Housing got little play during the Republican primary season, as we predicted, but will it get any attention in the presidential election? With the general election campaign now underway, we updated our Housing Misery Index to see if — and where — the candidates will focus on housing.

The Most Miserable Housing States

Our Housing Misery Index takes two important indicators of a state’s housing market and adds them together. These are:

1) The percentage change in home prices from each state’s own peak during last decade’s bubble until today, from FHFA. Big price drops lead to more underwater borrowers and less household wealth, which hurt the housing market and hold back economic recovery.

2) The percent of mortgages either severely delinquent or in foreclosure, from CoreLogic. Defaults and foreclosures damage consumer confidence in the housing recovery, and foreclosures hurt not only the people who lose their homes but also their neighbors.

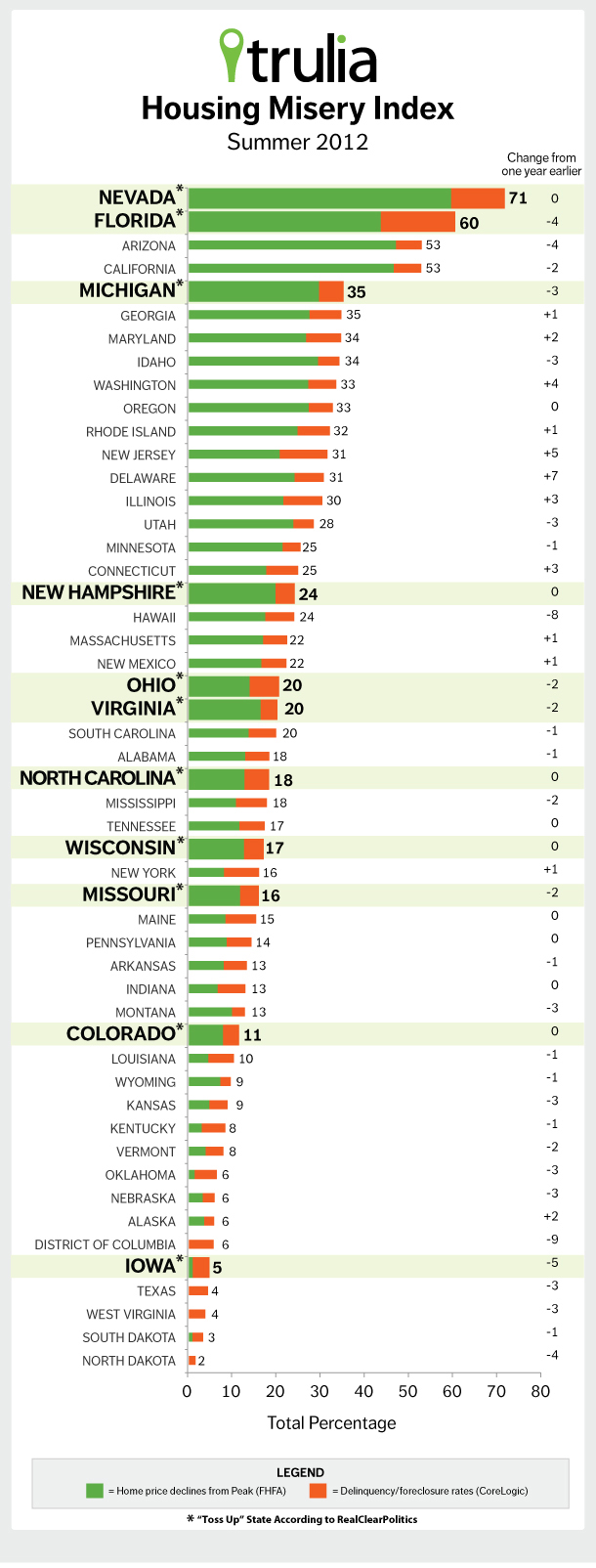

Four states continue to stand out from the rest for their housing misery: Nevada, Florida, Arizona and California. In these four states, home prices are 40% or more below their peak – and almost 60% in Nevada. In addition to big price declines, Florida has, by far, the highest share of homes where borrowers are either delinquent or in foreclosure; the state’s judicial foreclosure process means that foreclosures take much longer to complete than in most other states. But things are slowly improving: in three of these four most-miserable states – except Nevada – the Housing Misery Index has fallen several points in the last year.

Beyond these four states, housing misery is spread across the different regions of the country: the index is 30 or above in Michigan and Illinois in the Midwest; Georgia in the South; Maryland and New Jersey in the Mid-Atlantic; and Idaho, Washington and Oregon in the Northwest. At the other extreme, Texas escaped housing misery altogether: prices are no lower today than during the bubble, and relatively few homes are delinquent or in foreclosure. The chart below has all the details.

Candidates: Here’s Where You’ll Have to Talk About Housing

Housing markets, of course, are local. But so are presidential elections, which are fought in the handful of “swing states” that could conceivably go to either candidate. The election will be decided over the issues that matter most in swing states. Currently, RealClearPolitics identifies 11 states as “toss-up” states, which are bolded and enlarged in our chart. (Several organizations track “toss-up states”, “swing states” or “battleground states” – they mean the same thing and come up with pretty similar lists.) Of the four states highest on the Housing Misery Index, two – Nevada and Florida – are swing states and will therefore be getting plenty of candidate attention. A third, Arizona, “leans Romney” according to RealClearPolitics but is classified as a “swing state” by some other organizations. The fourth, California, is “solid Obama” and doesn’t come close to being a swing state. Among other swing states, Michigan also ranks high for housing misery, at 35. In total, that’s three swing states among the five most miserable states. And if Arizona shifts from “leans Romney” to “toss-up”, then four of the five states with the highest housing misery – California is the exception – would be swing states.

Are swing states more miserable than the states that are more clearly in the Obama or Romney camps? Generally, yes, as the table below shows. The “toss-up” states have, on average, a Housing Misery Index of 31. Only the “solid Obama” states have a higher average Housing Misery Index, thanks to big-and-miserable California (without California, the “solid Obama” average drops from 35 to 23). But the picture is different for Romney: the average Housing Misery Index score among “likely Romney” states is just 7, and among “solid Romney” states is just 13 – way below both swing states and states where Obama is strong. Among the “likely Romney” and the “solid Romney” states, only Idaho and Utah score above 20 on Housing Misery Index.

| Current Election Prediction | Average Housing Misery Index |

| Solid Obama (e.g. California, New York) | 35 |

| Likely Obama (e.g. New Jersey, Washington) | 28 |

| Leans Obama (e.g. Pennsylvania, Minnesota) | 21 |

| Toss-Up (e.g. Florida, Ohio) | 31 |

| Leans Romney (e.g. Georgia, Arizona) | 30 |

| Likely Romney (e.g. Texas, Tennessee) | 7 |

| Solid Romney (e.g. Alabama, Louisiana) | 13 |

Note: state election predictions from RealClearPolitics. Average Housing Misery Index for each group is weighted by electoral votes for each state.

How will housing play out in the election? Because candidates need to focus on swing states, they’ll have to face housing head-on. Even though the national housing market is clearly in recovery, housing misery is concentrated in several swing states, including Florida, Nevada and Michigan. When candidates are in Romney territory, which covers much of the South, the Plains and the Mountain regions, where the Housing Misery Index is low, they can safely ignore housing. But the states clearly in the Obama or Romney camp won’t determine the presidential election outcome; the swing states will. Voters in key swing states will want to hear what the candidates have to say about housing. And what will they say? As the incumbent, Obama needs to point to some clear housing-policy successes; as the challenger, Romney needs to point to some fresh new ideas about housing. They’ve both got their work cut out for them.