- September housing starts brought the second streak of three monthly declines in 2017, driven by a fall in both single-family and multifamily starts. While notoriously volatile, this trend is something we will continue to keep an eye on throughout the remainder of the year.

- Inventory-constrained homebuyers should fear not: most of the pullback in starts this year has been in the multifamily sector, where economists expected an eventual slowdown given their relatively high share over the past few years as well as softening rents.

- Looking ahead, the future of new housing starts looks solid. New single-family housing permits – which leads starts – increased in September and are on pace to finish the year 5% higher than 2016. Frustrated homebuyers should rest assured that the pipeline of new single-family inventory remains robust.

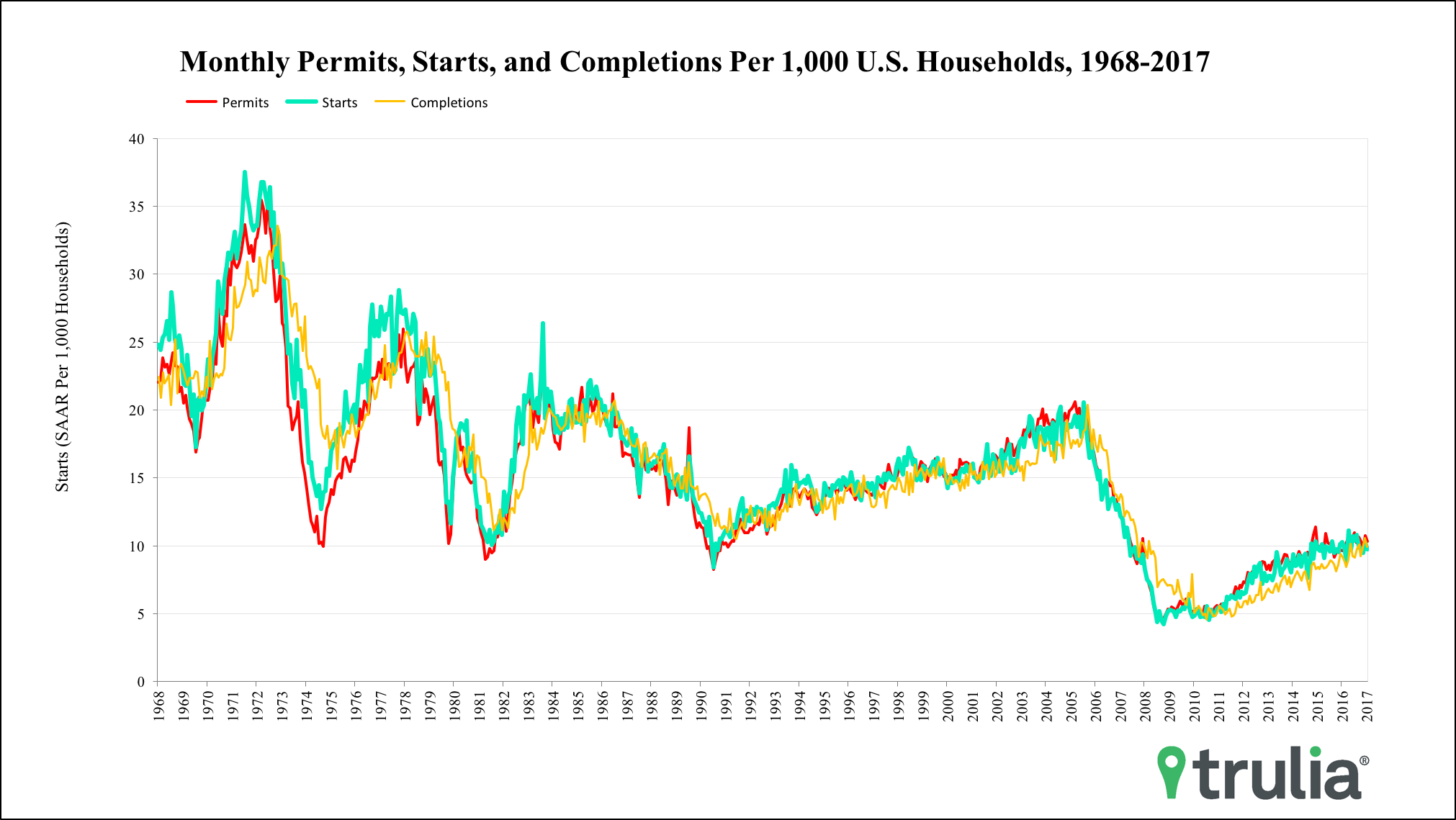

New housing permits and starts were both down over the month in September, dropping by 4.5%, and 4.7%, respectively, and fell to 65.9% and 58.2% of their 50-year average. However, inventory-constrained homebuyers should fear not: most of the pullback in new construction this year has been driven by the multifamily sector, which predominantly serves the rental market. This pullback has been expected by some economists, given that multifamily has composed a relatively large share of new construction as well as recent moderation of rents in several markets. For comparison, year-to-date multifamily starts have fallen 9.1% since last year, while single-family starts have increased 9.1%.

Looking ahead, the future of new housing starts looks solid. New single-family housing permits – which lead starts – increased in September and are on pace to finish this year 5% higher than 2016. Again, much of the decrease in permitting this year has been in the multifamily sector, where permits fell a whopping 17.4% on a seasonally adjusted basis. Frustrated homebuyers should rest assured that the pipeline of new single-family inventory remains robust.