 percent of the median household income—well below the 30 percent threshold experts recommend. There’s also a negative correlation between how expensive a ZIP code is and the share of outsiders searching for it. Wichita’s housing supply takes the form of a cheaper urban core, surrounded by a ring of more expensive suburban neighborhoods, and finally an outer ring of cheaper housing once more. Searches follow this pattern, with local searches concentrating in that more expensive suburban ring. Out-of-town searches come from places like Kansas City, Chicago, Oklahoma City and St. Louis—all markets that are more expensive than Wichita, but also still relatively affordable to the median household. On the East Coast, local/non-local search traffic in Albany, N.Y., follows a similar pattern.

Commuter Towns Defy Expectations

There are a few metros that, despite having relatively low home prices, still see a strong positive correlation between ZIP code prices and the share of searches coming from outside the area. Two metros—Lake County-Kenosha County, Ill.-Wis. and Fairfield County, N.Y.—fit this bill, and both have a key characteristic in common: they are both commuter towns comprised mostly of inexpensive neighborhoods but containing some pricier enclaves as well. The proximity of Lake and Kenosha counties to both Chicago and Milwaukee make them ideal destinations for commuters seeking lower home prices. Local searches were aimed at cheaper areas, like Waukegan, while Lake Forest, part of the priciest ZIP in the metro, gets the largest share of outside searches.

Fairfield County, Conn., follows a similar pattern. The metro receives over a third – 38 percent — of its local visits from the New York metro which is within the study’s required 100-mile boundary for locals; Fairfield represents about the 90-minute mark for a commute to New York. Cheaper areas like Danbury with a price point south of $300,000 get the most local searches. But the metro’s million dollar ZIPs – covering places like Westport, New Canaan, and Darien all get relatively more interest from more far-flung areas.

Conclusion

While prices and search patterns at the metro level gives an idea of the different dynamics of each market, diving deeper into more granular data starts to shed light on the local story. Neighborhood level search patterns show us how, even within a metro, the types of shoppers being attracted vary widely based on location. As much of the nation appears to be tipping back into a buyer’s market, sellers may especially benefit from understanding who’s looking into their neighborhood.

Methodology

We used search data for Trulia for-sale and for-rent listings from January through December 2018. Based on the user’s location, we categorized each page hit for a listing as:

- a local search when the user was within 100 miles of the property (based on the ZIP centroids of both the user and property); or if the user was within the same metro as the property (if ZIP centroids for one or both ZIPs were unavailable)

- a non-local search when the user was farther than 100 miles, or in a different metro (if ZIP centroids were unavailable).

We aggregated searches for the year in each ZIP code area to get the share of local searches of each ZIP code in the 100 largest metros (CBSAs/metro divisions, as per the OMB definitions from 2010). We also calculated the metro-wide share of local searches.

ZIP code and metro home values are based on the ZHVI as of December 2018. We calculated the correlation, for each metro, between median ZIP home values and the share of searches that were non-local in each ZIP.