How We Track This Uneven Recovery

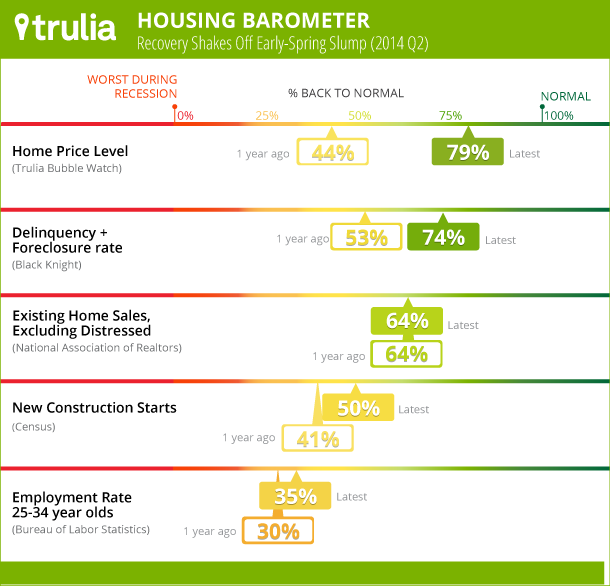

Since February 2012, Trulia’s Housing Barometer has charted how quickly the housing market is moving back to “normal” based on multiple indicators. Because the recovery is uneven, with some housing activities improving faster than others, our Barometer highlights five measures:

- Home-price levels relative to fundamentals (Trulia Bubble Watch)

- Delinquency + foreclosure rate (Black Knight, formerly LPS)

- Existing home sales, excluding distressed sales (National Association of Realtors, NAR)

- New construction starts (Census)

- The employment rate for 25-34 year-olds, a key age group for household formation and first-time homeownership (Bureau of Labor Statistics, BLS)

The first measure, home prices from our Bubble Watch, is a quarterly report. The other four measures are reported monthly; to reduce volatility, however, we use three-month moving averages for these measures. For each indicator, we compare the latest available data to (1) its worst reading for that indicator during the housing bust and (2) its pre-bubble “normal” level.

4 Out of 5 Measures Improve and Are At Least Halfway Home

All but one of the Housing Barometer’s five indicators have improved since last quarter, and all five have improved or remained steady since last year. Prices and the delinquency + foreclosure rate made the biggest strides:

| Housing Indicators: How Far Back to Normal? | |||

| Now | One quarter ago | One year ago | |

| Home price level | 79% | 68% | 44% |

| Delinquency + foreclosure rate | 74% | 63% | 53% |

| Existing home sales, excl. distressed | 64% | 61% | 64% |

| New construction starts | 50% | 45% | 41% |

| Employment rate, 25-34 year-olds | 35% | 39% | 30% |

| For each indicator, we compare the latest available data to (1) its worst reading for that indicator during the housing bust and (2) its pre-bubble “normal” level. | |||

- Home prices continue to climb, though at a slower rate. Trulia’s Bubble Watch shows prices were 3% undervalued in 2014 Q2, compared with 15% at the worst of the housing bust; that means prices are nearly four-fifths (79%) of the way back to their “normal” level of being neither over- nor under-valued. Even better, as prices approach normal, price gains are slowing down and becoming more sustainable: for the first time in almost two years, no local market has had price gains of more than 20% year-over-year.

- The delinquency + foreclosure rate was 74% back to normal in May, up from 63% one quarter ago. While fewer foreclosures means fewer discounted homes for sale, delinquencies and foreclosures have caused great pain for millions of households and the financial system. For the foreclosure crisis, the light at the end of the tunnel is getting brighter.

- Existing home sales (excluding distressed) were 64% back to normal in May, up from 61% one quarter earlier. Distressed sales have plummeted as the foreclosure inventory has dried up. Non-distressed sales also stumbled from their peak last summer as higher home prices and mortgage rates reduced affordability, but in the past quarter non-distressed sales have resumed their climb.

- New construction starts are 50% back to normal, up from 45% one quarter ago and 41% one year ago. Multi-unit starts — mostly apartment buildings — are leading the recovery: in 2014 so far, multi-unit starts accounted for 35% of all new home starts, the highest annual level in 40 years. This apartment boom started last year, and last year’s starts are now being completed, which is increasing the supply of apartments for rent.

- Employment for young adults, however, took a step back. May’s three-month moving average shows that 75.6% of adults age 25-34 are employed, which is just 35% of the way back to normal. That’s down from 39% one quarter ago, though still an improvement from one year ago. Because young adults need jobs in order to move out of their parents’ homes, form their own households, and eventually become homeowners, the housing recovery depends on Millennials getting jobs.

What’s Missing from the Housing Recovery

First-time homebuyers are still missing from the housing recovery, making up just 27% of existing-home buyers according to NAR’s May report. That’s down a bit both from last month and from last year.

How has the recovery gotten this far without first-time buyers? Investors and other bargain-hunters bought homes near the bottom of the market, in late 2011, which boosted sales and home prices. Now that prices are near long-term norms – just 3% undervalued – the bargain-hunting engine is sputtering. Repeat buyers, who are trading in one home for another, are taking more of the market.

Would-be first-time homebuyers are stuck: rising prices and mortgage rates have reduced affordability before young adults have been able to recover from the jobs recession. A full recovery that includes first-time homebuyers is still years away; many young adults still need to find jobs and keep them long enough to save for a down payment and qualify for a mortgage. Until that happens, the clearest signs of recovery will be apartment construction and renter household formation, not first-time home buying, as young adults move from their parents’ homes into their own rental units.

NOTE: Trulia’s Housing Barometer tracks five measures: existing home sales excluding distressed (NAR), home prices (Trulia Bubble Watch), delinquency + foreclosure rate (Black Knight), new home starts (Census), and the employment rate for 25-34 year-olds (BLS). Also, our estimate of the “normal” share of sales that are distressed is 5%; Black Knight reports that the share was in the 3-5% range during the bubble. For each measure, we compare the latest available data to (1) the worst reading for that indicator during the housing bust and (2) its pre-bubble “normal” level. We use a three-month average to smooth volatility for the four indicators that are reported monthly (all but home prices). The latest published data are May data for the employment rate, existing home sales, new construction starts, and the delinquency + foreclosure rate; and Q2 for home prices.