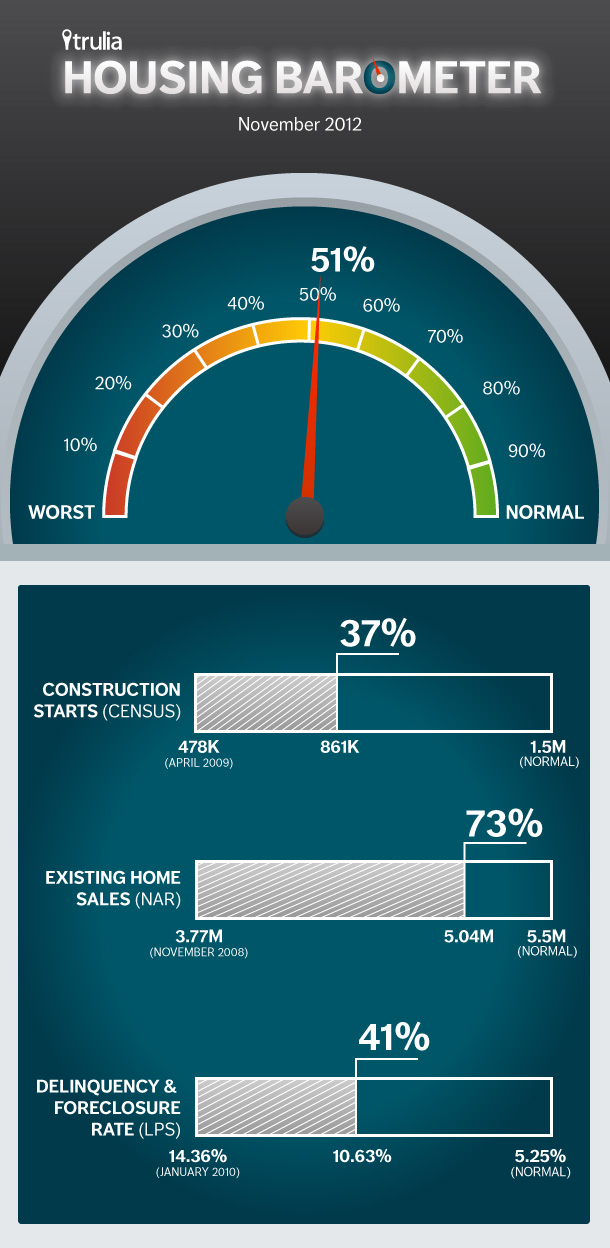

Each month, Trulia’s Housing Barometer charts how quickly the housing market is moving back to “normal.” We summarize three key housing market indicators: construction starts (Census), existing home sales (NAR), and the delinquency-plus-foreclosure rate (LPS First Look). For each indicator, we compare this month’s data to (1) how bad the numbers got at their worst and (2) their pre-bubble “normal” levels.

In November 2012, home sales saw strong increases, and the delinquency + foreclosure rate held steady–both signs of market improvement. However, new construction starts declined.

Hurricane Sandy appears to have lowered construction (and sales, to a lesser extent) in the Northeast. Average monthly construction starts were 14% higher nationally in October and November – the months affected by Sandy – than in the previous four months, but 5% lower in the Northeast. Average monthly home sales were 7% higher nationally in October and November than in the previous four months, but just 3% higher in the Northeast.

- Construction starts dipped in November but remain strong. Starts in November were at an 861,000 annualized rate, down 3% month-over-month and up 22% year-over-year. For the past three months, construction starts have remained solidly above 800,000–the highest level since September 2008. Nationally, construction starts are 37% of the way back to normal.

- Existing home sales rose once again in November. After climbing in October, existing home sales rose 6% month-over-month to 5.04 million in November–the highest level since November 2009. Sales are 73% back to normal. Even better, “distressed” sales (foreclosures and short sales) represent a declining share of overall sales, making way for more “conventional” home sales.

- The delinquency + foreclosure rate maintained a new post-crisis low. In November, 10.63% of mortgages were delinquent or in foreclosure, down a hair from 10.64% in October. The combined delinquency + foreclosure rate is at its lowest level in four years and is 41% back to normal.

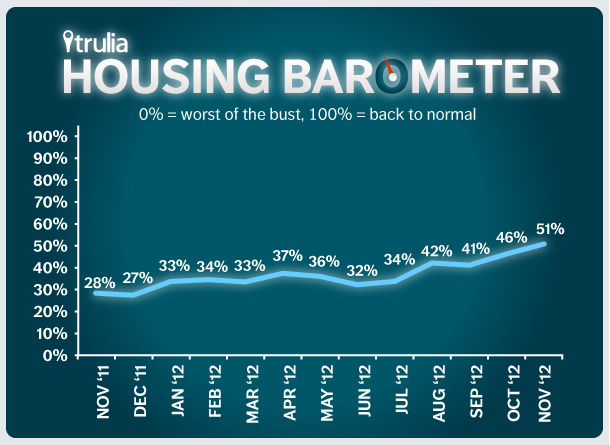

Averaging these three back-to-normal percentages together, the housing market is now 51% of the way back to normal, compared with 28% in November 2011. Trulia’s Housing Barometer has jumped five points in each of the last two months. Does halfway back to normal mean the glass is half-full or half-empty? The half-empty view is that our three housing measures hit bottom (on average) in 2009, so it’s taken the market a long time–three years–to get to the halfway mark. But the half-full view is that halfway back to normal is better than anyone –myself included–predicted for 2012 at the start of this year.