If you want your real estate agent to be able to speak from personal experience, you’re in luck. We discovered that the vast majority of agents – almost 85% – are homeowners rather than renters. That means they do, in fact, practice what they preach. Of course, there are lots of other things to consider when choosing a real estate agent (start with these questions and look through the Trulia Agent Directory), but if you want an agent who walks the walk, it’s not hard to find one.

To discover whether real estate professionals are especially committed to homeownership, we calculated homeownership rates by occupation using Census data from 2007-2012. We then adjusted for demographics, income, and location to determine whether real estate professionals are more likely to own their home compared to other people with similar attributes in a similar neighborhood. (See note for details on methodology.) Here’s what we found.

Real Estate Pros More Likely to Own

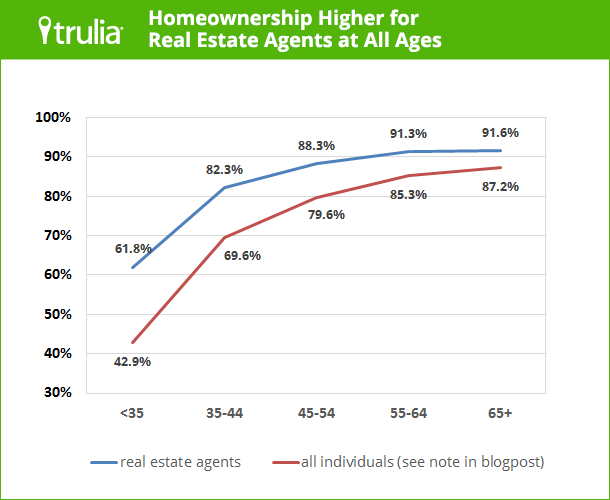

Let’s start with real estate agents. The homeownership rate for “real estate brokers and sales agents,” as the Census calls them, is 84.9%. That’s much higher than the homeownership rate for people in all occupations combined, which is 70.1% (see note for why this is higher than the published homeownership rate). Part of this gap is explained by the fact that real estate agents tend to be older, and homeownership tends to increase with age. But this chart shows that homeownership among real estate agents is higher than national norms even within age groups:

To go a step further, comparing homeownership for real estate agents with people who are similar not just in age, but also on other demographics, income, and location, we turned to regression analysis. We estimated the “expected” homeownership rate for each person based on their demographics (including age), income, and location – but NOT their occupation. For real estate agents, the expected homeownership rate is 80.4%, while the actual homeownership rate is 84.9% – a difference of 4.5%. That means that the homeownership rate for real estate agents is 4.5 percentage points higher than what we’d expect based on their demographics, income, and location.

Furthermore, actual homeownership is higher than expected for other real-estate-related occupations as well – not just real estate agents. The homeownership rates for appraisers, construction managers, and architects are all at least two percentage points higher than what’s expected based on their demographics, income, and location.

|

Actual and Expected Homeownership Among Real Estate Professionals |

|||

| Occupation |

Actual |

Expected |

Gap |

| Appraisers and assessors of real estate |

87.9% |

83.0% |

4.9% |

| Real estate brokers and sales agents |

84.9% |

80.4% |

4.5% |

| Construction managers |

82.9% |

79.8% |

3.1% |

| Architects |

80.1% |

77.8% |

2.3% |

| Construction workers |

65.9% |

64.3% |

1.6% |

| NOTE: Among selected real-estate-related occupations only. | |||

Why is homeownership higher among real estate pros? Two possible reasons. First, good salespeople truly believe in what they’re selling: real estate professionals probably believe in the importance of homeownership more than others do, and they apply that belief to themselves. Second, real estate professionals have an advantage when it comes to homeownership: they know the ins and outs of the home-buying and homeownership process, which makes buying and selling easier, or more profitable, for them than for the rest of us amateurs. The data can’t tell which reason matters more, but both likely have an impact.

Aside from the Pros, Who Else Owns? And Who Doesn’t?

It’s not just the real estate pros: for a handful of other occupations, homeownership exceeds what we’d expect to see even more than it does for real estate pros.

Police officers and firefighters, for instance, are much more likely to own homes than expected, partly because of targeted help in buying homes or getting mortgages from credit unions and programs like Homes for Heroes. But homeownership is also much higher than expected for hairdressers, hairstylists, cosmetologists, and miscellaneous personal appearance workers. Why? Many of them are self-employed and see customers at home, which might be easier for beauticians who own, rather than rent, their place. (The gap between actual and expected homeownership is much larger for hairdressers and other personal-appearance workers who are self-employed than for those who work for others.)

|

Occupations with Highest Actual Homeownership Relative to Expectation |

||||

| # | Occupation |

Actual |

Expected |

Gap |

| 1 | Firefighters |

83.6% |

75.7% |

7.9% |

| 2 | Miscellaneous personal appearance workers (not elsewhere categorized) |

63.3% |

56.3% |

7.1% |

| 3 | Farmers, ranchers, and other agricultural managers |

90.4% |

83.6% |

6.8% |

| 4 | Police officers |

80.1% |

74.9% |

5.2% |

| 5 | Supervisors of landscaping, lawn service, and groundskeeping workers |

75.3% |

70.3% |

5.0% |

| 6 | Hairdressers, hairstylists, and cosmetologists |

69.1% |

64.3% |

4.8% |

| 7 | Postal service mail carriers |

84.0% |

79.4% |

4.6% |

| 8 | Real estate brokers and sales agents |

84.9% |

80.4% |

4.5% |

| 9 | Construction equipment operators |

77.8% |

73.4% |

4.3% |

| 10 | Heavy vehicle and mobile equipment service technicians and mechanics |

78.5% |

74.4% |

4.1% |

| Note: Occupations where gap between actual and expected homeownership is largest, among occupations with at least 10,000 respondents in six years of the American Community Survey. | ||||

Therefore, real estate professionals aren’t the only people with an unusually high homeownership rate. They may walk the walk, but other factors specific to individual occupations – like targeted homeownership programs or businesses run from home – boost the likelihood of homeownership, too.

What about the flip side? Who is less likely to own a home than expected, based on demographics, income, and location? Chefs, writers, and software developers, for instance. And, finally, let’s not forget my people, the economists: we’re almost two percentage points less likely to own a home than expected. What a dilemma for a real-estate economist!

Note: this analysis is based on American Community Survey (ACS) Public Use Microdata Sample (PUMS) data over the years 2007-2012, using the 2011 5-year and 2012 1-year datasets. We included individuals with occupations, which excludes people who have never worked or who have been out of work for five or more years; furthermore, we included only household reference persons, spouses, and partners. The homeownership rate for these individuals is 70.1%, which is several points higher than the normally published homeownership rate, primarily due to estimation at the individual instead of at the household level. We used logistic regression of homeownership on categorical dummies for numerous demographic and income variables for the individual and the household, along with geographic variables.