- July home prices bucked the previous five-month downward trend of gains, but ticked up only marginally to 5.1% from June’s 5% increase.

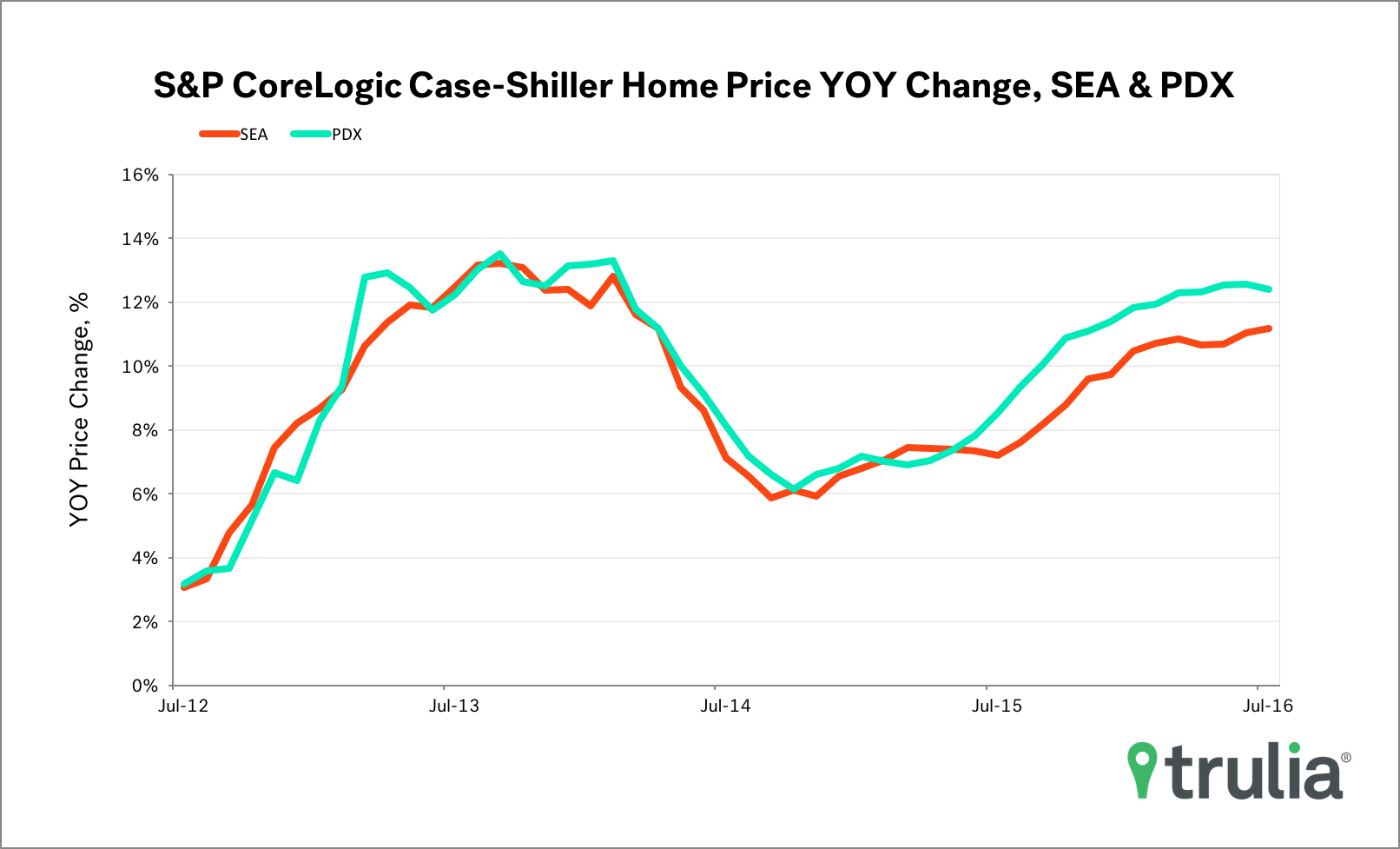

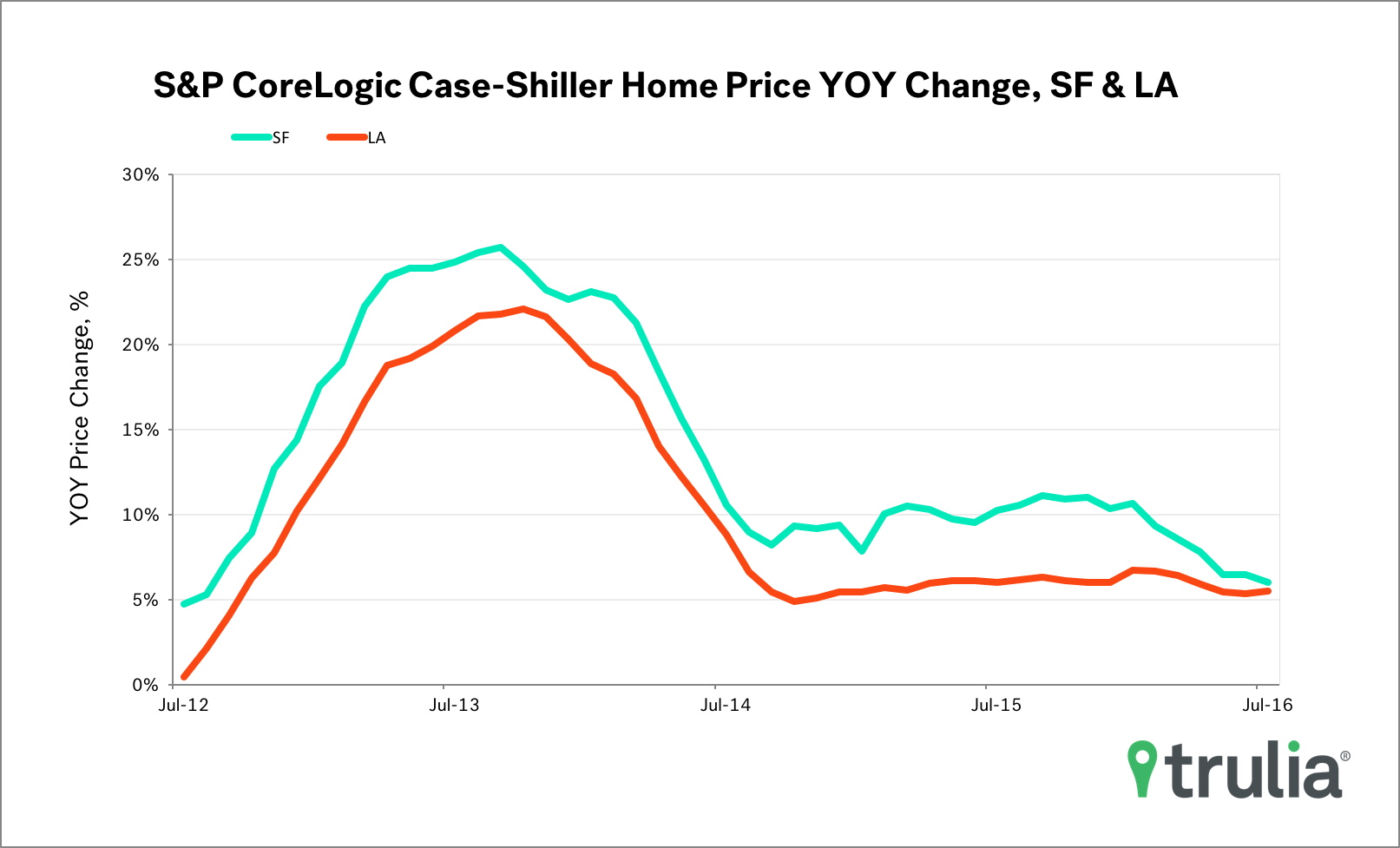

- Home prices in San Francisco and Los Angeles continue cooling in July, while prices in Seattle and Portland have another strong showing. The Pacific Northwest is to the housing market now what California was at beginning of the recovery: a beacon of strong gains in employment, income, and quality of life.

Today’s S&P/Case-Shiller National Home Price Index increased 5.1% year-over-year in July, which is the 51th consecutive month of positive gains. July home prices bucked the previous five-month trend of smaller gains, but ticked up only marginally from June’s 5% increase. Combined with Census income data released earlier this month showing incomes grew 5.2%, this a positive sign that home affordability pressures may start to ease. However, incomes will need to outpace prices for several years in order to reverse the severe drop in affordability seen since 2012. While the S&P/Case-Shiller National Home Price Index is an important metric to watch, it’s worth noting that the measure is more reflective of price movements in premium homes rather than middle or lower-tier homes.

Home prices in San Francisco and Los Angeles continue to cool in July, while prices in Seattle and Portland, Ore., have yet another strong showing. Prices in San Francisco cooled for the eight straight month, suggesting that affordability pressures and slowing job growth have finally taken their toll. On the other hand, the Pacific Northwest is now to the housing market now what California was at beginning of the recovery: a beacon of strong gains in employment, income, and quality of life. Seattle and Portland have seen a strong resurgence in prices after noticeable cooling between 2014 and 2015, while San Francisco and Los Angeles have not.