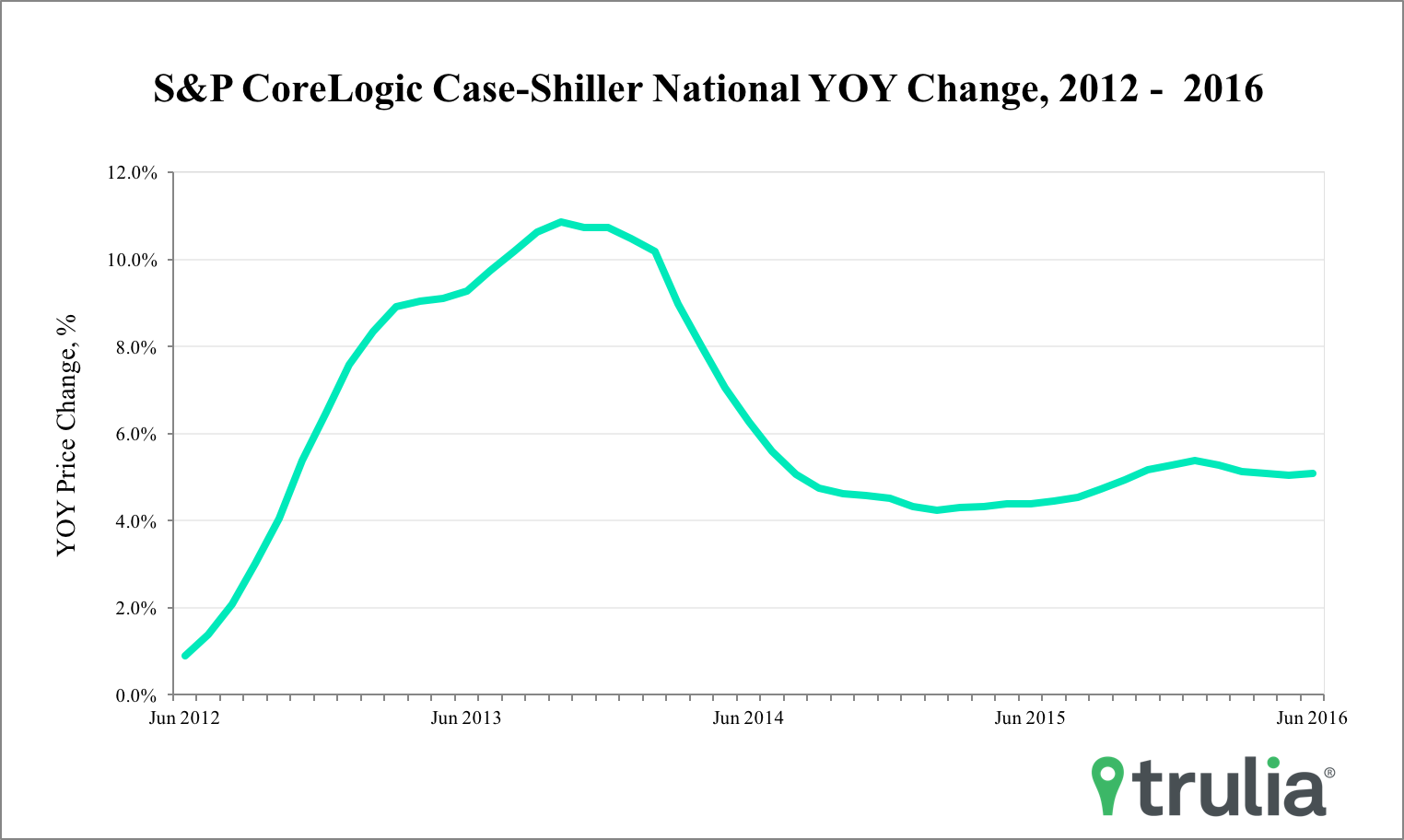

- June represents the fifth straight month of flat or decreasing year-over-year price gains, but homebuyers are still being challenged as prices outpace income growth yet again.

