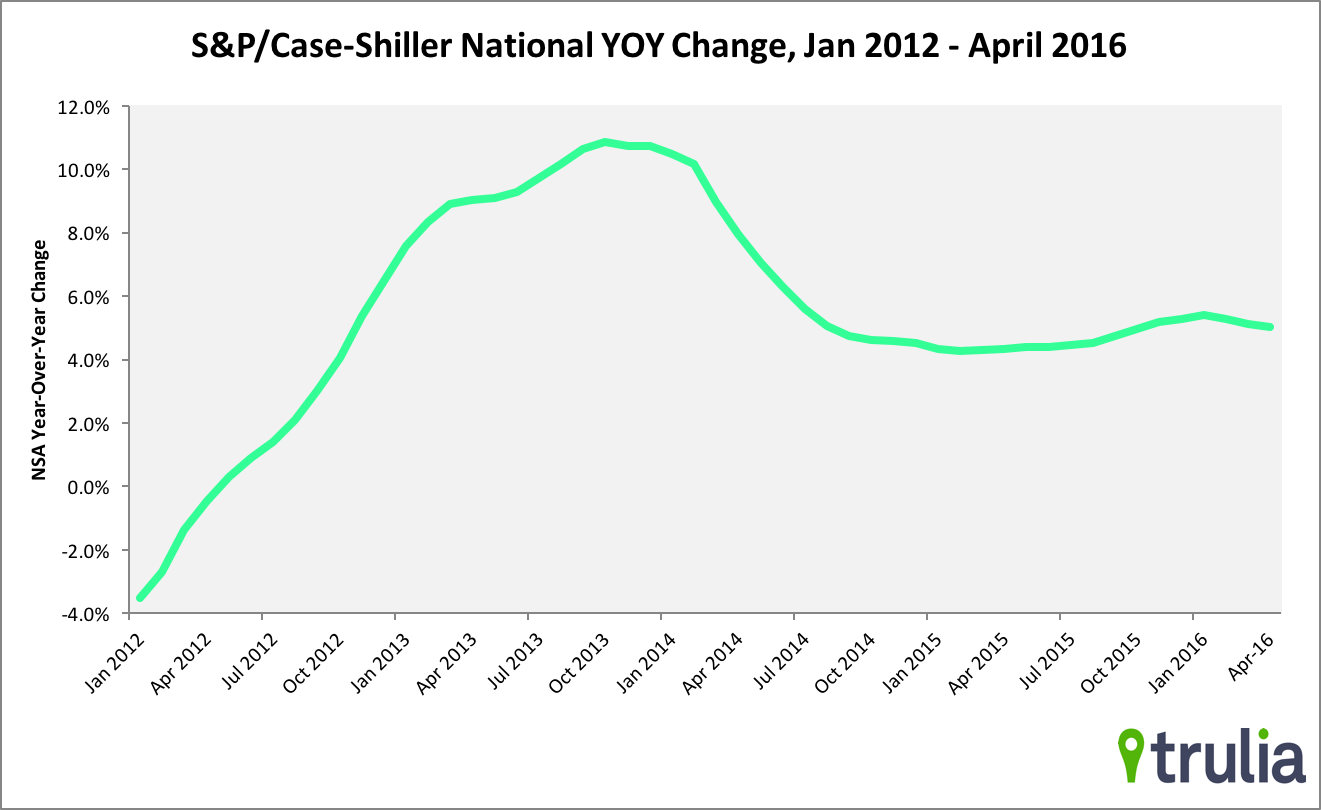

- The U.S. housing market is showing increasing signs of stabilization, as April represents the third straight month of decreasing price gains.

