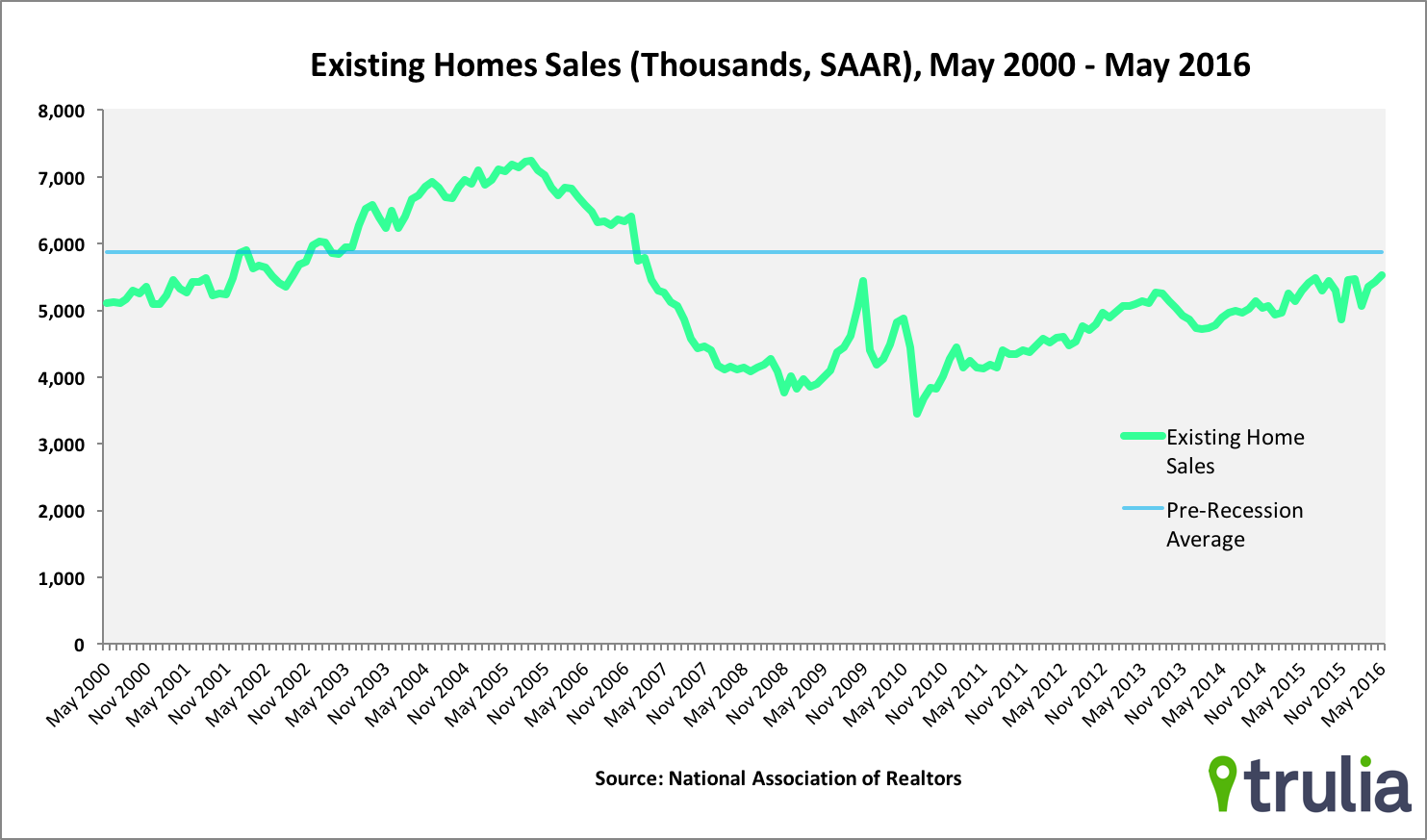

Existing home sales increased just 1.8% in May to an annual rate of 5,530,000 which is up just a bit from April’s 1.7% increase. This suggests that while demand for homes remains healthy, low inventory of homes for sale continues to keep the U.S. home resale market from recovering to pre-recession levels.

