As expected, the central bank on Wednesday raised the federal funds rate during the Federal Open Market Committee’s (FOMC) December policy meeting. The benchmark interest rate rose to a target of between 1.25% and 1.50%. What might this mean for mortgage rates and the housing market?

- In the long run the federal funds rate and the 30-year fixed mortgage rate are highly correlated, but Fed rate hikes this year did not always lead to increases in mortgage rates.

- Mortgage rates would have to rise to levels unseen since 2011 to have any impact on the home buying decision. If mortgage rates increase 0.8 percentage points to 4.6% in San Jose, Calif. the cost of buying will equal renting.

- Nationally, the 30-year fixed mortgage rate would have to rise to 8.3%–or 4.5 percentage points higher than they are today—for the cost home buying to equal the cost of renting.

On Dec. 13, the Federal Reserve Bank increased the target federal funds 0.25%, which determines the interbank lending rate. Prospective homebuyers often look to the FOMC announcement on the federal funds rate since they believe that mortgage rates will follow the direction of the rate change. While the federal funds rate is tied to consumer interest rates in the short-run, mortgage rates are not particularly sensitive to the federal funds rate.

<!–[if IE 9]>

<!–[if IE 9]><![endif]–>

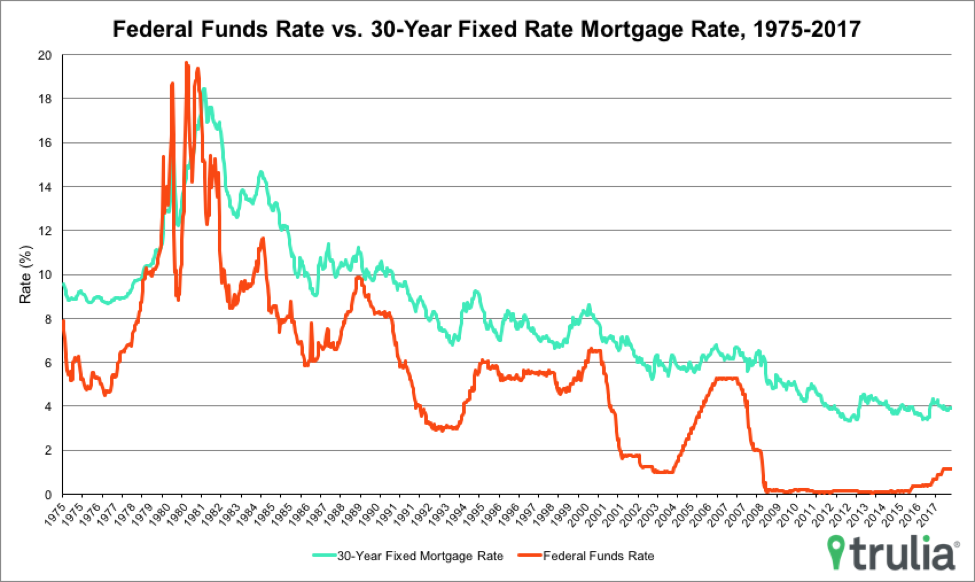

Source: Freddie Mac, 30-Year Rate Mortgage Bi-Weekly Average; Board of Governors of the Federal Reserve System, Effective Federal Funds Rate Bi-Weekly Average. Both metrics retrieved from FRED Federal Reserve Bank of St. Louis, Dec. 7, 2017.

A closer look at the movement of the federal funds rate and the 30-year fixed mortgage rate since 1975 shows that over the long term the rates are correlated (with a correlation coefficient of 0.93). However, when looking back at 2017 we see that the FOMC raised rates twice, after the March and June meetings. After the rate was raised to a target range between 0.75% and 1.00% in March, the 30-year fixed mortgage rate also edged up slightly. Mortgage rates rose from 4.16% on March 15 to 4.27% on March 29. However, when the Fed raised the target range to between 1.00% and 1.25% after the June FOMC meeting, mortgage rates slipped from 4.12% on June 12 to 4.03% on June 26. So while the federal funds rate and mortgage rates move together over time, small changes to the Fed rate don’t necessarily directly impact mortgage rates.

If mortgage rates do rise, however, the decision to buy a home may warrant a second thought –depending on the market. To calculate the cost of renting versus buying we assume households stay in their home for seven years, and can afford to put 20% down and a 30-year fixed rate mortgage to buy a home. Under these assumptions, the economic benefit of buying outweighs renting in the nation’s largest 100 markets, but rising mortgage rates could impact that inequality. The mortgage rate tipping point, or the mortgage rate at which the cost of buying equals renting is 4.6% in San Jose, Calif., or just 0.8 percentage points higher than mortgage rates are today.

| Metro | Tipping Point (Percentage Point Increase from Today’s Rate) |

| San Jose, CA | 4.6% (0.8) |

| San Francisco, CA | 5.2% (1.4) |

| Honolulu, HI | 5.5% (1.7) |

| Oakland, CA | 5.9% (2.1) |

| Orange County, CA | 6.8% (3.0) |

| Seattle, WA | 6.9% (3.1) |

| San Diego, CA | 7.1% (3.3) |

| Madison, WI | 7.2% (3.4) |

| Sacramento, CA | 7.3% (3.5) |

| Ventura County, CA | 7.3% (3.5) |

With mortgage rates hovering around 4.0% for the past several years, the last time rates exceeded 4.6% was in June, 2011. And the last time rates exceeded 5.2%, which is when the cost of renting would equal owning in San Francisco, was in August, 2009. So while rising mortgage rates would cost homebuyers more, unless there is a drastic increase in rates it still makes a lot more financial sense to buy than rent almost everywhere.