The February 2012 jobs report, released this morning, was once again very strong for housing. First, the jobs picture keeps getting better for 25-34 year-olds. Second, construction employment kept pace with solid overall employment growth.

Unemployment among 25-34 year-olds

Why does this indicator matter for housing?

Between the ages of 25 and 34 is prime time when many people form households with a spouse, partner, roommate, or by themselves, then start families and buy their first home. During and after the recession, household formation dropped for this age group, and more of them than ever were living with parents or other adults rather than renting or owning their own place. These folks will wait to form their own households and consider homeownership only when their job prospects improve. A key measure for housing demand and homeownership is the unemployment rate for this group and the share of this age group that is employed.

What happened this month?

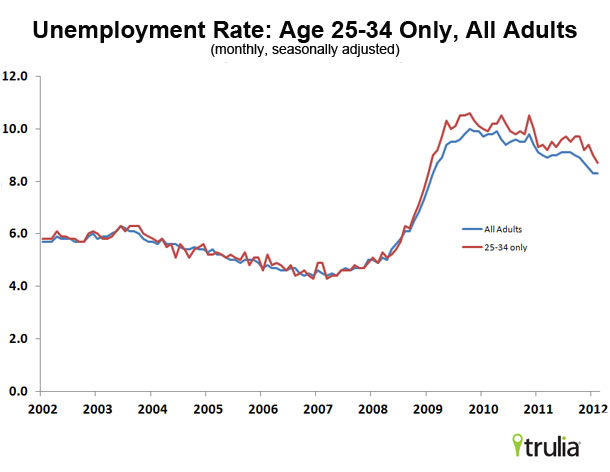

In February, the unemployment rate for 25-34 year-olds dropped to 8.7% from 9.0% in January and is at its lowest level in three years. The unemployment rate for all adults stayed steady at 8.3%. The recession hit this age group especially hard: their unemployment rate peaked at 10.6%, compared to 10.0% for all adults, but this gap is now closing. In February, 74.7% of 25-34 year-olds were employed (the rest were unemployed or not in the labor force because they’re in school, discouraged from looking or not looking for other reasons), up from 73.9% a year ago, but still way below the normal level of almost 80%.

Construction job growth

Why does this indicator matter for housing?

Construction jobs are at the heart of the virtuous or vicious cycle that connects jobs and housing. Housing demand leads to more jobs in construction and related industries, and more jobs means more income and housing demand. Construction job growth is a key indicator of whether this cycle is spiraling downward or spinning upward.

What happened this month?

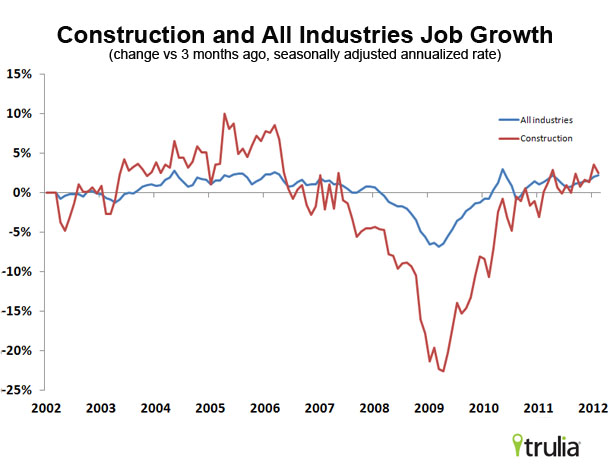

In February, construction employment was up 2.5% versus 3 months ago (annualized rate), outpacing overall employment growth of 2.2% over the same period. Construction job growth has kept pace with overall job growth for the last year. But construction remains a historically low share of overall jobs after contracting sharply in 2007-2009. Construction jobs in February were 4.2% of total U.S. employment, down from 5.7% at the height of the housing boom and below the normal range around 5%. Construction employment still has a lot of catching up to do to get back to its pre-boom share of overall jobs.

(A third key jobs measure I look at is employment growth in metros hurt most in the housing bust – the “clobbered cities.” But the BLS has not released metro growth figures for January or February yet.)