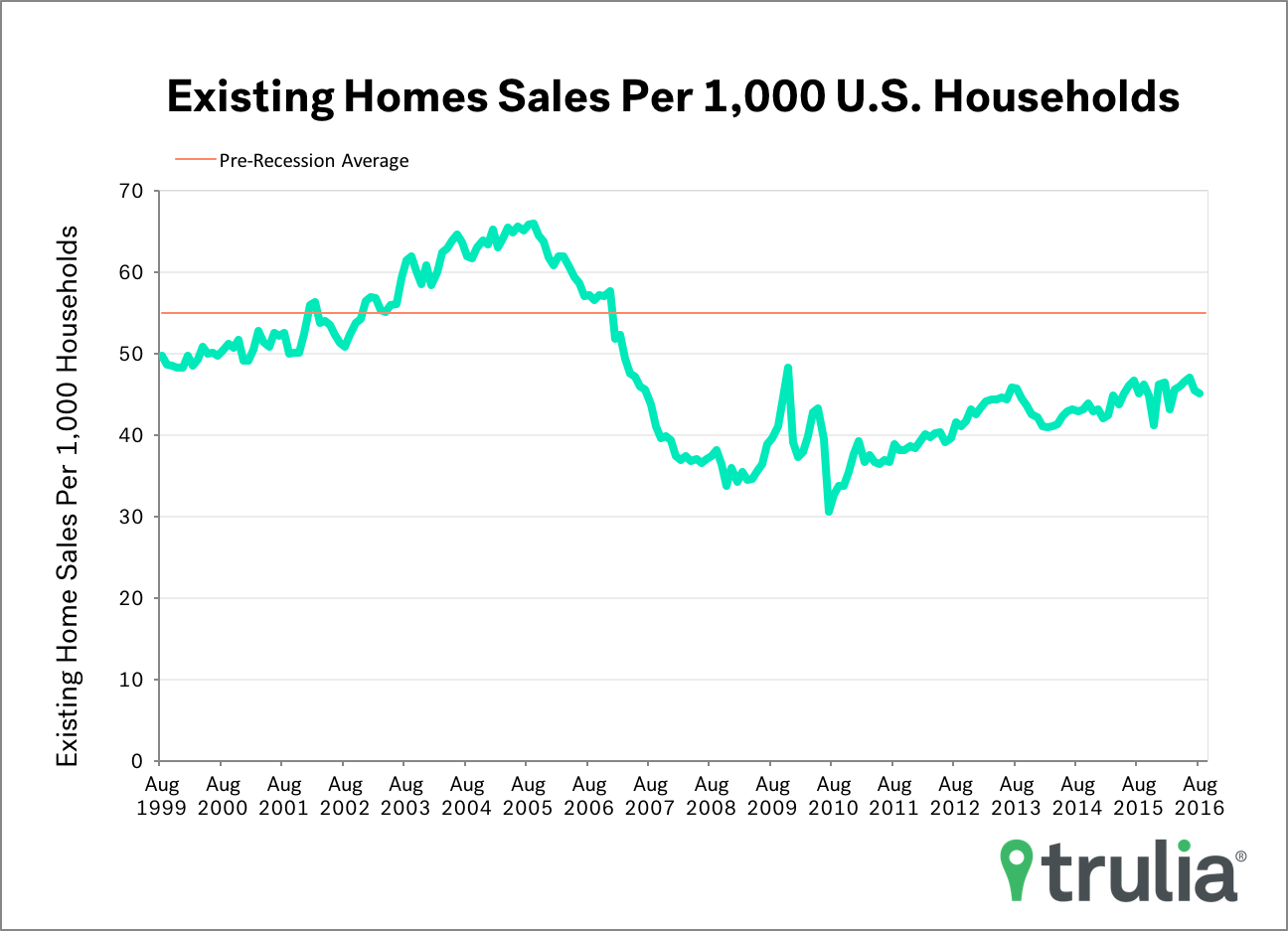

- Existing home sales fell again in August, and falling inventory continues to hold back home sales from reaching their pre-recession average.

