- June’s data release shows monthly starts are still about 20% below historical averages. Similarly, our new study finds the rate at which new housing is supplied relative to demand is about 15% below historical norms.

- Single-family starts continue on a strong growth trajectory, while multifamily pulls back from what has been a heck of a ride over the past several years.

- While restrictive zoning regulation is often named as public enemy number one, our latest research suggests delays in permit approval better explains why new supply is abundant in some areas and stingy in others. This is because zoning can be changed, while uncertainty over project approval cannot.

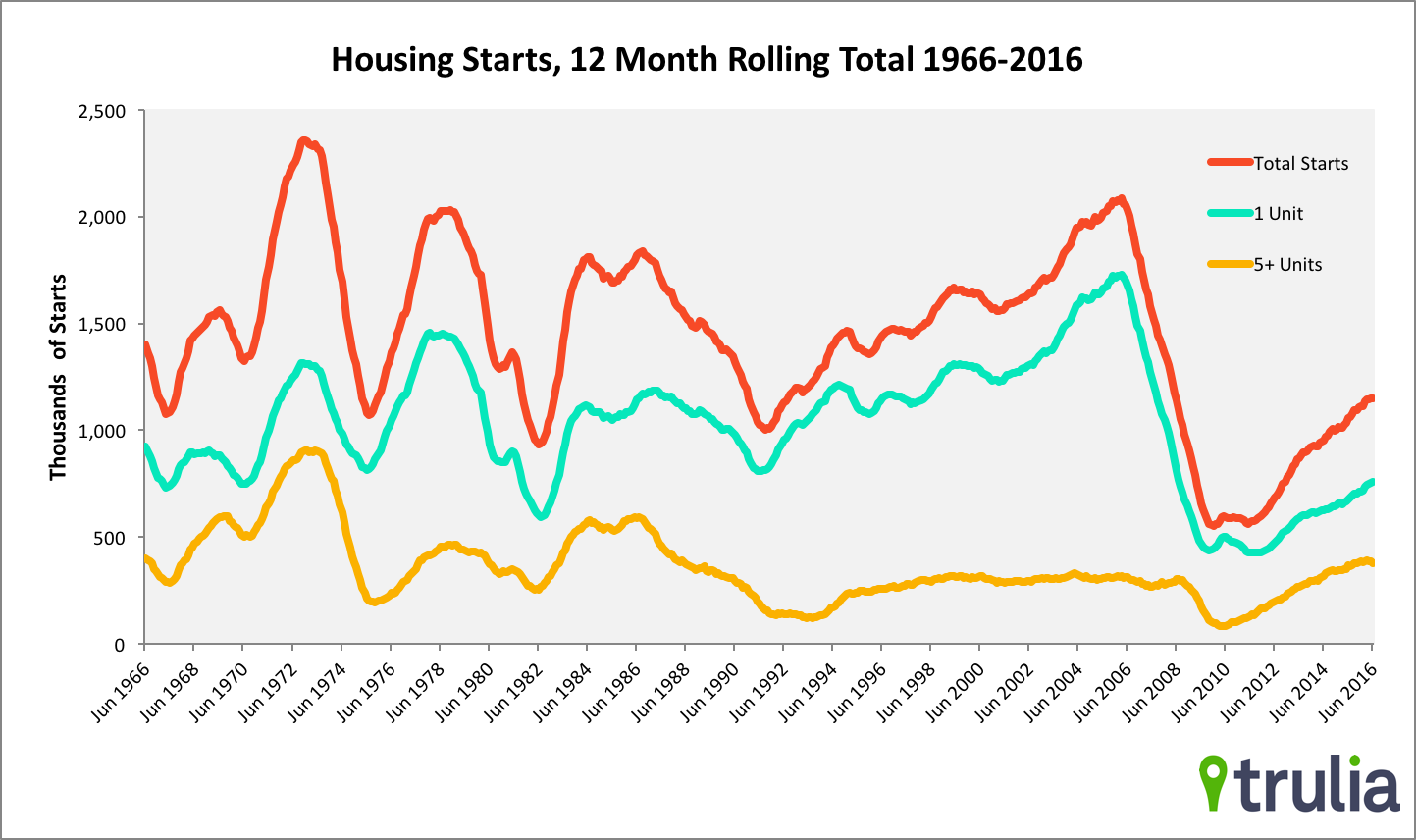

New housing starts grew solidly in June, but the rate slowed compared to May. The 12-month rolling total of starts-which is a less volatile measure of new construction activity-grew 8.6% year-over-year in April to 1,150,000 starts, which is down from May’s jump of 11.8%. While down slightly, this represents the second most starts in a 12-month period since August 2007. The 12-month rolling total remains flat at 80% of the 50-year average of 1,442,058 starts.

Starts of single-family units have also shown strong growth over the past year, increasing 12.3% from a 12-month rolling total of 676,700 in June 2015 to 760,000 in June 2016. The share of multifamily starts in 5+ unit buildings showed a large drop in growth, falling to just 3.2% year-over-year in June from 11.4% in May. While volatile, we may see multifamily starts turn into negative growth territory next month.

Last, we released a new report this morning measures the extent to which U.S. homebuilding is satisfying demand. Nationally, new housing supply relative to demand is about 15% below the historical average. Though restrictive zoning has taken much of the rap for limiting supply, we find that delays in the project approval process is more impactful. This is because zoning can be changed, while uncertainty over project approval cannot.