Vacancies are one of the best measures of how the housing market is really doing. Vacant homes depress neighborhood home values and discourage new construction. During the housing bubble, new home construction ran ahead of demand: there were more new homes than people to live in them, and some stayed vacant. As prices dropped and foreclosures rose, people lost or left homes they couldn’t afford, creating more vacant homes. Then, construction nearly stopped. Since then, it’s remained below normal levels and way below bubble levels. As a result, the vacancy rate has been moving back down toward normal.

As always, it’s not the national picture that matters: housing is local. Unfortunately, the main up-to-date source of vacancy data is the quarterly Census Housing Vacancy Survey, which is based on too small a sample of homes to provide reliable data at the state or local level. With this post, we present a new measure of vacancies, based on U.S. Postal Service (USPS) monthly data on the number of addresses that are and are not receiving mail. (See the end of post for how the USPS collects these data.) Here’s what we found.

Empty Homes are Filling Up

Nationally, the number of occupied housing units – that is, those receiving mail — rose by 970,000 in the last year, from mid-July 2011 to mid-July 2012. Over the same period, the total number of housing units – those that could receive mail – rose by 760,000. The difference – 210,000 – is the reduction in the number of vacant units. That’s a 5% drop in the number of vacant units nationally. As a percentage of all units, the vacancy rate declined from 3.6% one year ago to 3.4% now.

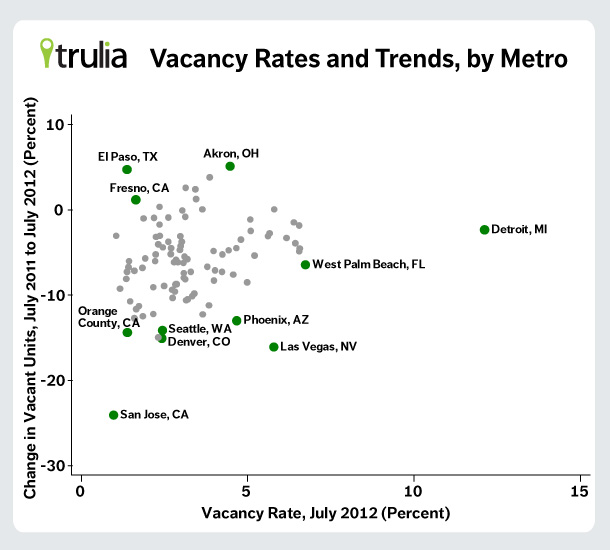

In fact, vacancies have declined in 90 of the 100 largest metros. The biggest year-over-year decline – by a wide margin — was in San Jose, where vacancies dropped by 24.1%. At the other extreme, vacancies increased by 5.1% in Akron OH, which was the largest increase of any metro. The 10 metros with the biggest declines and increases (or smallest declines) are here, along with their vacancy rate as of mid-July 2012:

|

Biggest decline in vacant units, last 12 months |

||

| U.S. Metro | % change in vacant units, July 2011 to July 2012 | % of all units that are vacant, July 2012 |

| San Jose, CA |

-24.1% |

1.0% |

| Las Vegas, NV |

-16.1% |

5.8% |

| Denver, CO |

-15.0% |

2.4% |

| Bakersfield, CA |

-15.0% |

2.3% |

| Orange County, CA |

-14.4% |

1.4% |

| Seattle, WA |

-14.1% |

2.4% |

| Phoenix, AZ |

-13.0% |

4.7% |

| San Diego, CA |

-12.8% |

1.6% |

| Raleigh, NC |

-12.7% |

1.6% |

| Nashville, TN |

-12.5% |

1.9% |

|

Biggest increase (or smallest decline) in vacant units, last 12 months |

||

| U.S. Metro | % change in vacant units, July 2011 to July 2012 | % of all units that are vacant, July 2012 |

| Akron, OH |

5.1% |

4.5% |

| El Paso, TX |

4.7% |

1.4% |

| Greensboro, NC |

3.8% |

3.9% |

| Syracuse, NY |

2.6% |

3.1% |

| Providence, RI-MA |

2.4% |

3.4% |

| Milwaukee, WI |

1.3% |

3.4% |

| Fresno, CA |

1.2% |

1.6% |

| Camden, NJ |

0.3% |

2.4% |

| Palm Bay–Melbourne–Titusville, FL |

0.0% |

5.8% |

| Lakeland–Winter Haven, FL |

0.0% |

3.6% |

Vacancies drop when the number of households grows faster than the number of housing units. The change in the number of households is closely related to employment growth, and the change in the number of housing units is driven primarily by construction. Therefore, the decline in vacancies is highest in markets with strong employment growth, like San Jose, Denver and Seattle, and markets where construction remains well below normal levels, like Las Vegas, Bakersfield and Phoenix. In contrast, vacancies rose in markets with slower job growth, like Akron, Providence and Milwaukee, and in the one market with a construction boom, El Paso.