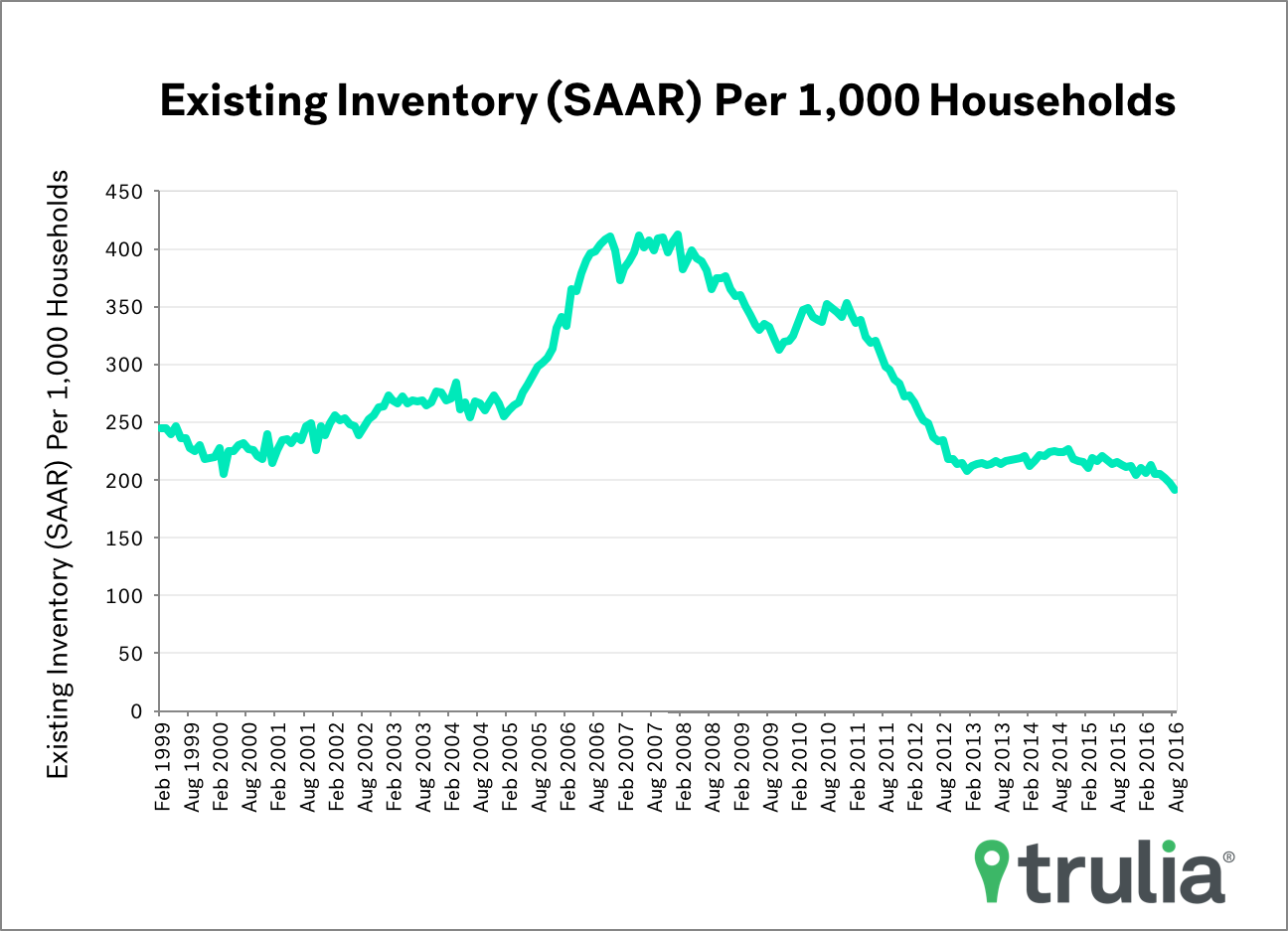

- Existing inventory in August hit another record low when controlling for seasonality and household formation, down again from a record setting July.

- Inventory woes continue to introduce supply gridlock for homebuyers. Those who want to sell their home might not do so because finding another home is difficult. This introduces a first-mover problem into the home buying landscape.

- Despite the decline in inventory, there are signs supply is on the rise in several markets such as San Francisco and Miami. What’s more, many of these markets have seen consecutive quarterly gains, suggesting an upward trend rather than a one-time blip.

Existing home sales dropped 0.9% for the second straight month in August to an annual rate of 5,330,000. When compared to the pre-recession average and adjusting for the fact that there are more households in the U.S., July’s numbers are about 81.9% back to normal. This is a drop from 82.9% last month.

Existing sales are slow to come back to normal because of continued inventory woes, as the number of homes on the market fell 10.1% year-over-year. However, inventory looks significantly worse when controlling for seasonality and the number of households in the U.S. Taking seasonality and the number of U.S. households into account, existing inventory took another dive and is set another record low, even eclipsing last month’s record setting plummet.

Despite the decline, there are some signs housing supply is easing. Trulia’s quarterly Inventory and Price Watch, released Tuesday, found that inventory in several markets is on the rise. What’s more, many of these markets have seen consecutive quarterly gains in available housing, suggesting an upward trend rather than a one-time blip. For example, inventory is up in San Francisco and Miami by 19.3% and 33.1%, respectively. For San Francisco it’s the fourth straight quarterly gain and the second straight for Miami.