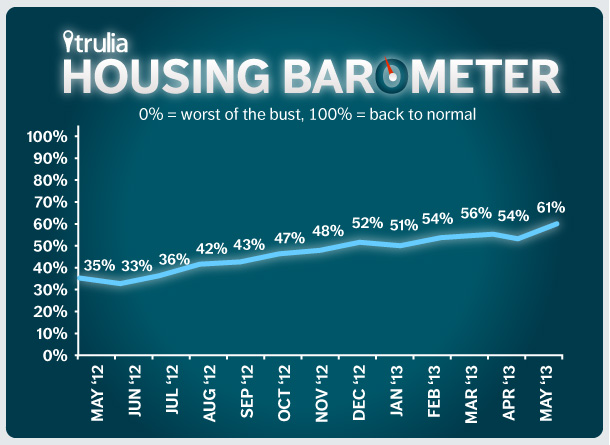

Each month, Trulia’s Housing Barometer charts how quickly the housing market is moving back to “normal.” We summarize three key housing market indicators: construction starts (Census), existing home sales (NAR), and the delinquency-plus-foreclosure rate (LPS First Look). For each indicator, we compare this month’s data to (1) how bad the numbers got at their worst and (2) their pre-bubble “normal” levels.

In May 2013, all three measures improved: construction starts and existing home sales rose, while the delinquency + foreclosure rate notched downward:

- Construction starts did a half-rebound. Starts were at a 914,000 seasonally adjusted annualized rate – up 7% from April but still below February and March levels. Building permits remained strong, pointing to bigger increases in construction starts in coming months. For now, construction starts are 43% of the way back to their normal level of 1.5 million.

- Existing home sales climb as inventory begins to expand. Sales rose 4% in May to a seasonally adjusted annualized rate of 5.18 million – that’s up 13% year-over-year. Excluding foreclosures and short sales, conventional home sales were up 23% year-over-year in May. Tight inventory isn’t holding back sales as much: for the fourth straight month, inventory expanded even after taking seasonality into account. It now looks like inventory might have bottomed in January. Overall, existing home sales are 82% back to normal.

- The delinquency + foreclosure rate continued its retreat. The share of mortgages in delinquency or foreclosure dropped to 9.13% in May, a big drop from 11.08% a year ago. As the economy recovers, fewer people are falling behind on their mortgage payments. Also, with prices rising, people have more to lose if they default. The combined delinquency + foreclosure rate is 57% back to normal.

Averaging these three back-to-normal percentages together, the housing market is now 61% of the way back to normal – a big jump from 35% one year ago. That’s the first time Trulia’s Housing Barometer has crossed 60%. The recovery has reached full-fledged teenager status, with awkward, sudden growth spurts and parents – the Fed – who now threaten to take away its allowance by winding down measures that pushed mortgage rates down to historic lows. Before long, the recovery should make it into adulthood, but it will face some grown-up challenges in the next couple of years: still-tight mortgage credit for many borrowers, a slow jobs recovery for young adults, and unaffordable housing in large coastal markets.