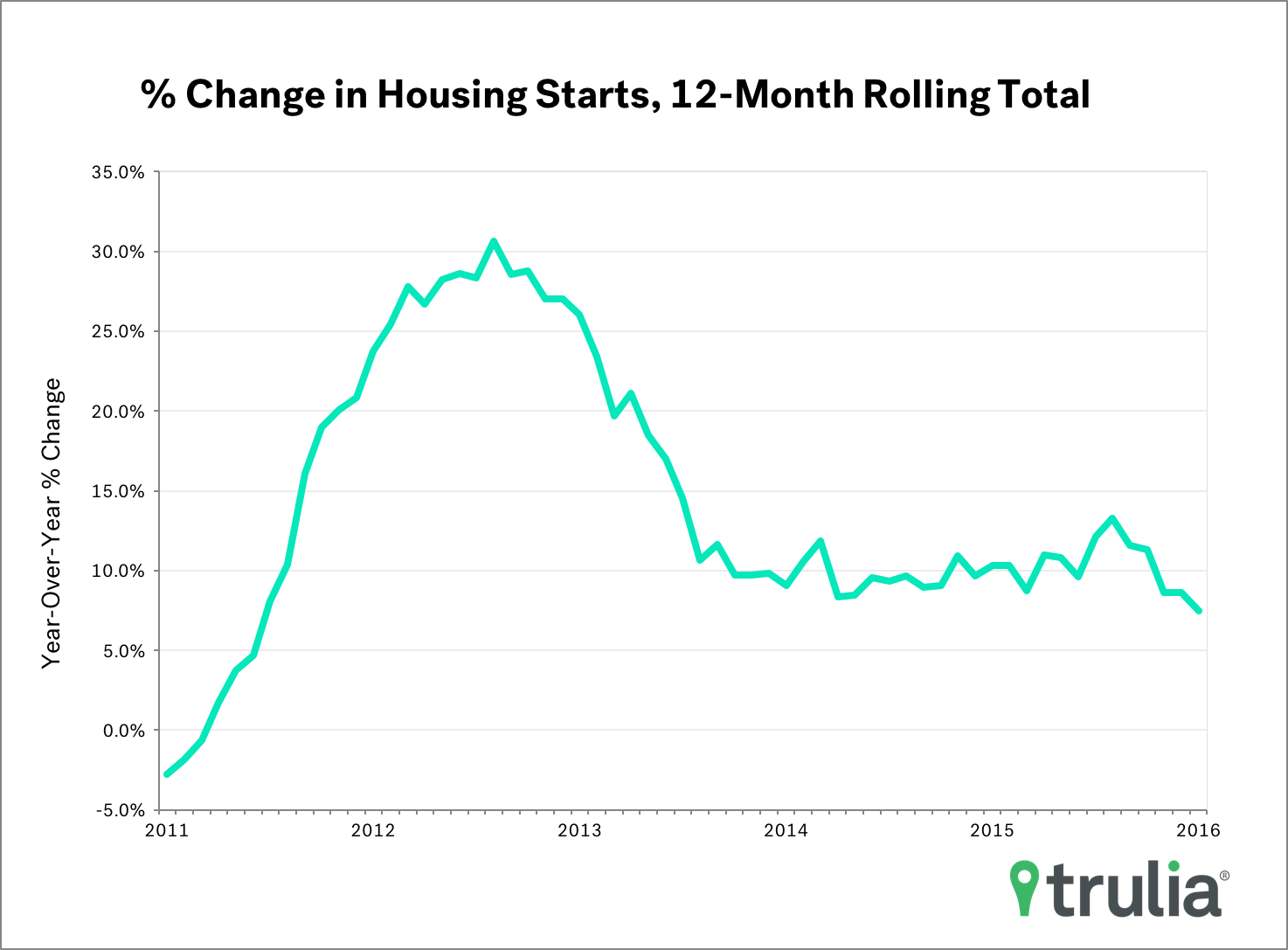

- Housing starts slowed considerably in August, but the year-rolling total is still 7.5% higher than last year. Though a welcome relief for homebuyers stymied by low inventory, homebuilders still have a long way to go to meet historical norms.