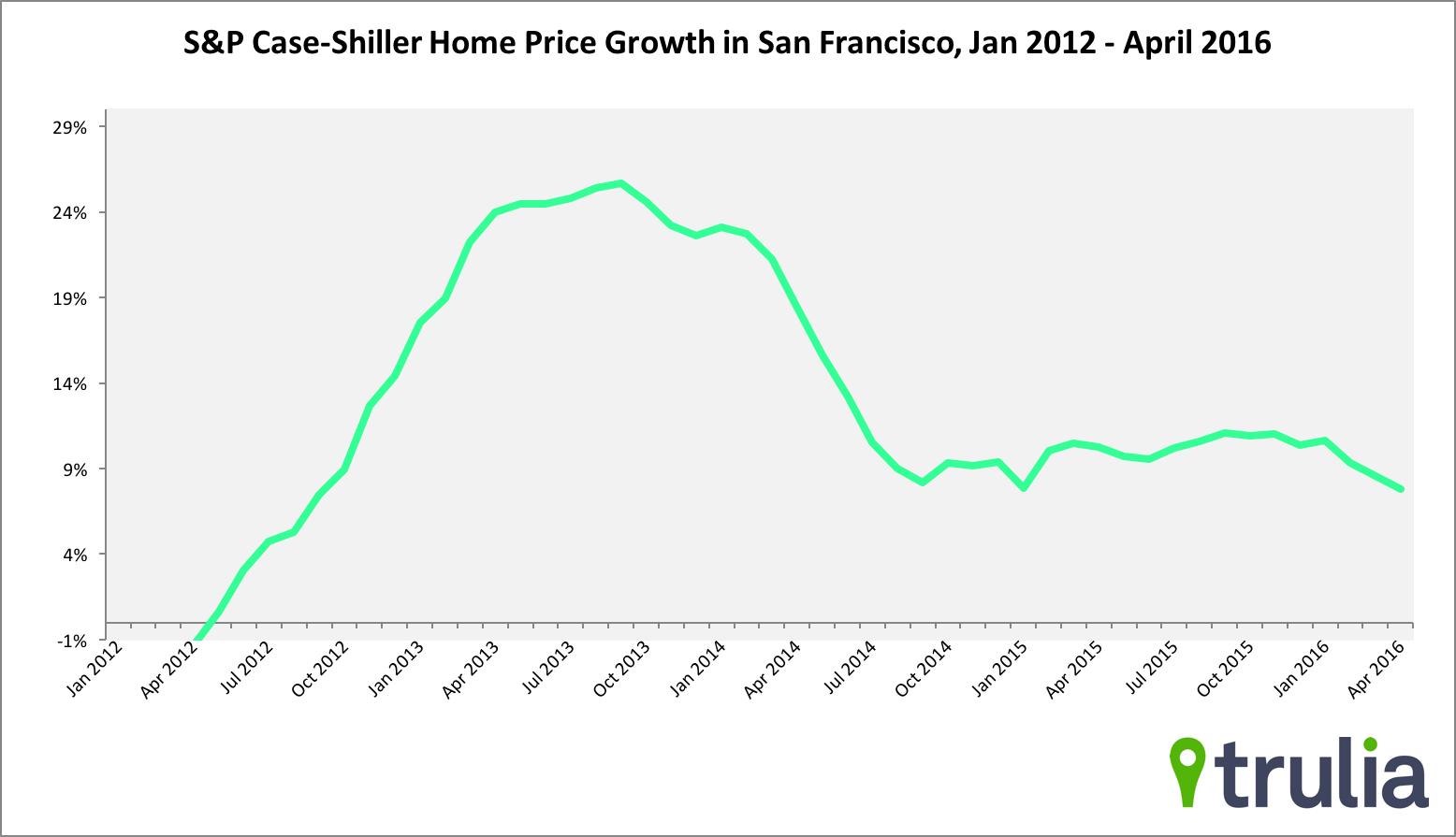

- Home price growth in San Francisco home prices drops for the third straight month, signaling a downward trend.

- While the housing market continues to moderate, the rate of price gains is still outpacing income growth. Housing affordability continues to be a headwind for homebuyers in many of the country’s largest markets.

Today’s S&P/Case-Shiller National Home Price Index increased 5% year-over-year in April, which is the 48th consecutive month of positive gains. However, April is also the third straight month in which the year-over-year figure decreased over the previous month. This is a sign that the U.S. housing market is stabilizing in the wake of double-digit price appreciation between 2012 and 2014. While the S&P/Case-Shiller National Home Price Index is an important metric to watch, it’s worth noting that the measure is more reflective of price movements in premium homes rather than middle or lower-tier homes.

Prices in last month’s three hot markets – Portland, Seattle, and Denver – continue to lead the pack with increases between 9.5% to 12.3%. While strong price growth in these markets should help increase inventory in the coming months, homes will be significantly less affordable for homebuyers than this time last year.

Finally, growth in San Francisco home prices continues a noticeable slowdown with a year-over-year increases of 7.8%, which is the smallest annual gain since January 2015. The continued slowdown suggests the San Francisco housing market may finally be entering a phase of normalcy after years of sustained price appreciation, although persistent increases have left homebuyers struggling to find affordable homes.