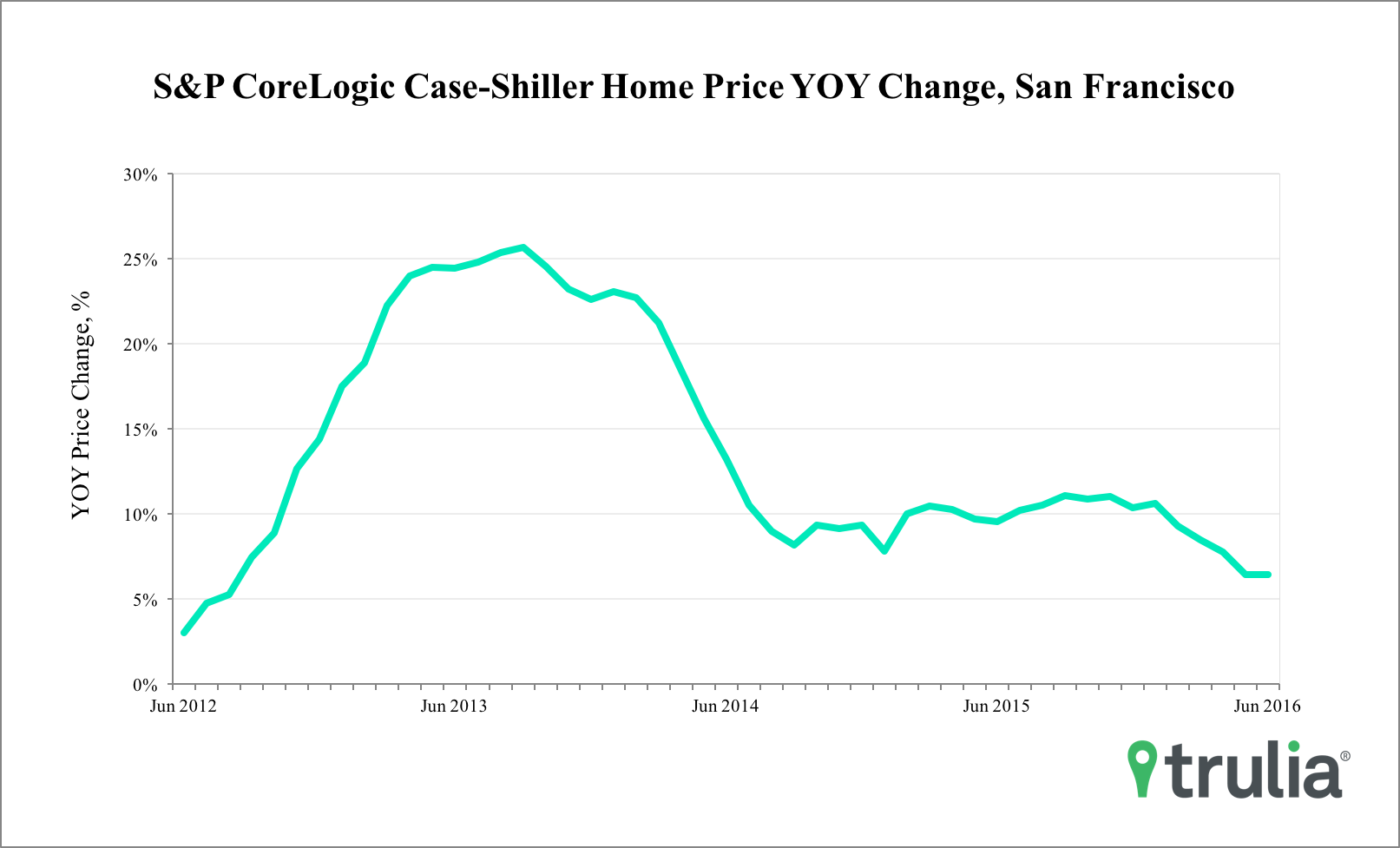

- Home price growth in San Francisco drops for the fifth straight month, signaling the smallest gains since August 2012. Still, prices are up 6.4% and have a long way to go before incomes catch up.

Today’s S&P/Case-Shiller National Home Price Index increased 5.1% year-over-year in June, which is the 50th consecutive month of positive gains. However, June is also the fifth straight month in which the year-over-year increase was smaller or flat than the previous month. Though this a sign that the U.S. housing market continues to stabilize, homebuyers are still being challenged as prices outpace income growth yet again. While the S&P/Case-Shiller National Home Price Index is an important metric to watch, it’s worth noting that the measure is more reflective of price movements in premium homes rather than middle or lower-tier homes.

Prices in last month’s three hot markets – Portland, Seattle, and Denver – continue to lead the pack with increases between 9.2% to 12.6%. Though Western markets dominate U.S. price growth, San Francisco continues to show a noticeable cooldown. Home prices in the City by the Bay increased of 6.4%, which is the smallest annual gain since August 2012. The continued slowdown suggests the San Francisco housing market might start looking more “normal” by the end of the year, but the market still has a long way to go before most Bay Area homebuyers would agree.