- The homeownership rate continues its rebound, with Q4 2017 representing the fourth consecutive quarter where the number of new homeowners outpaced the number of new renters. This upward trend reflects solid economic fundamentals, such as low unemployment and an aging pool of house-hungry millennials, that will likely persist throughout the remainder of the year.

- What’s even more positive news for the housing market is that much of the increase in the homeownership rate over the past year has come from 18- to 44-year olds. Increases in homeownership amongst these two cohorts are a sign that the scars of the Great Recession are finally starting to heal, and provide a source of optimism that the owner-occupied segment of the housing market will continue to grow throughout the remainder of this economic cycle.

- While this is exciting news for proponents of homeownership, those looking to get into the door of homeownership still face headwinds. Home prices outpaced rents in each month of 2017, making homeownership more difficult to achieve for those looking to buy instead of rent, and the plunge in inventory makes it increasingly difficult for potential homebuyers to find housing that suits their needs.

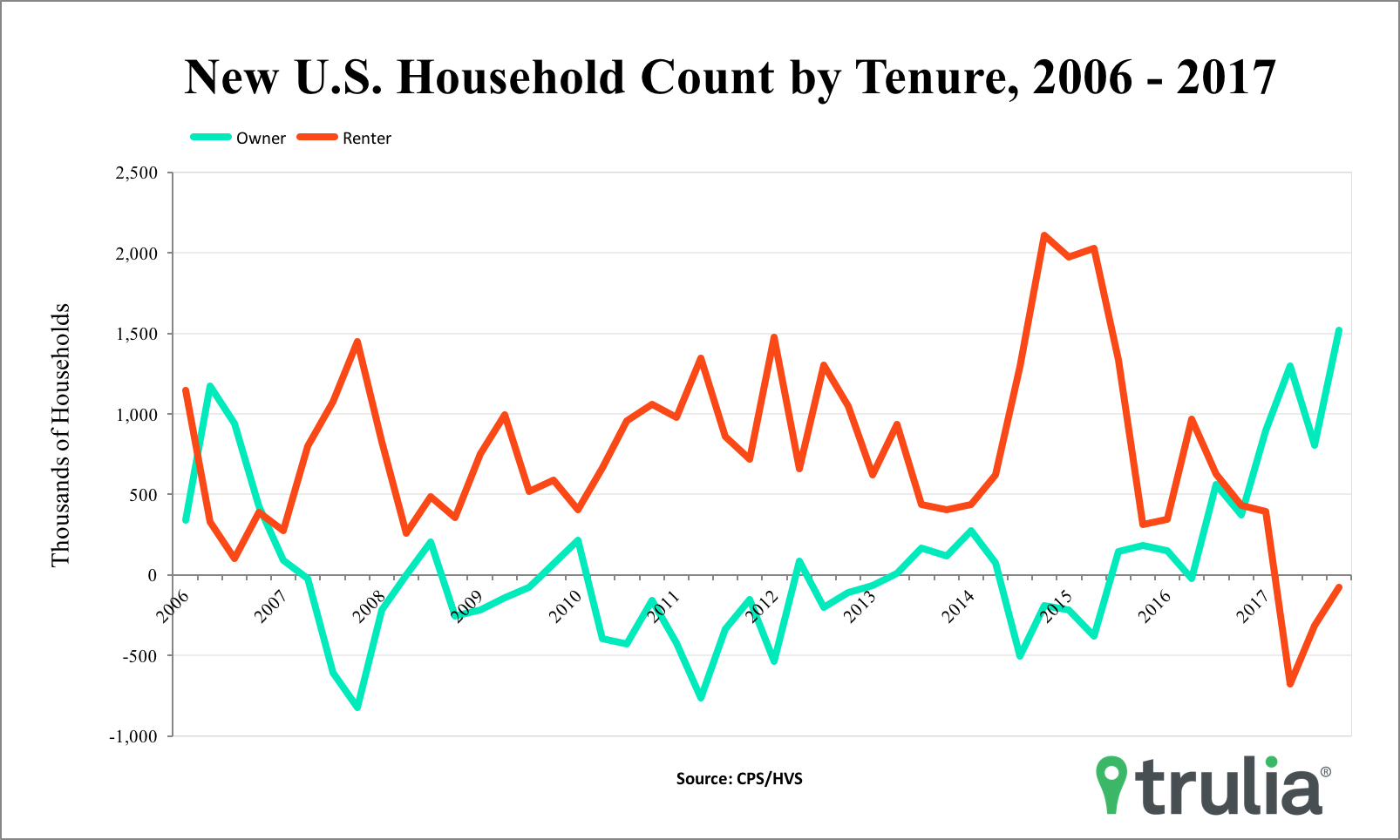

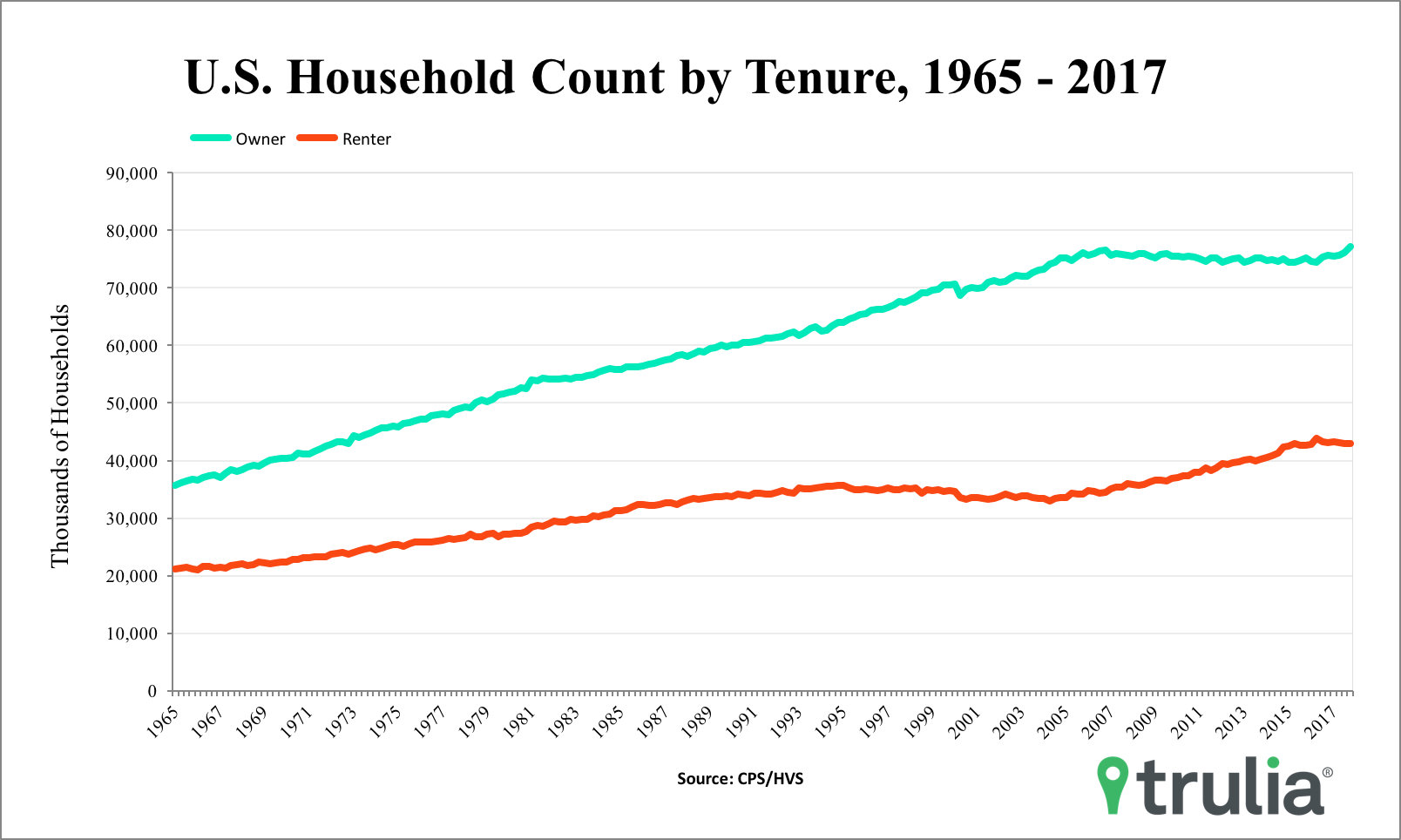

The Census Homeownership and Vacancy Survey (HVS) released Tuesday shows that U.S. homeownership increased over the year to an unadjusted rate of 64.2%, up strongly from 63.7% last year. Not only is this exciting news, but the change was a rare one that was on the upper bound of statistical significance. There is more surprising news from this quarter’s report. For the fourth consecutive quarter, the