Does the change in vacancies matter for local housing markets? Absolutely. Vacant homes are a key part of the actual listed inventory and of the “shadow inventory” of homes that could come onto the market in the future. Changes in vacancies and inventories are strongly correlated: for example, San Jose, Bakersfield and Seattle all had large vacancy declines and large inventory declines year over year (using NAR inventory data). This means that inventories are dropping partly because homes are actually filling up – not just because people or banks are unable or unwilling to put homes on the market. In fact, vacancies are better than inventories as a measure of whether there’s a housing shortage or housing glut: price increases according to the Trulia Price Monitor are more strongly associated with declining vacancies than with declining inventories. [Wonk alert: the correlation between price increases and vacancy declines is .30, while the correlation between price increases and inventory declines is weaker, at .18.]

Tight Markets, Slack Markets

For the U.S. as a whole, the decline in vacancy rates is a good and necessary part of the housing recovery. But vacancy rates are falling in many of the wrong places. The table below shows that vacancies are dropping sharply in many metros that had few vacancies to begin with. San Jose not only has the biggest decline in vacancies year over year: it also has the lowest vacancy rate in the country. Two other California metros — Orange County and Los Angeles – have very low vacancy rates along with double-digit declines in vacancies. While this is good news for sellers and homeowners who want prices to rise, it’s bad news for buyers or renters struggling to find someplace to live.

|

Lowest vacancy rates |

||

| U.S. Metro | % of all units that are vacant, July 2012 | % change in vacant units, July 2011 to July 2012 |

| San Jose, CA |

1.0% |

-24.1% |

| Bethesda–Rockville–Frederick, MD |

1.1% |

-3.1% |

| Austin, TX |

1.2% |

-9.3% |

| Middlesex County, MA |

1.4% |

-8.1% |

| El Paso, TX |

1.4% |

4.7% |

| Washington, DC-VA-MD-WV |

1.4% |

-7.3% |

| Orange County, CA |

1.4% |

-14.4% |

| Long Island, NY |

1.4% |

-6.7% |

| Ventura County, CA |

1.4% |

-6.1% |

| Los Angeles, CA |

1.5% |

-10.8% |

California, in fact, has a very low vacancy rate – despite the huge price declines and massive foreclosure wave during the housing crisis. That’s because geography and restrictive regulations make it difficult to build new homes in California, and construction typically can’t keep up with housing demand. Except for the past few years, California usually worries more about a housing shortage than a housing glut.

At the other extreme, Detroit has the highest vacancy rate by far – close to twice as high as any other large metro. Many years of population decline and job losses have left Detroit with too few households to fill its homes: Detroit has 18% fewer jobs today than it did ten years ago. High vacancy rates plague other Midwestern metros with long-term job losses, like Gary IN, Dayton OH, Toledo OH and Cleveland OH. Excessive construction during the boom has also led to high vacancy rates, which is why South Florida, Arizona and Nevada all have metros with high vacancy rates.

|

Highest vacancy rates |

||

| U.S. Metro | % of all units that are vacant, July 2012 | % change in vacant units, July 2011 to July 2012 |

| Detroit, MI |

12.1% |

-2.4% |

| West Palm Beach, FL |

6.7% |

-6.5% |

| Tucson, AZ |

6.6% |

-4.6% |

| Fort Lauderdale, FL |

6.6% |

-4.9% |

| Gary, IN |

6.6% |

-1.9% |

| Dayton, OH |

6.4% |

-3.9% |

| Toledo, OH |

6.4% |

-1.5% |

| Cleveland, OH |

6.2% |

-3.3% |

| Palm Bay–Melbourne–Titusville, FL |

5.8% |

0.0% |

| Las Vegas, NV |

5.8% |

-16.1% |

Where are the right places where vacancies are falling? Phoenix and Las Vegas stand out as metros where vacancy rates are both high and declining (see the graph below). Continued population growth and household formation in these metros, combined with relatively little new construction, are helping these markets absorb those vacant homes and move toward normal. In these markets, the decline in vacancies shows that the housing recovery is real.

These local vacancy rates show that some metros have a housing shortage while others have a housing glut. And, although vacancies nationally are dropping back toward normal, the trend is uneven: some tight markets, especially in California, are getting tighter, while vacancies remain stubbornly high in parts of the Midwest. If Detroit could ship some of its vacant homes to San Jose, both markets would be better off –but that’s not how the housing recovery works. A real housing market recovery needs household growth and construction to stay in balance, not just nationally, but in each local market.

The findings presented in this post are based on the U.S. Postal Service (USPS) Delivery Statistics files, which report “active” and “possible” addresses on postal carriers’ routes. These data show the number of residential addresses that are occupied and vacant each month at the ZIP code level. Typically, addresses are considered “vacant” 90 days after mail delivery to that address stops. Seasonal or vacation homes are not counted as vacant. P.O. Boxes are excluded from this analysis. This post is based on data from mid-July 2012 and mid-July 2011. We converted the ZIP code level data to metro areas, using official Office of Management and Budget definitions for Metropolitan Statistical Areas and Metropolitan Divisions, where defined.