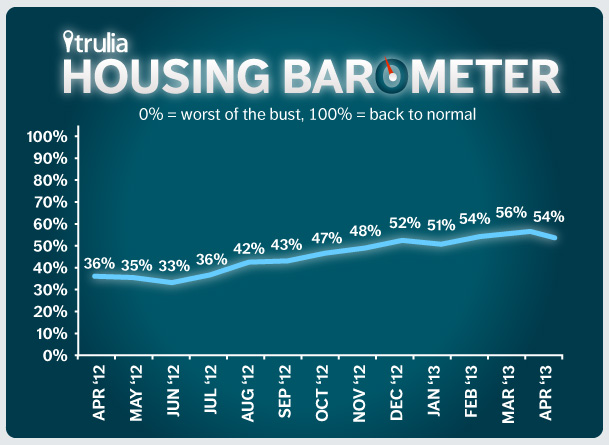

Each month, Trulia’s Housing Barometer charts how quickly the housing market is moving back to “normal.” We summarize three key housing market indicators: construction starts (Census), existing home sales (NAR), and the delinquency-plus-foreclosure rate (LPS First Look). For each indicator, we compare this month’s data to (1) how bad the numbers got at their worst and (2) their pre-bubble “normal” levels.

In April 2013, construction starts tanked, while the delinquency + foreclosure rate improved sharply, and existing home sales rose slightly:

- Construction starts fell backwards to a five-month low. Starts were at an 853,000 seasonally adjusted annualized rate – down 16% from March to the lowest level since November 2012. The volatile multifamily sector led the decline, dropping 38% month-over-month. But building permits – a leading indicator of future starts – jumped 14% from March, so starts should bounce back soon. For now, construction starts are just 37% of the way back to normal.

- Existing home sales rose – especially conventional sales. Sales rose 0.6% in April to a seasonally adjusted annualized rate of 4.97 million – that’s up 9.7% year-over-year. Excluding foreclosures and short sales, conventional home sales were up 25% year-over-year in April. Further good news: inventory rose even on a seasonally adjusted basis for the third month in a row. Inventory rose 1.8% month-over-month seasonally adjusted, and 12% without seasonal adjustment. Overall, existing home sales are 69% back to normal.

- The delinquency + foreclosure rate fell sharply. The share of mortgages in delinquency or foreclosure dropped to 9.38% in April, the lowest level since September 2008. As the economy recovers, fewer people are falling behind on their mortgage payments. Also, more homes are moving through the foreclosure process, though at different speeds depending on state foreclosure laws. For the first time since the crash, the combined delinquency + foreclosure rate is more than halfway back to normal, at 55%.

Averaging these three back-to-normal percentages together, the housing market is now 54% of the way back to normal, below the March level of 56% and back to the same level as in February. But this will probably just be a one-month setback. The reason for the decline – the drop in construction starts – should reverse itself in the next month or two. A bounce-back in construction next month, combined with this month’s big drop in delinquencies + foreclosures and the slow increase in sales, would put the housing recovery right back on track.