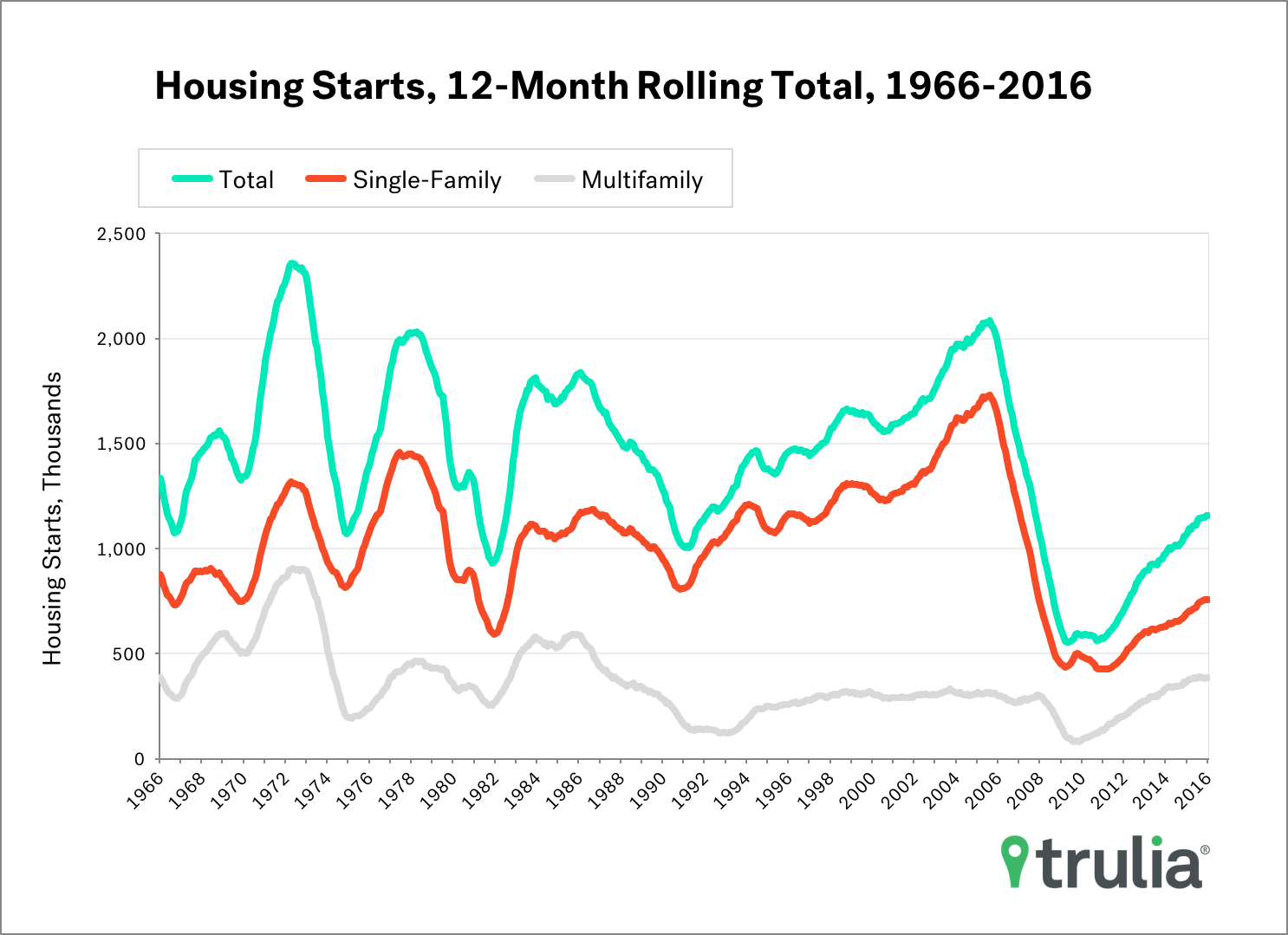

- While it’s tempting to compare to August housing starts to pre-recession peaks, homebuilders arguably built too many homes during this period. A better norm is the 50-year average, of which we’re still about 20% below.

- Looking through the monthly volatility, the persistent gain in year-over-year starts reflects a healthy combination of homebuilder confidence and sustained demand for homes during a time of solid job and income growth.

New housing starts slowed in August, but the 12-month rolling total of starts – which is a less volatile measure of new construction activity – grew 7.5% year-over-year in August to 1,154,600 starts. Though solid growth, it the fifth straight month where gains fell from the previous month. While growth is slowing, this represents the most starts in a 12-month period since May 2007. While it’s tempting to compare to August housing starts to pre-recession peaks, homebuilders arguably built too many homes during this period. A better norm is the 50-year average, of which we’re still about 20% below.

Starts of single-family units continue to show strong growth over the past year, increasing 9.1% year-over-year. Multifamily starts increased as well to 4.9% year-over-year, but this was down from 6.3% in June. Though growth in single-family starts has taken the reigns from multifamily, growth in both types of units should be a welcome sign for both homebuyers and renters who have experienced prices and rents outpace prices for much of the current economic expansion.

While there are signs of slowing, the persistent gain in starts reflects a healthy combination of homebuilder confidence and sustained demand for homes during a time of solid job and income growth. With both employment and income growing strongly at a time when inventory is falling, it’s up to homebuilders to help ease demand pressures. While not a silver bullet, increases in homebuilding should help moderate price and rent increases headed into the fourth quarter.