- Homebuyers seeking relief from escalating prices found a housing market that didn’t budge in May. As homebuying season entered full swing, homebuyers continued to take advantage of relatively low mortgage rates by descending on the limited number of homes on the market with unrelenting demand.

- Regionally, Seattle continues its home price appreciation tear with a 13.3% increase in the index, surpassing its year-over-year price growth high from its post-crisis peak in fall of 2013.

- The duo of high demand and low inventory is driving price increases and is especially punishing for starter home buyers who face dwindling affordable options and stiff competition.

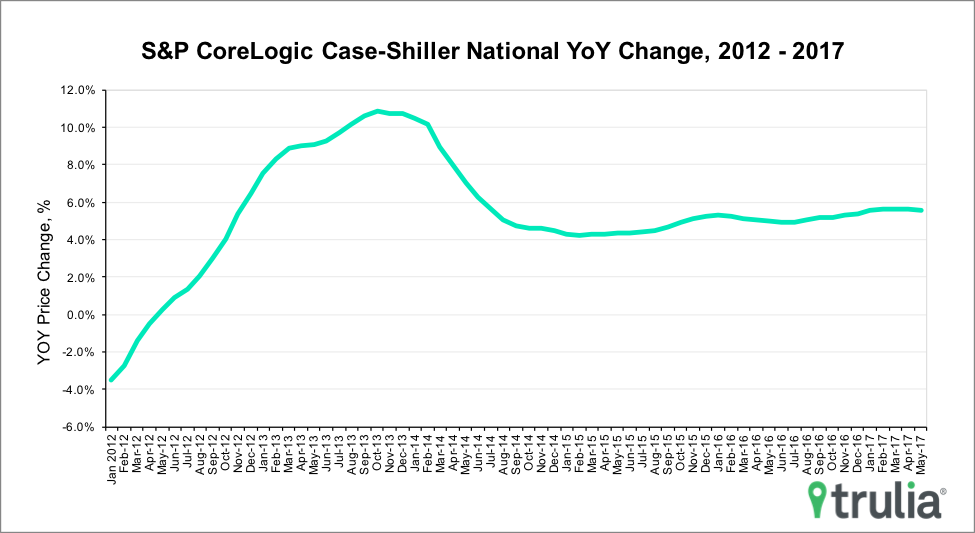

U.S. home prices dropped very slightly in May, according to the S&P CoreLogic Case-Shiller National Home Price Index released Tuesday. Low inventory and the quickened pace of home sales maintained May’s index at 5.58%, but fell from April’s revised year-over-year change of 5.65%. While optimistic numbers on housing starts and permits were announced last week, expect the index – and the underlying home prices – to remain strong before seeing any sort of reprieve, especially in light of Monday’s news of existing home inventory falling in June.

Seattle saw another month of double-digit increases to the home-price index, climbing 13.3% year-over-year in May. Previously hot markets such as Portland, Ore., Dallas, and Denver joined nine of the other 20 markets that saw year-over-year changes drop from April’s numbers.