- Though steadily marching upwards, existing home sales hovers at about 94% of the pre-recession average of 5,875,300 units sold annually.

- Low inventory, especially for starter and tradeup homes, continues to stifle home sales activity. Finding a home is increasingly a challenge for both first and second-time homebuyers.

- May’s existing home sales numbers suggest that healthy demand continues to support a recovering housing market, but that inventory woes are preventing a full recovery to pre-recession levels.

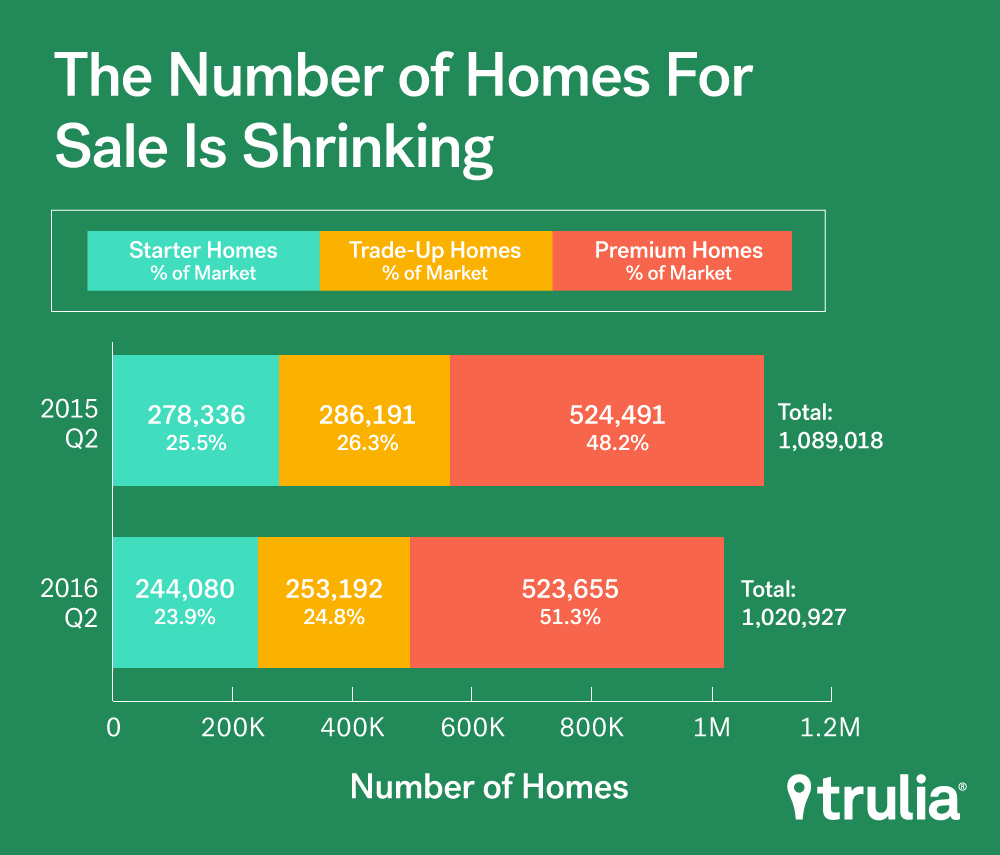

Looking more broadly, our Inventory and Price Monitor – released yesterday – also finds that inventory woes continue to plague the housing market. This spring house-hunting season brought no relief for homebuyers, as inventory of all homes has dropped nationally by about 6% over the past year. In addition:

- The number of starter homes on the market dropped by 12.3%, while the share of starter homes dropped from 25.6% to 23.9%. Starter homebuyers today will need to shell out 1.3% more of their income towards a home purchase than last year;

- The number of trade-up homes on the market decreased by 11.5%, while the share of trade-up homes dropped from 26.3% to 24.8%. Trade-up homebuyers today will need to pay 0.8% more of their income for a home than last year;

- The number of premium homes on the market decreased by just 0.2%, while the share of premium homes increased from 48.2% to 51.3%. Premium homebuyers today will need to spend 0.5% more of their income for a home than last year.