- There is little sign of relief from high home prices as we enter the spring home buying season. The tough buying market is characterized by competition driven by low inventory and challenges for first-time home buyers as prices outpace income growth.

- Hot markets remain hot: Denver, Portland, Ore., and Seattle reached their highest index values ever.

- Mortgage rates are lower than expected, so the anticipated cooling of home prices as a result of higher rates is likely delayed. Spring homebuyers will be eager to lock in rates that remain low.

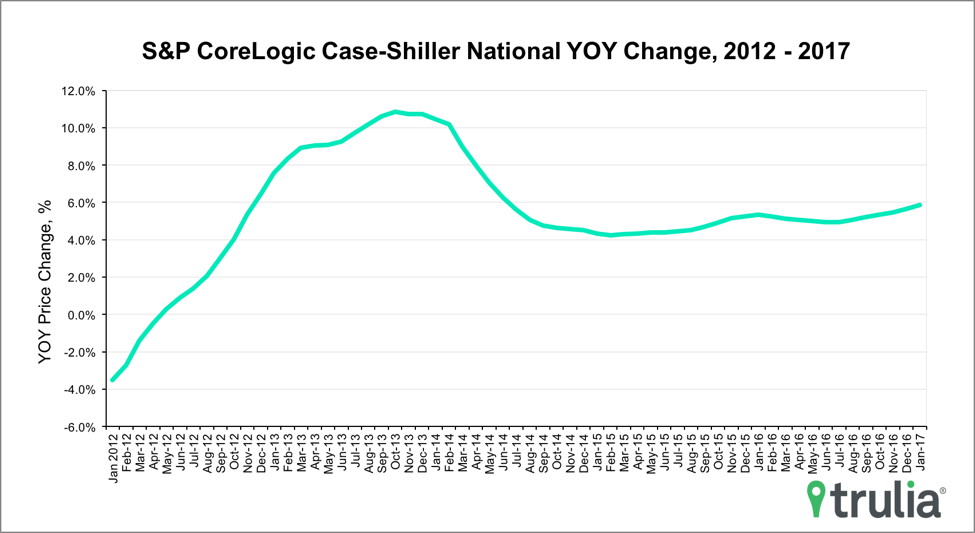

Today’s S&P CoreLogic Case-Shiller National Home Price Index reached a two and half year high of 5.9% year-over-year in January, up from December’s 5.8% annual increase. January’s index kicks off the 2017 with the 10th consecutive period of positive seasonally-adjusted monthly gains. Low inventory continues to drive prices higher and indicates spring home buying season will be a challenge for first-time homebuyers. Mortgage rates are trending lower than expected despite the Fed rate hike earlier this month. This points to uncertainty in the financial markets, which will continue to color mortgage rate performance and keep home prices tracking higher.

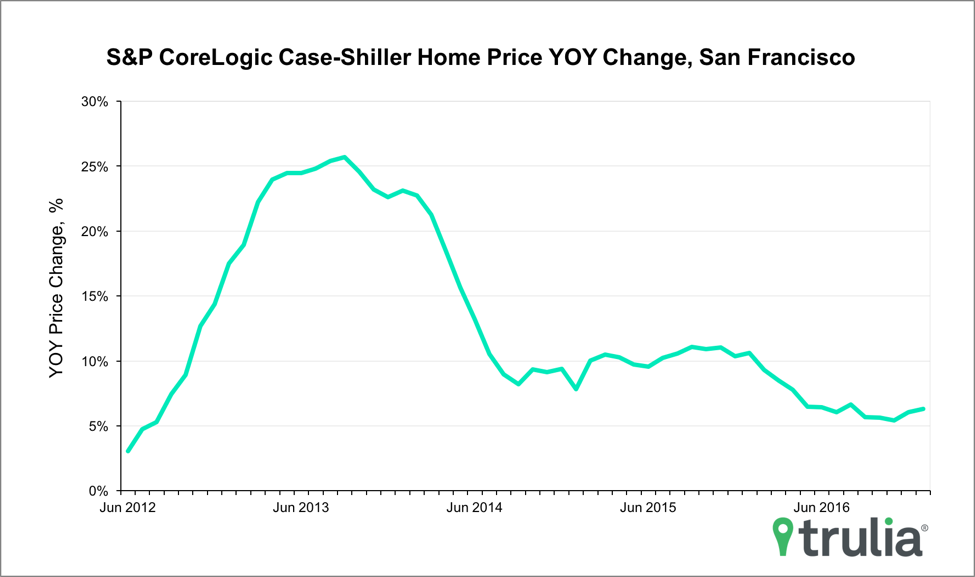

The 20-City Composite is also up from December, hitting a 5.9% year-over-year increase. Denver, Portland, Ore., and Seattle remain hot—these cities reached their highest index values yet in January. While Portland is seeing the rates of year-on-year increases slowing from the previous month, Seattle posted a double-digit annual increase for the 12th straight month. San Francisco, which saw the index peak at an all-time high last month, saw prices dip slightly in January. Annual changes in San Francisco have slowed considerably from this time last year.