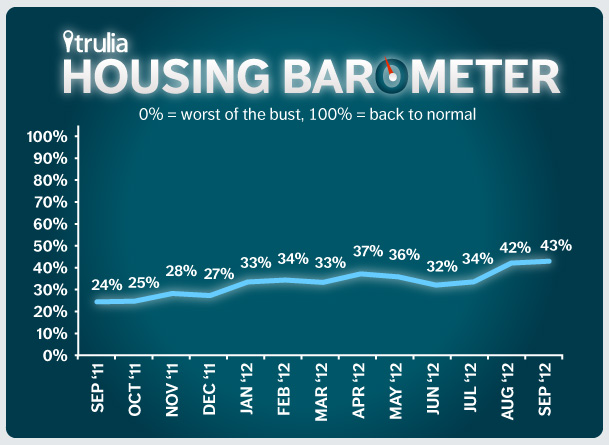

Each month Trulia’s Housing Barometer charts how quickly the housing market is moving back to “normal.” We summarize three key housing market indicators: construction starts (Census), existing home sales (NAR) and the delinquency-plus-foreclosure rate (LPS First Look). For each indicator, we compare this month’s data to (1) how bad the numbers got at their worst and (2) their pre-bubble “normal” levels.

In September 2012, construction starts surged. However, existing home sales fell slightly, and the delinquency + foreclosure rate unexpectedly jumped.

- Construction starts held roughly steady. Starts in September were at an 872,000 annualized rate, up 15% month over month and up 35% year over year. Construction activity in September was at its highest level since July 2008. Nationally, construction starts are 39% of the way back to normal.

- Existing home sales slipped a bit in September. After a big increase in August, existing home sales fell 1.7% month over month to 4.75 million in September – but that’s still a respectable 11% increase from one year ago. Sales are 57% back to normal, which is more than halfway.

- The delinquency + foreclosure rate jumped back up. In September, 11.27% of mortgages were delinquent or in foreclosure, up from 10.91% in August due to an unexpected increase in the share of delinquent loans. The combined delinquency + foreclosure rate is at its highest level in seven months and is 34% back to normal.

Averaging these three back-to-normal percentages together, the housing market is now 43% of the way back to normal – compared with 42% in August and 24% in September 2011. For the second month in a row, the Housing Barometer is at a post-crisis high.