number of owner-occupied households grew faster than renter households over the year. The number of new owner households grew by 1.518 million from a year ago, while renters lost 75,000 households. Strong renter household formation is one of the reasons why the homeownership rate has continued to drop since the onset of the housing crisis. The fact that we now have four consecutive quarters where owner households outpaced renters is a strong sign this is a true trend and that the decline in homeownership caused by the Great Recession is reversing course.

What’s even more positive news for the housing market is that much of the increase in the homeownership rate over the past year has come from 18 to 44-year olds. This is noteworthy, since 18 – 35-year-olds represent the largest potential group of homebuyers that aren’t yet homeowners (roughly the millennial demographic), and 35 to 44-year olds (roughly Gen X) represent the demographic that was most impacted by the foreclosure crisis. Increases in homeownership amongst these two cohorts are a sign that the scars of the Great Recession are finally starting to heal, and provide a source of optimism that the owner-occupied segment of the housing market will continue to grow throughout the remainder of this economic cycle.

While this is exciting news for proponents of homeownership in the U.S., those looking to get into the door of homeownership still face headwinds. Home prices outpaced rents in each month of 2017, which makes homeownership more difficult to achieve for those looking to buy instead of rent, and the inventory plunge in inventory makes it increasingly difficult for potential homebuyers to find housing that suits their needs.